User growth

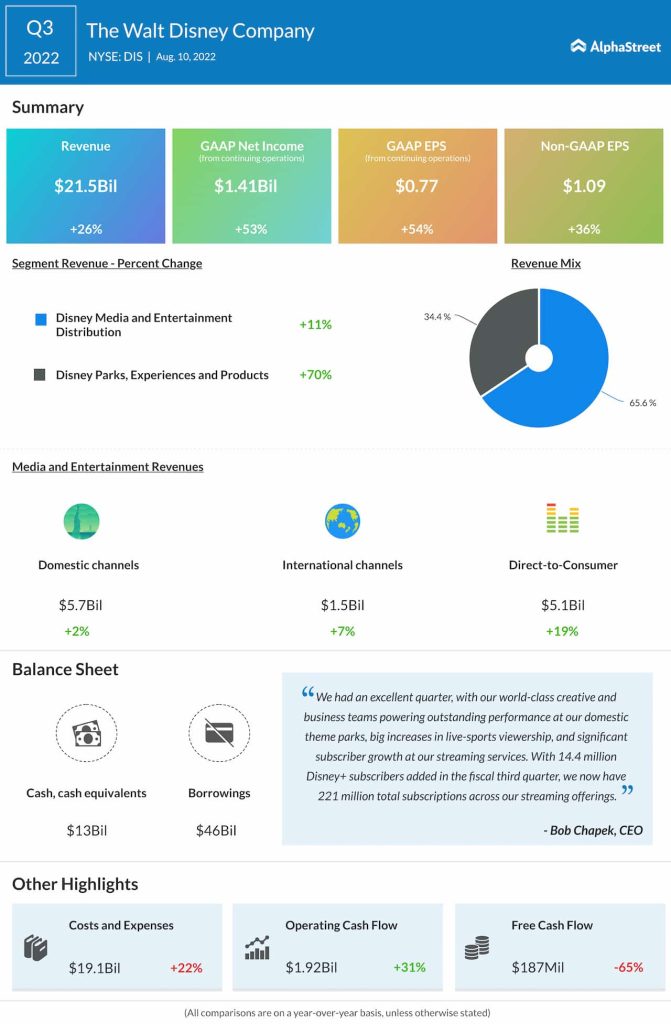

Disney added 15.5 million subscriptions across its streaming services during the third quarter of 2022. This included 14.4 million subscribers for Disney+, of which 6 million were core Disney+ and 8 million were Disney+ Hotstar. The company ended the quarter with 152.1 million global paid subscribers for Disney+.

Hulu added over 600,000 subscribers during the quarter to end the period with 46.2 million paid subscribers. ESPN+ ended the quarter with 22.8 million paid subscribers. At the end of Q3, Disney had a total of 221 million subscriptions for its streaming business, which was ahead of Netflix’s total number of 220 million. Although this was pretty inevitable, it is still a huge win.

The growth in core Disney+ subscribers reflect growth in existing markets and the company expects net additions in the fourth quarter to accelerate modestly versus the third quarter, especially in the domestic market, which would mean there is room for growth and that the point of saturation has not been reached.

Disney provided subscriber guidance separately for its core Disney+ and Disney+ Hotstar platforms this quarter. The company expects to have 135-165 million core Disney+ subscribers by the end of FY2024. This is largely consistent with its previous guidance that non-Hotstar Disney+ subscribers in 2024 would approximate 60-70% of the expected 230-260 million total subscriber base.

Disney updated its subscriber guidance for Disney+ Hotstar to up to 80 million subscribers by the end of FY2024. The company lowered its guidance after it decided not to renew digital rights for the Indian Premier League.

Content

Once again, Disney’s franchise content from Marvel, Star Wars and Pixar has proved its mettle. The company saw massive success with the latest Doctor Strange and Thor movies. Series like Obi-wan Kenobi and Ms. Marvel are examples of how the company can attract viewers and drive engagement with new characters within existing franchises. This, combined with its Hulu Originals and multi-platform hits like The Old Man, give Disney significant opportunity to drive growth and expansion.

Disney+ is currently available in 155 markets after the company expanded this service into 53 new territories this quarter. Disney is investing in regional content within these markets and this will help bring more viewers to its platform and drive engagement.

Ad-supported subscription tier

In December, Disney will launch its ad-supported subscription offering in the US. The basic plan, which will have ads, will cost $7.99 per month while the ad-free premium plan will reflect a hike of $3 to $10.99. These price hikes are expected to generate more profits for the company over the coming months.

Click here to read the full transcript of Walt Disney’s Q3 2022 earnings conference call