High Caution

Experts predict that medical insurance costs would spike by about 40% by next year in the US. According to media reports, some of the leading life insurance providers have stopped processing new applications. There is apprehension that patients who have been hospitalized for COVID-19 treatment might be denied life insurance for the rest of their life.

[irp posts=”51311″]

Meanwhile, a few US states have demanded legislation to ensure that all the epidemic-related losses are covered in the business interruption category, which will result in claims that run into several billion dollars. Insurers are also being urged to expand the scope of coverage by including all business activities affected by the coronavirus-related market turmoil.

Can all claim?

Though the conditions for claims are well-defined for most policies, there are grey areas in certain cases that might lead to legal disputes. For reviving the economy and easing the strain on the financial system, it is important to extend support to commercial entities struggling due to the virus attack. Wall Street has suffered such a huge blow that billionaire investor Warren Buffett’s Berkshire Hathaway (NYSE: BRK-A) lost about $65 billion in the last few months.

GEICO, owned by Berkshire, recently decided to stop cancelling coverage for policy expiration and non-payment of premium, until month-end. The company is also offering special payment plans once normalcy is reinstated.

There is a likelihood of insurance companies resisting the attempt to include items that have not been charged as per the original contract, such as a virus attack. Typically, losses other than physical damage and theft are not covered in the business interruption category, which is currently being challenged in courts.

Leading general insurance providers reported their latest quarterly results in the early weeks of the year when the epidemic had not unfolded fully. So, the executives did not factor in the impact in their future outlook, though they discussed business performance while interacting with analysts.

Good Gesture

Considering the lockdown, some insurers have initiated steps like extending deadlines for premium payment and scrapping fees to avoid cancellations due to non-payment. There is a government-level proposal to treat COVID-19 as a terrorist attack – under a backstop program created several years ago for coverage against terrorism – allowing the affected businesses to file claims. In this arrangement, a part of the compensation will be borne by the government.

“Insurance works well and remains affordable when a relatively small number of claims are spread across a broader group, and therefore it is not typically well suited for a global pandemic where virtually every policyholder suffers significant losses at the same time for an extended period.”

National Association of Insurance Commissioners, in response to the Congress’ proposal

For insurance companies, 2019 was a mixed year in terms of financial performance. Here’s a look at the growth plans of some key players for the year. It needs to be seen whether they would be able achieve the targets, given the troubled market conditions:

Growth Strategies

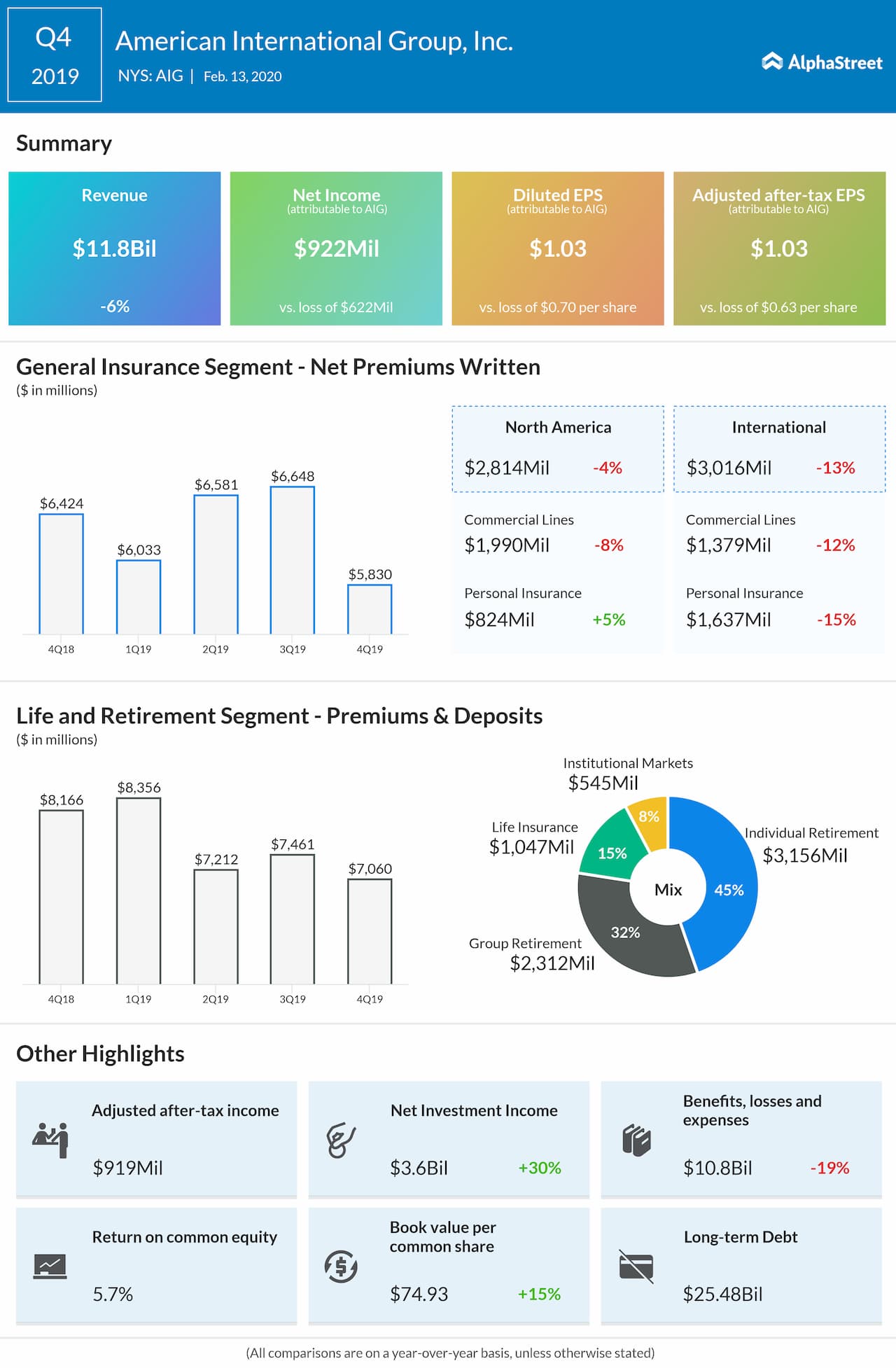

American International Group, Inc. (NYSE: AIG), the largest underwriter of commercial insurance, recorded full-year underwriting profit for the first time in 2019. The company attributed the positive momentum to the revival of the General Insurance segment, despite the troubles it has been facing for more than a decade. A rush of claims will not bode well for AIG, which is expecting a margin squeeze from inflation and litigated claims this year.

[irp posts=”53039″]

If liquidity comes under pressure, it might derail execution of the 10 core operational programs identified by the management, with investments worth $1.3 billion in the next three years. In the fourth quarter, AIG turned to profit from a loss in the prior year – despite a 6% dip in revenues – aided by lower catastrophe losses and better cost-management. AIG expects overall performance to get a boost in the latter part the year when it sells majority stake in legacy insurance business Fortitude Re.

“Given an unprecedented decline in driving, customers will receive a Shelter-in-Place Payback of more than $600 million over the next two months. We are also providing free identity protection for the rest of the year to all U.S residents who sign up, since our lives have become more digital.”

Tom Wilson, CEO of Allstate

ADVERTISEMENT

MetLife, Inc. (NYSE: MET) is planning to fund its growth initiatives through $1 billion of additional capacity it expects to create by optimizing the portfolio and cutting costs. The company, which ended 2019 on an upbeat note, recorded a 47% earnings growth in the fourth quarter aided by volume growth and effective capital management. At the conference call, CEO Michel Khalaf predicted a $900-million margin expansion for this year. MetLife’s stock maintained a steady uptick until recently, all along creating value for shareholders.

[irp posts=”53911″]

Among others, The Progressive Corporation (NYSE: PGR) is on track to buy the remaining stake in ARX Holding this month – a year earlier than initially planned. In the fourth quarter, earnings surged to $1.81 per shares and topped the Street view, reflecting a double-digit growth in net premiums.

Chubb Limited (NYSE: CB) reported stronger-than-expected earnings and revenues for the fourth quarter in early February. The company said it expects limited impact from coronavirus, which was confined to China at that time.

When it comes to achieving the goals, a lot will depend on the volume of claims the companies are required to process. Most insurers have conveniently excluded damages linked to virus attacks, foreseeing the potential impact it could have on their business. But, the growing number of pandemic-related lawsuits shows that tough times are awaiting insurance providers.