Q3 Report Due

Deere has revealed plans to intensify the integration of new technology into its products to expand market share and deliver value to customers. That, combined with the ongoing efforts to cut costs, should translate into better margin performance in the future. There was an improvement in inventory levels after the company reduced production in the first half of the year, which also resulted in a healthier cash position.

Tech Push

Early this year, Deere inked a pact with SpaceX to expand rural connectivity to farmers through satellite communication, with a focus on key markets like the US and Brazil. That complements the company’s initiative to incorporate advanced automation tools in its machines. Those efforts are significant, considering the positive outlook for commodity prices. Experts predict a rebound in prices in the coming months, which will lift demand as farmers typically buy new equipment when their incomes are good.

Deere’s CFO Joshua Jepsen said during a recent interaction with analysts, “We’re starting to think about market share, not only as the number of units sold but as the number of acres covered by Deere products and technologies as a percentage of total acres farmed. In the future, we’re going to continue accelerating the utilization of technology as we grow our precision upgrade retrofit business as well as Solution-as-a-Service offerings. Our engaged acre journey helps demonstrate the progress we’ve made in delivering value for customers and making their jobs easier to do.”

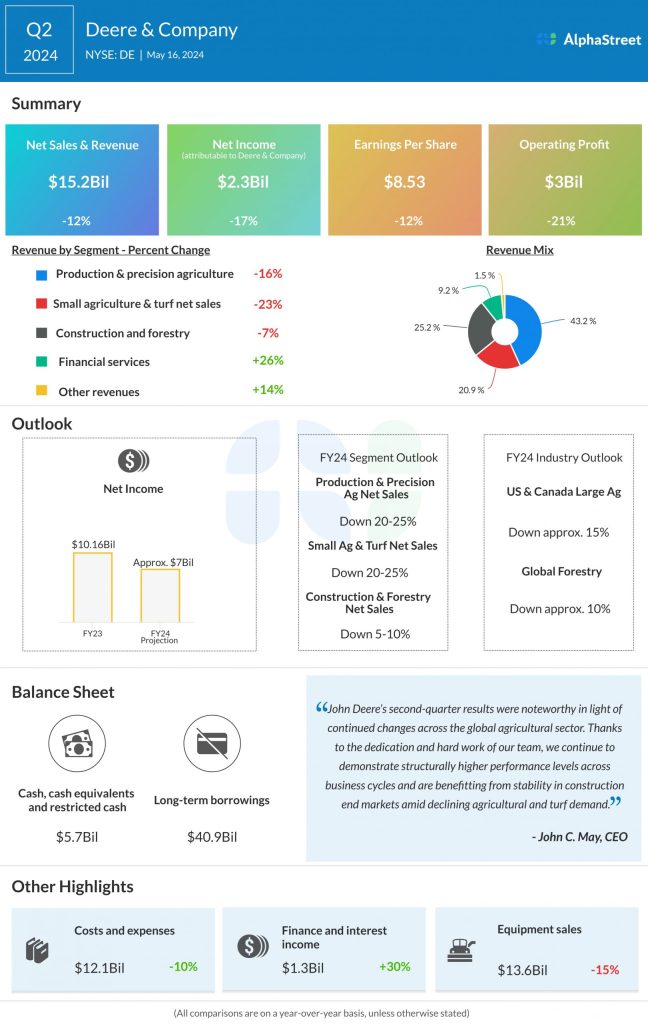

Deere’s quarterly revenue beat analysts’ estimates regularly over the past four years, including in Q2 when sales dropped 12% year-on-year to $15.2 billion. The top line suffered mainly due to a double-digit sales decline in the main operating segments. Consequently, net profit decreased to $2.3 billion or $8.53 per share in the April quarter from $2.86 billion or $9.65 per share in the year-ago quarter but topped expectations, marking the seventh beat in a row.

Outlook

Anticipating the downtrend to extend into the remainder of the year, the Deere leadership expects full-year sales for the main operating segments to decline. Net income is seen falling by a third in fiscal 2024 to about $7 billion, which is lower than the earlier guidance.

On Tuesday, Deere’s stock opened at $345.01 and traded higher in the early hours. It has dropped about 12% so far in 2024 and currently trades below the 52-week average.