Q2 Estimates

The Woonsocket-headquartered retail pharmacy chain is all set to unveil second-quarter financial data on August 7, at 6:30 am ET. The market will be closely following the event as the report is expected to provide updates on emerging trends in the healthcare sector. It is worth noting that in the preceding quarter, CVS’ earnings missed estimates for the first time in about nine years. The top line also fell short of expectations, after beating consistently over the past several quarters.

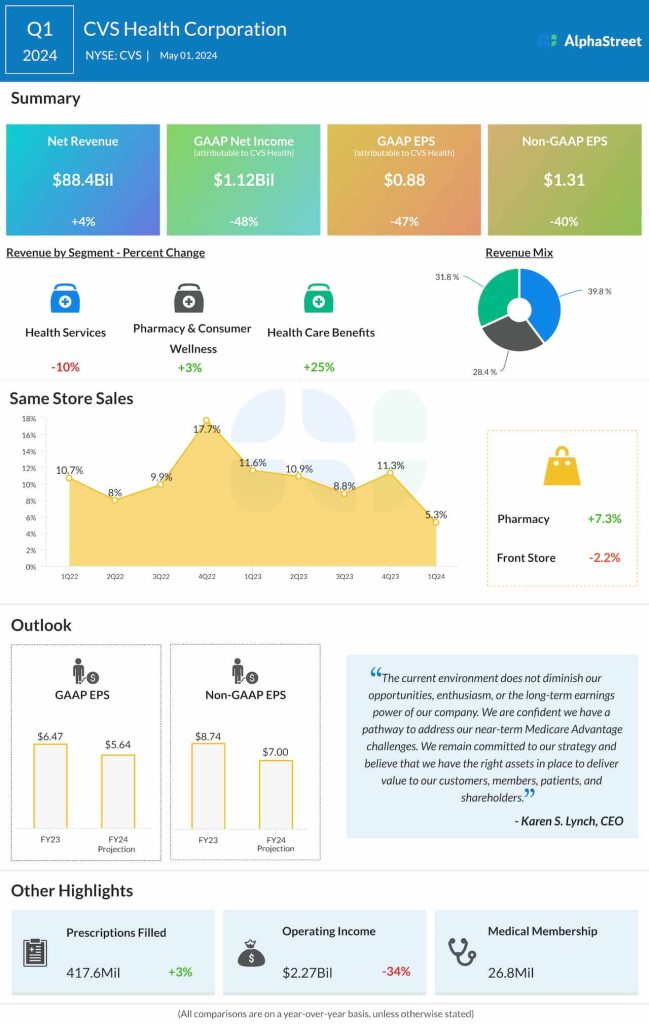

On average, analysts following the company are looking for Q2 earnings of $1.73 per share, adjusted for one-off items. In the second quarter of 2023, the company earned $2.21 per share. It is estimated that June-quarter revenues increased about 3% to $91.51 billion. In the first quarter, same-store sales growth decelerated to 5.3% from 11.3% in the previous quarter and 11.6% in the year-ago quarter.

Mixed Q1

Revenue rose 4% to $88.4 billion in Q1, as higher sales at the pharmacy and healthcare benefits segments more than offset a double-digit drop in healthcare services revenue, which accounts for about 40% of the total. Meanwhile, adjusted earnings plunged 40% annually to $1.31 per share in the March quarter. Unadjusted profit nearly halved year-over-year to $1.12 billion or $0.88 per share. Anticipating the recent downtrend to extend into the latter half of the fiscal year, especially challenges in the Medicare Advantage business, the management has slashed its full-year earnings per share guidance to about $7.0.

From CVS Health’s Q1 2024 earnings call:

“Despite the recent challenges in Medicare Advantage, we firmly believe the program can remain a compelling offering for seniors and a very attractive business for Aetna and CVS Health over time. Medicare Advantage will continue to deliver significant value to members as well as better outcomes and patient experiences. Over the next few years, we are determined to improve our positioning in Medicare Advantage. The combination of our internal efforts and the multiyear repricing opportunity gives us confidence in our ability to return to our target margin of 4% to 5% in three to four years.”

Headwinds

Retail pharmacy chains are facing the threat of losing market share to discount stores and large retailers, as the ongoing inflation puts pressure on family budgets. With other issues like widespread shop-lifting adding to the problem, the company and its rival Walgreens Boots Alliance have announced large-scale store closures. After closing hundreds of stores in recent years, CVS targets to close around 300 more units this year, which will harm sales and profitability.

Shares of CVS traded at $58.00 in the latter half of Monday’s session, down 2.23%. The price dropped about 26% since the beginning of 2024 and stayed below the 52-week average over the past four months.