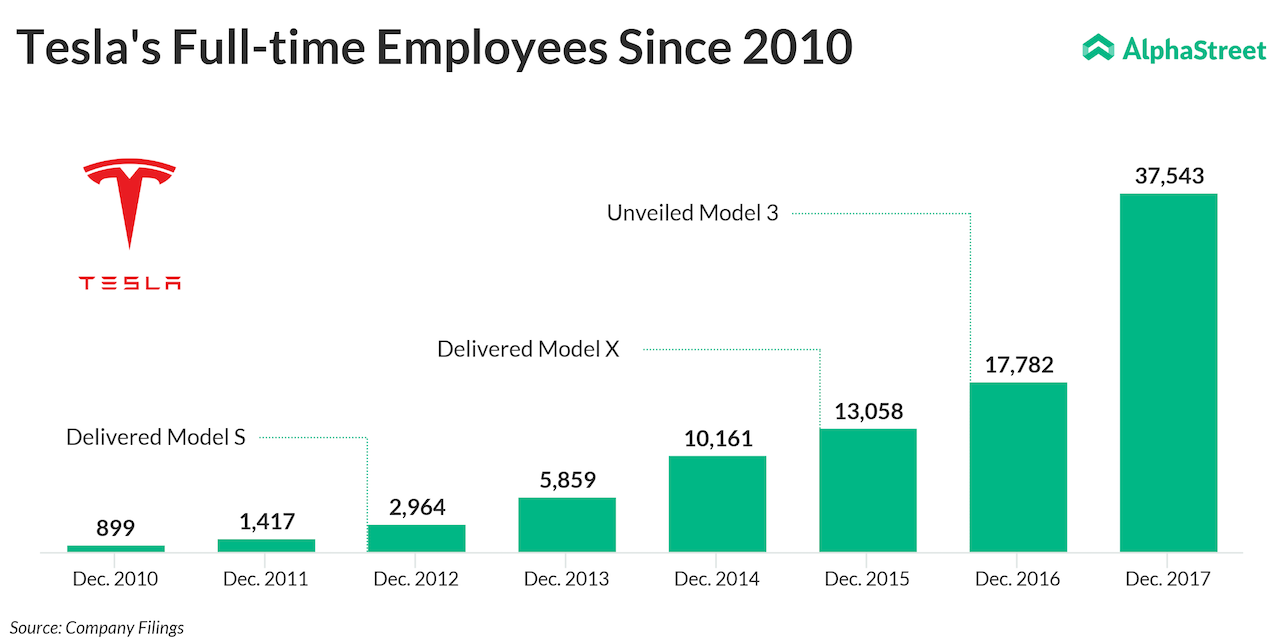

Earlier this year in April, CEO Elon Musk had predicted that the company will become profitable in the second half of this year. Tesla’s road to profitability began by slashing thousands of jobs. In June, it slashed 9% of its workforce.

A Tesla spokesperson said the company is looking for price reductions from its suppliers to boost its competitive advantage, mainly as it increases the Model 3 production. Tesla’s latest demand is unusual, given the fact that it is asking for price reduction for past work.

Related: Tesla hides large number of Model 3 cars in a parking lot

This news comes at a time when a substantial number of buyers have cancelled their order for Model 3 following supply chain issues. It is rumoured that cancelled orders outpaced the new orders, which Tesla denied.

Now that the company is seeking for refunds, it shows that Tesla’s liquidity position could just get worse and that the company could struggle to address its cash needs in the future. As of today, the company stock is down 4.20% during the premarket trading at $300.42.

Related: OPINION: See the full picture before bashing Elon Musk

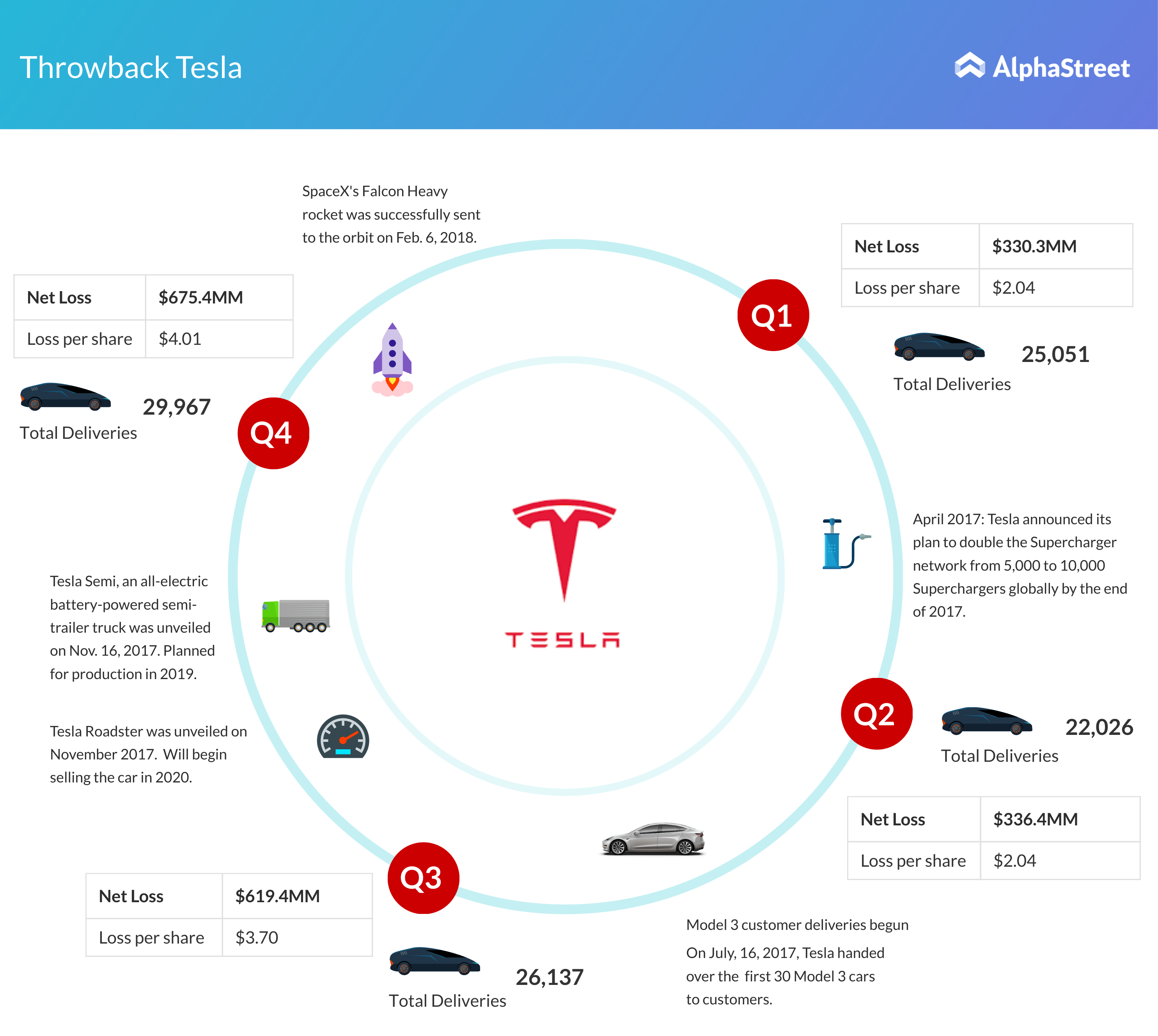

Musk has been serious about making a profit in Q3 and Q4, but many experts have expressed their skepticism over this ambitious target. It may be recalled that just last year, the company had lost $2 billion.

As per Investopedia, Tesla’s key suppliers include AGC Automotive, Fisher Dynamics, Inteva Products, Modine Manufacturing Co., Sika, Stabilus, and ZF Lenksysteme.