For most of the investors, an earnings beat helped by one-time tax benefits was not pleasing enough. The tax benefit had lifted the earnings per share by $0.17. Trump won’t be there to help the next time! Declining gross margin proved to be yet another dark spot in the earnings report, given inflation.

Perhaps what worried investors the most were concerns about how the warehouse retailer plans to improve subscription rate without reducing the prices of its high-end articles. Membership renewal rate saw only a modest 1% improvement over the sequential quarter, though subscription revenue jumped about 13% driven by fee upticks in the US and Canada.

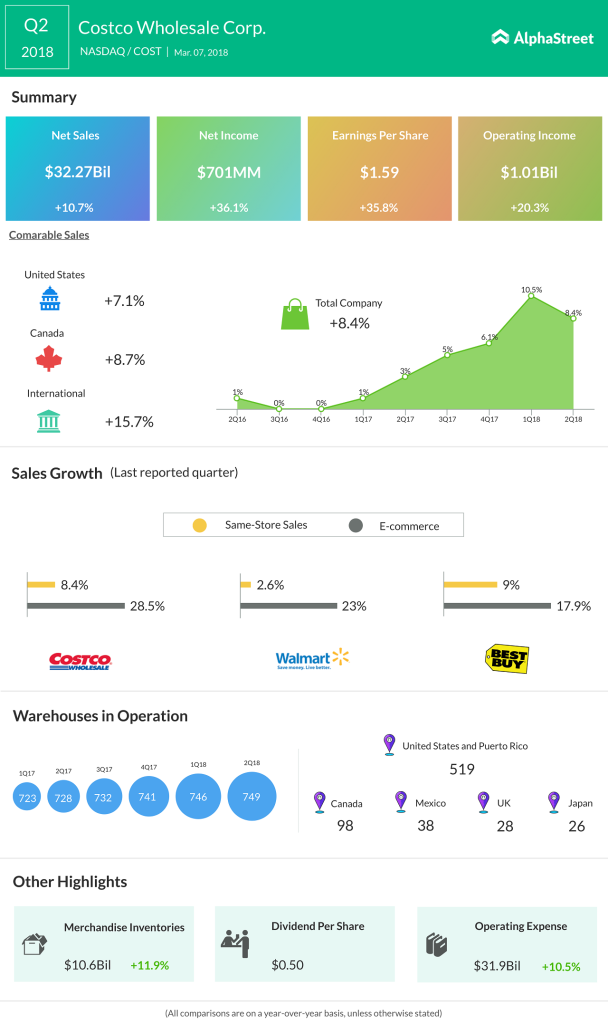

Meanwhile, total revenue during the second quarter jumped 11% to $33 billion, as comparable sales grew 8.4% and its e-commerce sales grew 28.5%. Also, Costco’s habit of not spending on advertising helps it save almost 2% of its budget each year.

Sam’s Club closure

It may be safely said that Walmart’s decision to close 63 of its Sam’s Club warehouses across the US will benefit Costco in the coming quarters. Closure of the membership-only rival warehouse chain is estimated to boost Costco’s sales by $1.8 billion.