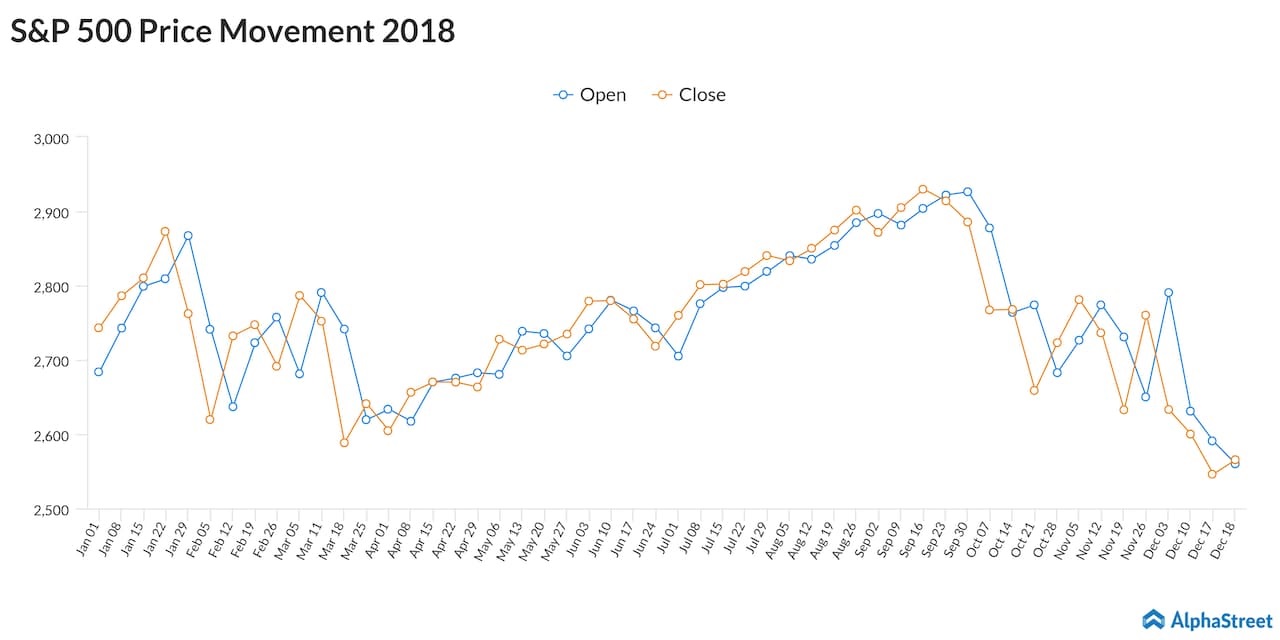

Justifying the reduction, especially when it was done even before the year started, Credit Suisse said stock prices dropped about 13% in the last three months. The S&P 500 index lost about 12% during that period – when overall market volatility nearly doubled – descending from the all-time high seen in September. The benchmark index dropped 2% and closed the last session at 2,545, the lowest so far this year.

Justifying the reduction of the price target, Credit Suisse said that stock prices dropped about 13% in the last three months

The brokerage, however, maintained its EPS estimate for 2019 and 2020 at $174 and $185 respectively, encouraged by the market’s unchanged ‘fundamental backdrop.’ Experts had raised questions about the sustainability of the growth momentum witnessed this year, which was driven mainly by one-off factors like the positive impact of the tax reform and the government’s stimulus programs. According to the experts, the economy is expected to witness a more realistic growth rate when it enters 2019.

Confused when to sell your stocks? Here are a few tips to master selling

The positive sentiment witnessed in the market in the second half of September and early October gave way to uncertainty and caution as the year-end approached, owing mainly to the recessionary conditions created by the rising interest rates and escalation of the US-China trade dispute.

Earlier, the other brokerages including Sanford C Bernstein and Canaccord Genuity had also lowered their price targets on S&P 500, citing the ongoing market disruption and stock selloff. Having recovered modestly from Monday’s fall, the index was at $2,558 Tuesday afternoon.