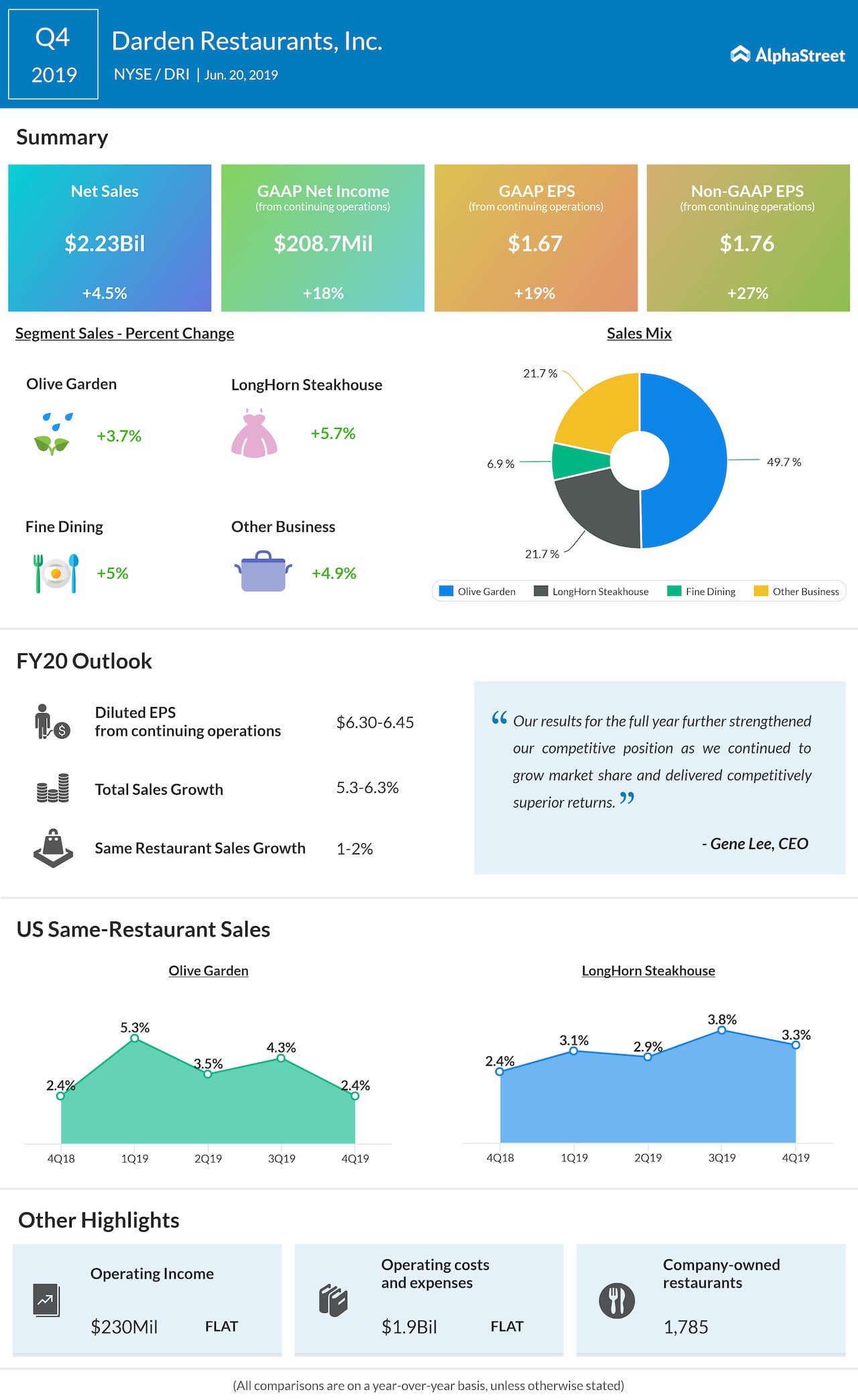

Reported net income was $208 million, or $1.67 per share,

compared to $174 million, or $1.39 per share, in the year-ago period. Adjusted

EPS from continuing operations increased 26.6% to $1.76, beating forecasts of

$1.72.

During the quarter, Darden reported sales and profit increases

across all its business segments. The company also recorded same-restaurant

sales growth across its Olive Garden, LongHorn Steakhouse, The Capital Grille

and Eddie V’s brands. However, same-restaurant sales declined in the Cheddar’s

Scratch Kitchen, Yard House, Seasons 52 and Bahama Breeze brands.

Fiscal 2020 is a 53-week fiscal year and Darden’s outlook

includes the impact of the additional week. For fiscal 2020, the company

expects total sales growth of 5.3-6.3%, including approx. 2% growth related to

the 53rd week.

Same-restaurant sales is expected to grow 1-2%. Diluted EPS

from continuing operations is expected to be $6.30-6.45. Darden anticipates approx.

50 gross and 44 net new restaurant openings during the year.

Darden increased its quarterly dividend by 17% to $0.88 per common share. The dividend is payable on August 1, 2019 to shareholders of record on July 10, 2019.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.