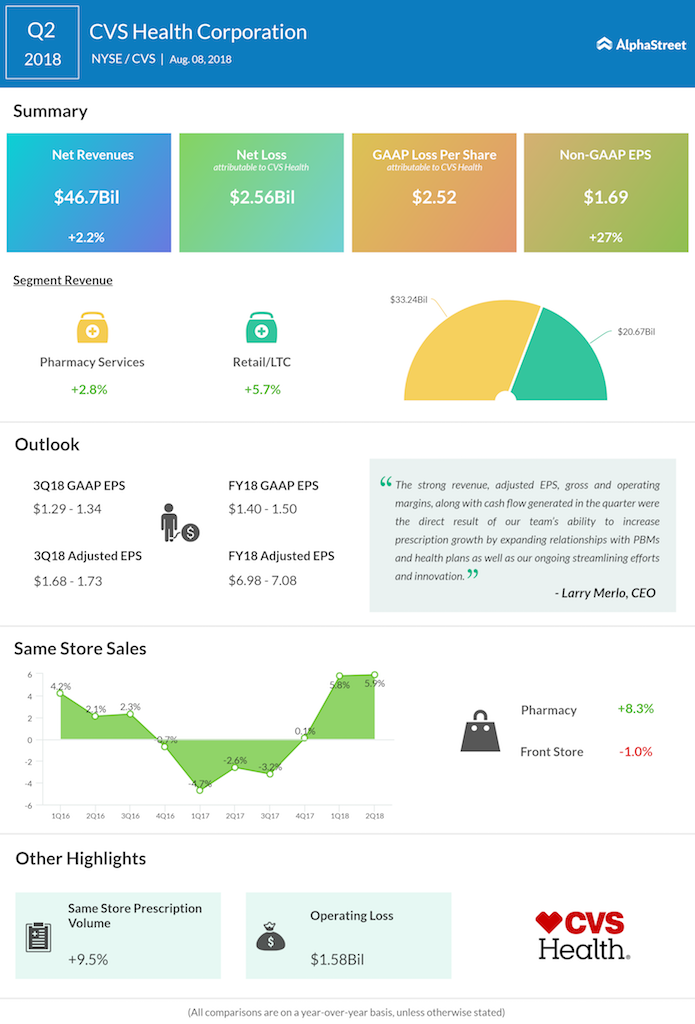

Revenue rose 2.2% to $46.7 billion as the company lifted prescription growth by expanding relationships with pharmacy benefit managers (PBM) and with the success of health plans. Same-store sales rose 5.9% and pharmacy same-store sales increased 8.3%.

Shares of CVS Health ended Tuesday’s regular trading up 0.63% at $65.45 on the NYSE. The stock has fallen more than 9% for the year-to-date and more than 17% for the past year.

The continued reimbursement pressure and a negative impact due to recent generic introductions have impacted the pharmacy same-store sales.

Revenues in the Pharmacy Services segment increased 2.8%, primarily driven by growth in the pharmacy network as well as brand inflation. Pharmacy network claims processed grew 5.9%, on a 30-day equivalent basis, to 398.2 million from 376.0 million last year, on a rise in net new business.

Revenues in the Retail/LTC segment grew 5.7% primarily due to an increase in the same-store prescription volume of 9.5%, on a 30-day equivalent basis. The volume benefited from the continued adoption of Patient Care Programs, alliances with PBMs and health plans, inclusion in a number of additional Medicare Part D networks this year, and brand inflation.

The company revised its full-year 2018 EPS outlook to $1.40-$1.50 from the previous estimate of $5.11-$5.32. Meanwhile, CVS Health narrowed its adjusted EPS forecast to $6.98-$7.08 from $6.87-$7.08.

For the third quarter of 2018, the company predicts GAAP diluted EPS of $1.29 to $1.34 and adjusted EPS of $1.68 to $1.73. GAAP operating profit is anticipated to decline in the range of 4.5% – 7.0% and adjusted operating profit is predicted to decrease in the range of 2.5% – 5.0%.

As previously announced, the acquisition of Aetna (AET) by CVS Health was approved by shareholders of both companies on March 13, 2018. To date, CVS Health has received approval from a substantial number of states and more are expected to approve this summer. The transaction is expected to close during the third quarter or the early part of the fourth quarter of 2018.