Resilience

Costco’s business has remained largely unaffected by inflation and macro uncertainties, mainly due to the unique business model that gives it a good competitive advantage. However, there has been a slowdown in the sales of big-ticket discretionary items in recent quarters, reflecting the strain on household budgets. Average transaction value was hit by deflation in gas prices and unfavorable exchange rates.

While Costco is a late entrant to e-commerce, its online business is steadily picking momentum as customers respond positively to facilities like buy-online-pickup-in-store. The record subscription renewals underscore the exceptional customer loyalty the company enjoys. The retailer’s focus on essential items like groceries helped it maintain consistent customer traffic despite the general slowdown in consumer spending.

Q1 Data on Tap

The Issaquah-headquartered company will be releasing results for the first quarter of 2024 on December 14, at $4:15 p.m. ET. It is estimated that Q1 earnings increased to $3.41 per share from $3.07 per share last year. The consensus revenue estimate is $57.7 billion. The management recently hinted at hiking membership fees, without revealing the details, and that will add to revenues going forward.

“While still negative, relatively speaking, our e-commerce showed good improvement. Results showed good improvement this quarter versus our year-over-year results in Q2 and Q3. In the previous two fiscal quarters, big-ticket discretionary, majors, home furnishings, small electrics, jewelry, and hardware, were down 15% and 20% year over year, respectively, and down just 5% year over year in the fourth quarter, with those big-ticket departments making up over half of our e-commerce sales,” Costco’s CFO Richard Galanti said at the last earnings call.

Another Strong Quarter

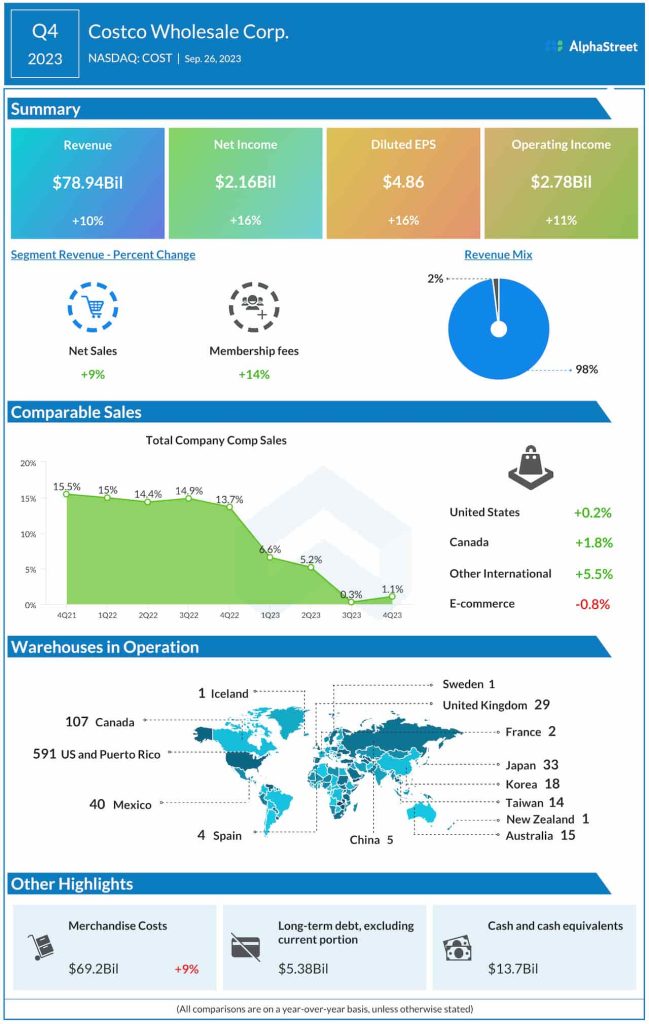

In the final three months of fiscal 2023, both earnings and revenues topped expectations after missing in the previous quarter. At $79 billion, fourth-quarter revenue was up 10% year-over-year. As a result, earnings rose sharply by 16% to $4.86 per share. Comparable store sales increased at a faster pace or 1.1% in Q4 than the prior quarter’s 0.3% rise. In the trailing four quarters, comp sales growth had decelerated.

This week Costco’s stock crossed the $600 mark for the first time, after gaining about 26% since the beginning of the year.