Weak Comps

The main reason cited by the company for the sales slowdown is the cooling demand for discretionary items. All major retailers are facing such a situation, and that should improve when macro uncertainties and inflation pressure ease. Moreover, Costco’s unique business model is focused on providing quality products at reasonable prices, while offering customers the best shopping experience. If sales of a particular product category drop, the diversified merchandise model helps the business stay unaffected.

Q3 Results Due

Over the years, Costco has maintained a healthy subscriber base that keeps growing, even as the company enjoys good customer loyalty. It will be publishing third-quarter results on Thursday, after regular trading hours. On average, analysts estimate that earnings increased 8% from last year to $3.29 per share in Q3, aided by an estimated 4% increase in revenues to $54.57 billion.

Commenting on the Q2 results, Costco’s CFO Richard Galanti said a few weeks ago, “Regarding capital expenditures, our second quarter fiscal ’23 capital spend was approximately $900 million. Our estimate for the year remains in the range of $3.8 billion to $4.2 billion based on timing. In terms of e-commerce, as I mentioned, e-commerce sales in Q2, FX decreased by 8.7%. This weakness was driven mostly by our online mix of sales. Big-ticket discretionary departments like majors, home furnishings, small electrics, jewelry, and hardware.

Mixed Q2

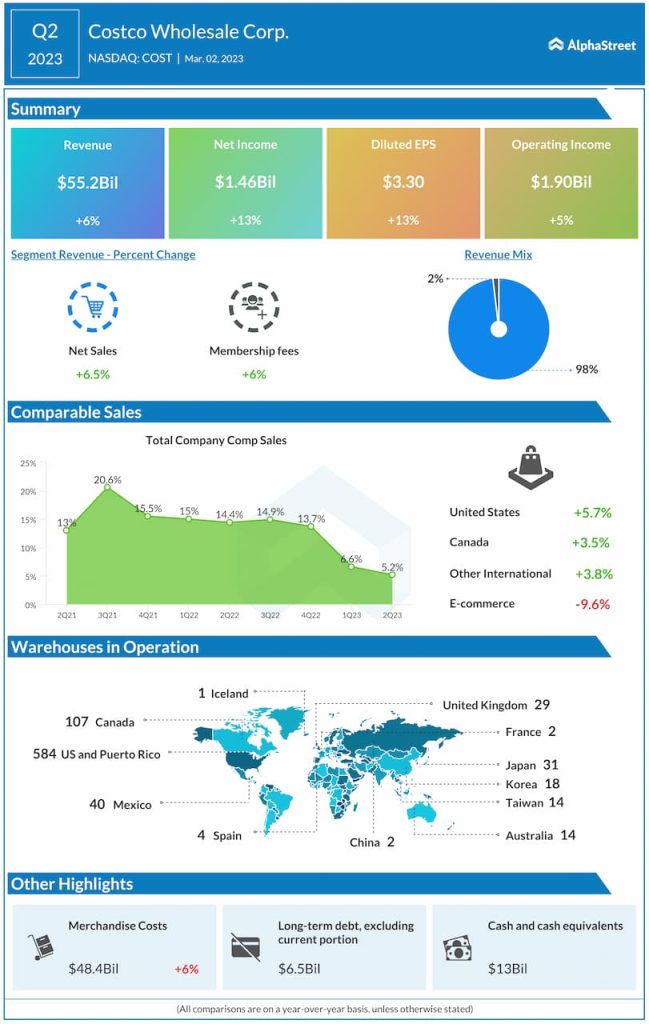

For the second quarter, the company reported mixed results, with earnings beating the Street view and the top line missing. At $55.2 billion, revenues were up 6% from last year. That resulted in a 13% growth in net income to $1.46 billion or $3.30 per share. Comparable sales growth decelerated during the three-month period, continuing the recent trend, while e-commerce sales declined.

After experiencing volatility in recent months, Costco’s shares remained below their long-term average this week. On Tuesday, the stock had a weak opening and traded lower in the early hours of the session.