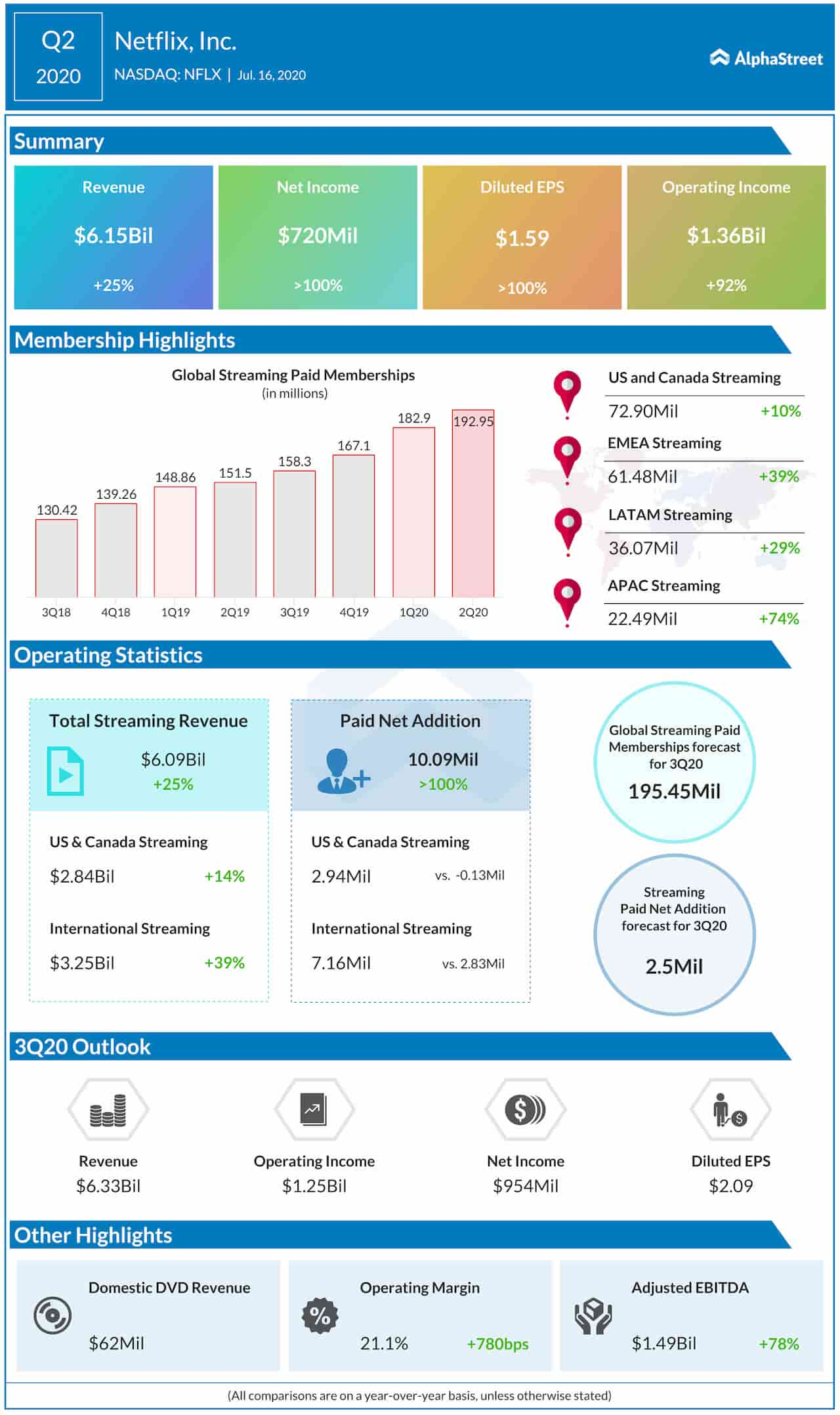

That is, until last week when it ended 2.8% in red. One prime factor that impeded the strong rally was the earnings miss and poor guidance from Netflix (NASDAQ: NFLX) in Q2. Disappointed investors sent the stock spiraling by almost 8%. Note that Netflix was among the biggest beneficiaries of the shelter-at-home order when people had nothing but online streaming for entertainment.

Keeping up with expectations

Over the next two weeks, major tech companies including fellow FAANG firms will announce quarterly results. And since these stocks together account for almost half the weightage of the NASDAQ 100, the index is looking at a crucial fortnight.

Also read: Is Netflix a buy after rising 50% in 2020?

If you split the entire technology sector into sub-sectors, it was the cloud computing and software segments that witnessed the biggest growth rates. Cloud infrastructures of Amazon (NASDAQ: AMZN) Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOGL) saw rapid adoption during the past couple of months, while firms like Zoom (NASDAQ: ZM), DocuSign (NASDAQ: DOCU) and Wix.com (NASDAQ: WIX) that cashed on the valuable services they provided during the lockdown.

The latter three have soared over 100% this year and the rally hardly tallies with the fundamentals. It is possible that the Netflix earnings was a foreshadowing to what was expected out of tech earnings in the next two weeks.

The recent CFRA outlook report reaffirms a similar sentiment. It projects a decline of over 9% in the second quarter, and a further 5% decline in the third quarter. The market is expected to see recovery by the last quarter of the year, followed by continued recovery next year.

A wake-up call

Microsoft, when it reports quarterly figures after the market close on Wednesday, is likely to feel the heat as investors are keeping high expectations on it. The stock, which has gained 29% year to date, could be punished for even missing these expectations, which under normal circumstances, might have been termed outlandish. The same logic applies to other tech firms as well.

On the other hand, tech companies that were ignored for their lack of value during lockdown – including NXP Semiconductors (NASDAQ: NXPI), Verisign (NASDAQ: VRSN) and Cognizant (NASDAQ: CTSH) – might tread higher as they don’t have greedy investors breathing down their shoulders.

Separately, the Supreme Court’s recent decision to uphold a tax regulation that put an end to certain relaxations on overseas businesses of US companies is expected to add to the financial strain of many tech firms. This could have material impact on the bottom-line going forward for companies that have considerable exposure to foreign markets.

Overall, with high valuations, tech stocks seem to be perched at precarious levels. The next two weeks will offer more clarity on how many of these firms are able to keep up with the over expectations.

Related: 3 key takeaways from Netflix’s Q2 earnings

_______

DISCLAIMER: The article does not necessarily imply the views of AlphaStreet, and contains opinions of the author alone.