Despite this, IBM remains optimistic about the opportunities in hybrid cloud and artificial intelligence and continues to focus its efforts and investments in these areas. The company also believes it will be able to generate growth in 2021.

Hybrid cloud

During the fourth quarter, Red Hat witnessed revenue growth of 17%, driven by subscription growth. The strength in subscription bookings helped generate a growth of over 20% in backlog, which in turn exceeded $5 billion.

IBM stated on its quarterly conference call that it sees a $1-trillion opportunity in hybrid cloud with less than 25% of workloads having moved to the cloud so far. Linux, along with Containers and Kubernetes, forms the foundation of the company’s hybrid cloud platform while Red Hat OpenShift is its core product. IBM has a vast software portfolio which is modernized to run cloud-native.

IBM currently has 2,800 clients using its hybrid cloud platform, up 40% from last year. In order to drive growth in its hybrid cloud platform, the company is partnering with system integrations and software vendors and is also investing $1 billion in its ecosystem.

Artificial intelligence

IBM sees vast opportunity in artificial intelligence as the rate of enterprise deployment is currently in single digits. The company’s AI platform is focused on data, automation and security and has more than 30,000 clients at present. IBM continues to invest in future market opportunities within AI such as quantum computing which has the potential to yield billions of dollars in value for its clients.

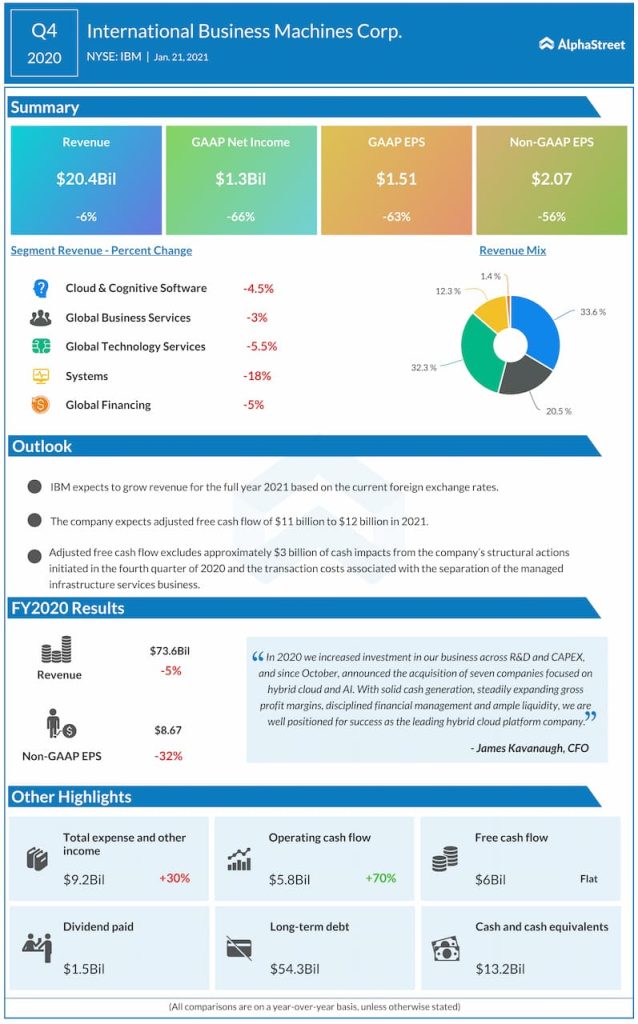

Outlook

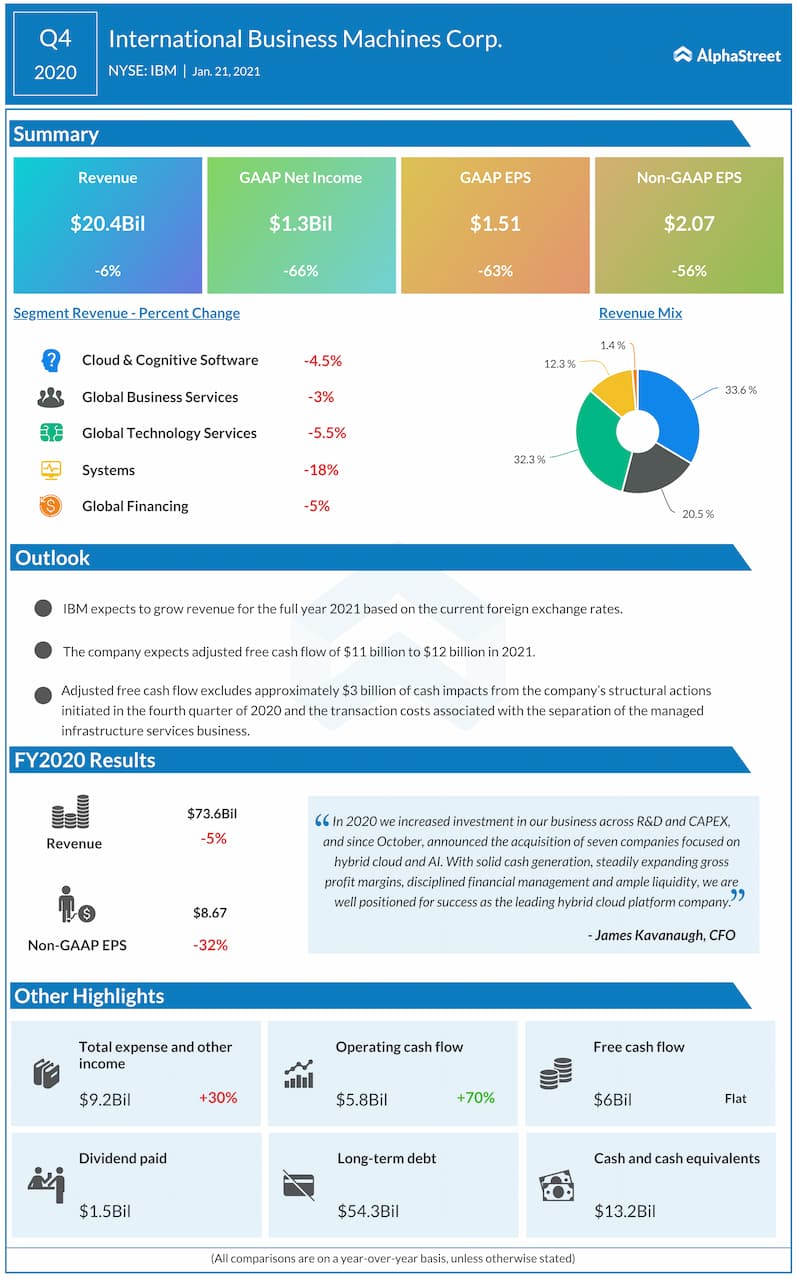

Looking ahead over the next two years, IBM expects to generate mid-single digit revenue growth following the separation of its Managed Infrastructure Services business. Red Hat is expected to contribute significantly to this revenue growth. The company expects the Global Business Services division to return to pre-pandemic growth rates by mid-2021.

In 2021, IBM expects to grow revenues at current spot rates with the performance picking up in the second half versus the first half. Adjusted free cash flow is expected to range between $11-12 billion.

Click here to read the transcripts of the latest earnings calls