Read management/analysts’ comments on quarterly reports

The company achieved a return-focused strategy, which acted as a response to the unit crisis and helped the company absorb the global standards. North America was a prime location where the company scaled and increased its own capacity for manufacturing. On a global level, the company was able to identify its low performing business units and rework them to increase profits. These actions helped the company achieve the EBITDA margin it had in 2019.

Schlumberger has a bird’s eye view on the recovery cycle, which was in line with the workflow and new industry standard drivers. The digital transformation ,which is quite essential going ahead in the future, is given equal importance. The company has also made plans for low carbon-emitting machinery, which will not only increase the production but also construction efficiency as well.

Positive liquidity margins

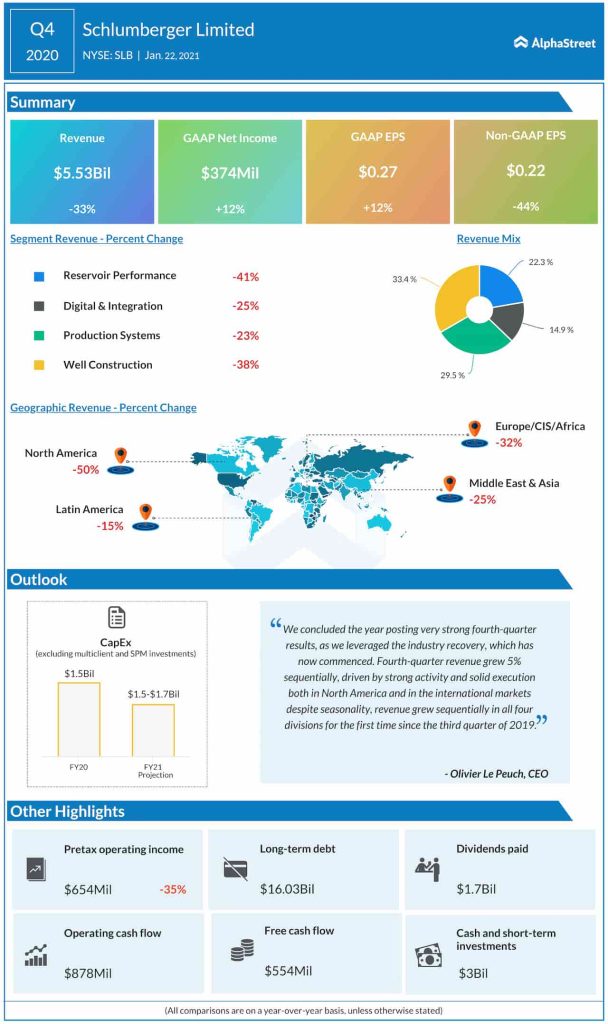

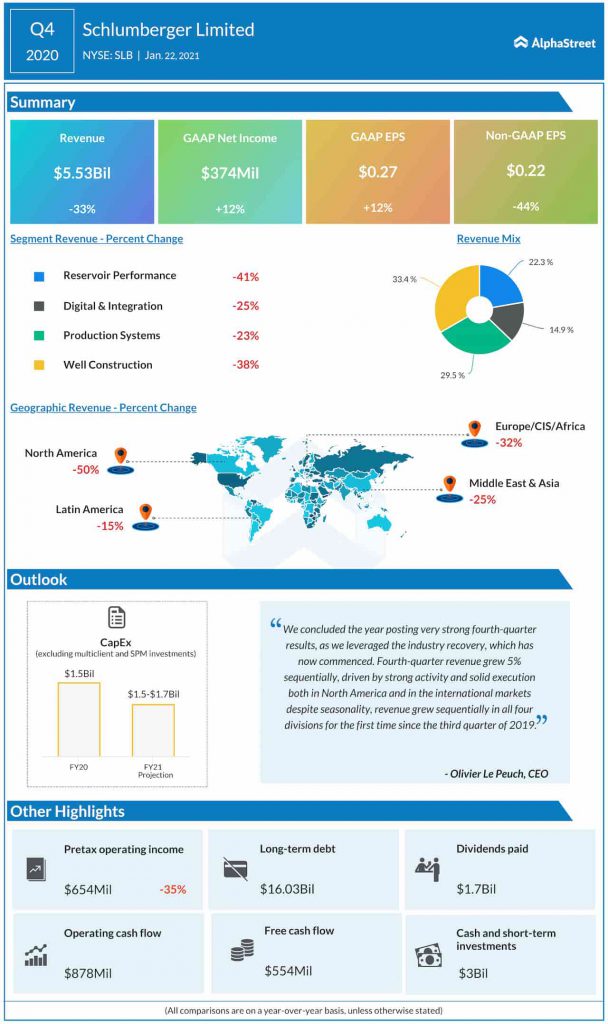

In terms of cash flow, the Houston-based firm had a very successful quarter. Schlumberger generated $878 million of cash flow from operations and $554 million of free cash flow, despite suffering $144 million of severance payments. After all the payments and expenses the company incurred during the year, it still managed to maintain a margin of double digits, which is a good sign for the year 2021.

Net debt improved later by $46 million, despite an unfavorable currency impact of $223 million and by the end of the year, it was $13.9 billion with an increase of $753 million year-on-year. The oilfield services firm gained around $600 million in exchange rates that impacted their foreign currency-denominated debt.

Vision 2021

The year 2021 marks an important beginning to the new ventures the company has proposed. The Celsius Energy project plugs buildings to the geothermal energy, reducing carbon emissions by 90%, and the Genvia project, which focuses on the development and industrial deployment of a game-changing electrolyzing technology for clean hydrogen production. These two projects will help the company become a leading entity in the sustainable energy segment in the coming year.

The company plans on building the international activity, which was severely affected last year due to Covid-19. As the market is starting to rebalance, the company expects the international demand to increase and see an acceleration in both short and long cycles. Well Construction revenue of $1.9 billion increased 2% and margins increased 42 basis points to 10% due to increased activity in North America, Latin America, Africa, and the Middle East, and Asia, partially offset by seasonality in Russia.

Production Systems revenue of $1.6 billion increased 8% sequentially as international and North American revenues increased 7% and 11% respectively. For the full year 2020, the company spent $1.5 billion on capital investments, followed by the capital stewardship program for 2021. The company plans to spend between $1.5 to $1.7 billion on capital investments and the capital expenditure portion of these investments is expected to be towards the lower end of the previous guidance of 5% to 7% of revenue.

______