CrowdStrike Holdings, Inc. (NASDAQ: CRWD) has benefited significantly during the COVID-19 pandemic as companies rapidly moved their operations to a remote environment. This accelerated digital transformation increased the need for cybersecurity thus leading to higher demand for CrowdStrike’s products.

The company reported solid results for the second quarter of 2021 and raised its guidance for the full fiscal year. The stock has jumped 161% since the beginning of this year.

Quarterly performance

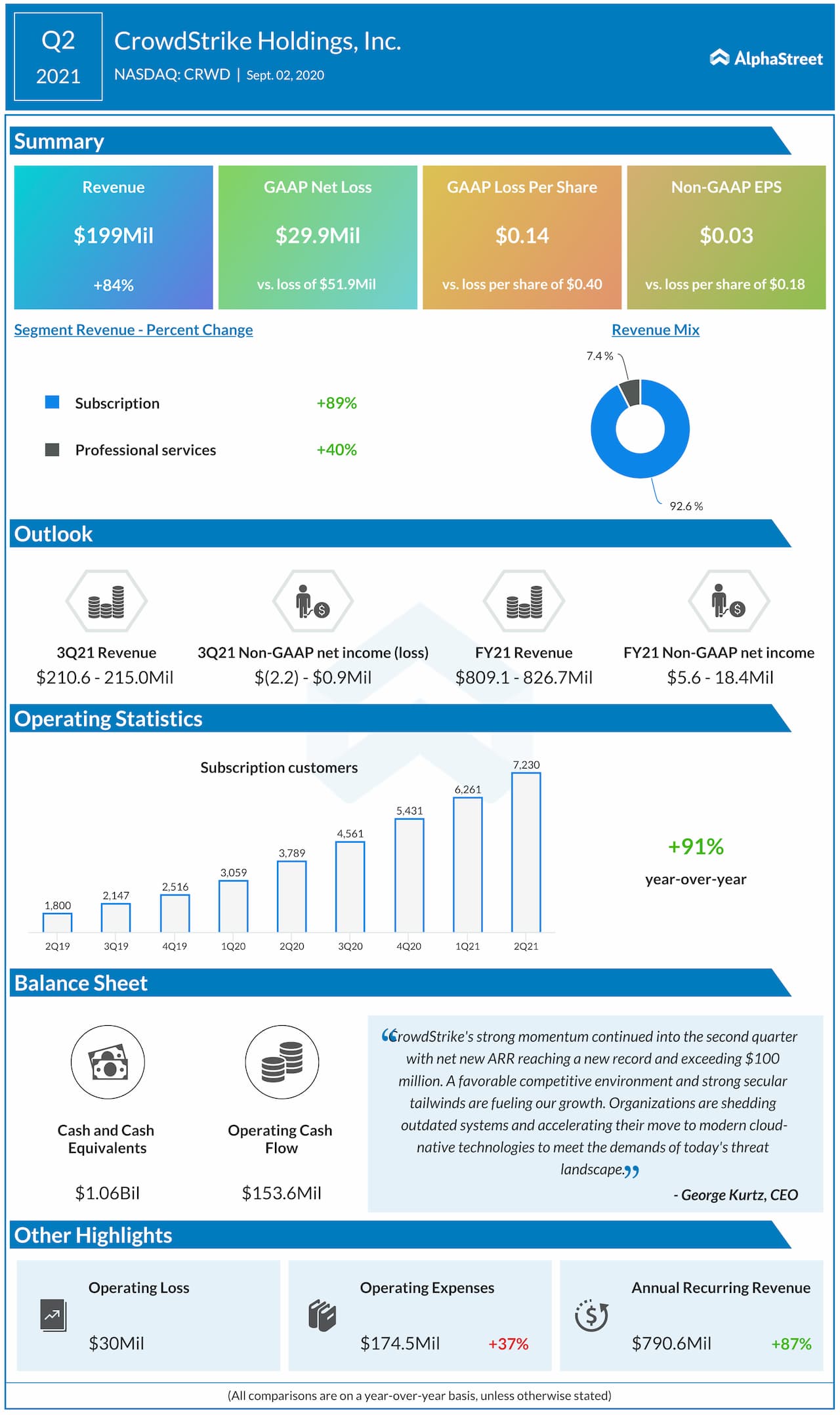

Total revenue grew 84% year-over-year to reach $199 million, helped by an 89% increase in subscription revenue and 40% growth in professional services revenue. Professional services form a strategic part of the company’s business as these engagements lead to new subscription business.

In the quarter, CrowdStrike saw higher demand for its services business and an increase in the number of seven-figure subscription ARR deals, resulting from the services engagements. The company added $104.5 million in net new annual recurring revenue, which was up 77% over last year and above pre-COVID expectations. CrowdStrike saw growth both in the US and in international markets.

Strong demand

CrowdStrike witnessed strong partner engagement and deal flow throughout the quarter among large and SMB customers across multiple industries. The company’s retention rates remained strong and it saw rapid module adoption by both new and existing customers. The percentage of subscription customers with four or more modules increased to 57% and those with five or more modules rose to 39%.

CrowdStrike is benefiting from a favorable competitive environment and strong secular trends as organizations move from outdated systems to modern cloud-native technologies in order to improve their security infrastructure.

“As organizations adapt to the new distributed workforce paradigm, it has become clear that the endpoint is the new security perimeter and the complex patchwork of legacy solutions is inadequate in this new environment.” – George Kurtz, Chief Executive Officer

In the current environment, the need for cybersecurity has increased significantly as the threat environment continues to grow. In the first half of 2020, CrowdStrike saw a 154% increase in intrusions along with a sharp increase in e-crime. The company stopped 41,000 potential breaches during this period which was more than all of last year.

Outlook

CrowdStrike believes it will continue to see demand for its offerings and that the current favorable growth trends will continue going forward. The company expects to see some seasonality in net new annual recurring revenue as it moves into the third quarter.

For the third quarter of 2021, total revenue is expected to grow 68-72% to $210.6-215 million while adjusted EPS is estimated to range from a loss of $0.01 to breakeven. For the full year of 2021, total revenue is projected to grow 68-72% to $809.1-826.7 million. Adjusted EPS is estimated to range between $0.02 and $0.08.

Click here to read the full transcript of CrowdStrike Q2 2021 earnings call