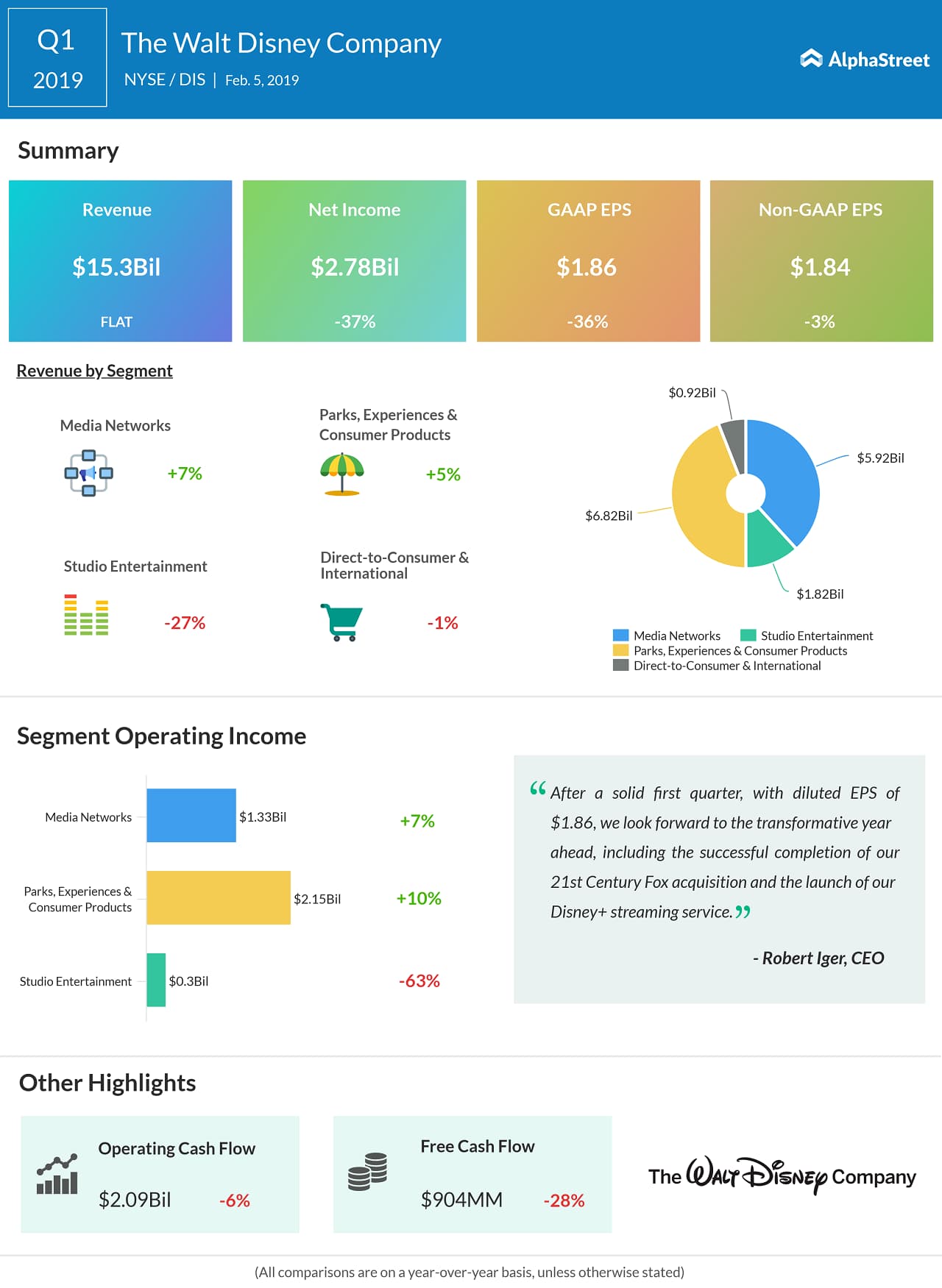

GAAP net income dropped more than 35% to $2.7 billion, or $1.86 per share, versus last year. Adjusted EPS dropped 3% to $1.84, but topped analysts’ expectations of $1.57.

During the quarter, the company posted revenue increases in the Media Networks and Parks, Experiences & Consumer Products segments. Within Media Networks, both Cable Networks and Broadcasting delivered revenue growth. Higher programming costs hurt results at ESPN but were partly offset by growth in affiliate and advertising revenues.

Studio Entertainment saw double-digit declines in both revenue and operating income, driven by a decrease in theatrical distribution results, partially offset by growth in TV/SVOD distribution. The current quarter’s releases such as Mary Poppins Returns and The Nutcracker and the Four Realms could not match the success of the prior-year quarter releases such as Thor: Ragnarok and Star Wars: The Last Jedi, thereby impacting theatrical distribution results.

Also see: Disney Q1 2019 Earnings Conference Call Transcript

Direct-to-Consumer & International revenues dropped by 1%, reflecting a 4% negative impact from foreign currency. Operating loss increased to $136 million from $42 million last year, mainly due to higher investments in ESPN+, a loss from streaming technology services and costs associated with the launch of Disney+.

“Building a robust direct-to-consumer business is our top priority, and we continue to invest in exceptional content and innovative technology to drive our success in this space”, said Robert A. Iger, Chairman and CEO.

In November, Disney announced that its streaming service will be called Disney+ and that it will launch in late 2019. Disney+ is expected to be a formidable competitor to Netflix (NFLX) and the former holds a massive advantage in terms of content from the Disney media library, which will give it an edge over the latter.