Resilient Model

Costco’s success can be attributed mainly to its membership program that ensures customer loyalty. The company is hiking prices in certain merchandise categories to help margins, after launching a crackdown on membership sharing recently to stop card misuse that impacts membership fees. Right now, inflation and weak consumer confidence are the main challenges to sales, but things are expected to improve in the coming months. The latest monthly sales report shows that comparable sales are improving after a long-drawn slowdown. Costco enjoys relatively stronger consumer engagement due to its strategy of marking up products with low margins. That is a key reason why card renewals and memberships keep increasing.

It is widely expected that the warehouse chain will report higher earnings and revenues when it publishes fourth-quarter results. The report is expected to be out on September 26, at 4:15 pm ET. Market watchers project total revenues of $77.96 billion for the final months of the fiscal year, which represents an 8.1% year-over-year increase. In the retail-month of August, the company generated $18.42 billion in revenues, up 5% from last year. It is estimated that Q4 earnings per share grew 14% from last year to $4.79.

Weak Q3

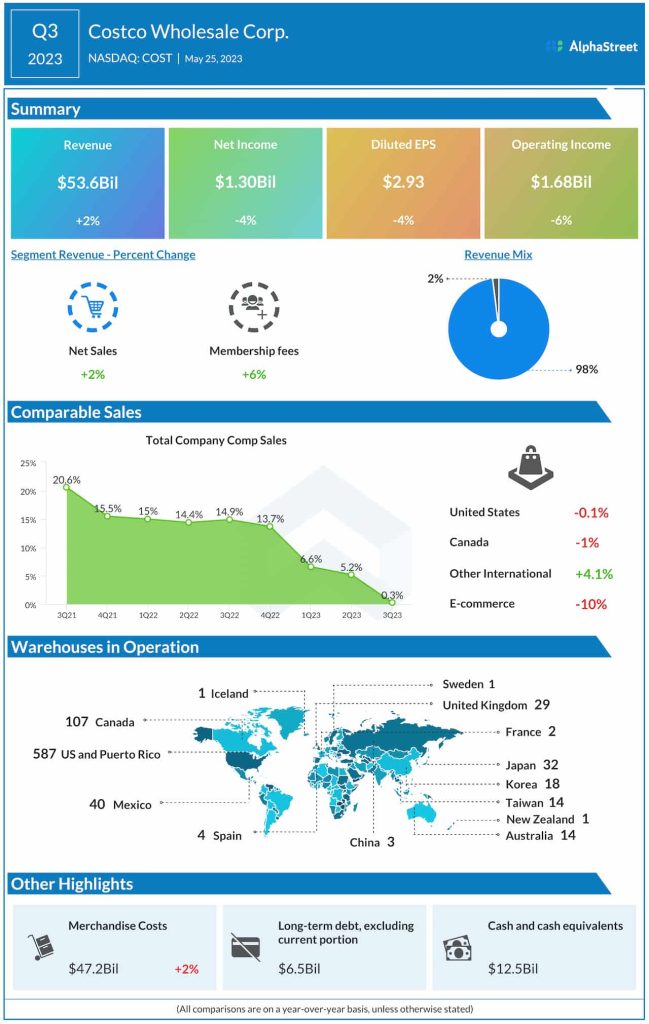

Costco reported mixed results for the third quarter when sales moved up 2% annually to $53.6 billion, while earnings decreased by 4% to $2.93 per share. Net income was $1.30 billion, compared to $1.35 billion in the prior-year quarter. Comparable sales growth decelerated to 0.3%, continuing the downtrend that started a few years ago. The results missed consensus estimates.

Costco’s CFO Richard Galanti said at the last earnings call, “Inflation continues to abate somewhat. If you go back a year ago to the fourth quarter of ’22 last summer, we had estimated that year-over-year inflation at the time was up 8%. And by Q1 and Q2, it was down to 6% and 7% and then 5% and 6%. In this quarter, we’re estimating the year-over-year inflation in the 3% to 4% range. We continue to see improvements in many items, notably food items like nuts, eggs, and meat, as well as items that include, as part of their components, commodities like steel and resins on the non-food side.”

After recent gains, Costco’s shares are currently trading above their 52-week average. On Tuesday, the stock opened lower, after closing the previous session higher.