DocuSign is currently focused on transforming the business through innovation – like the integration of generative AI and inclusion of new features like user-friendly Web Forms and advanced ID verification tools – and strengthening its self-service and partner-distribution channels. While the company serves around two-thirds of the market, of late it’s been facing competition from the likes of Dropbox which forayed into the eSignature space a few years ago with the acquisition of HelloSign. Meanwhile, high inflation, elevated interest rates, and economic uncertainties will remain a drag on the company’s growth in the near future.

Results Beat

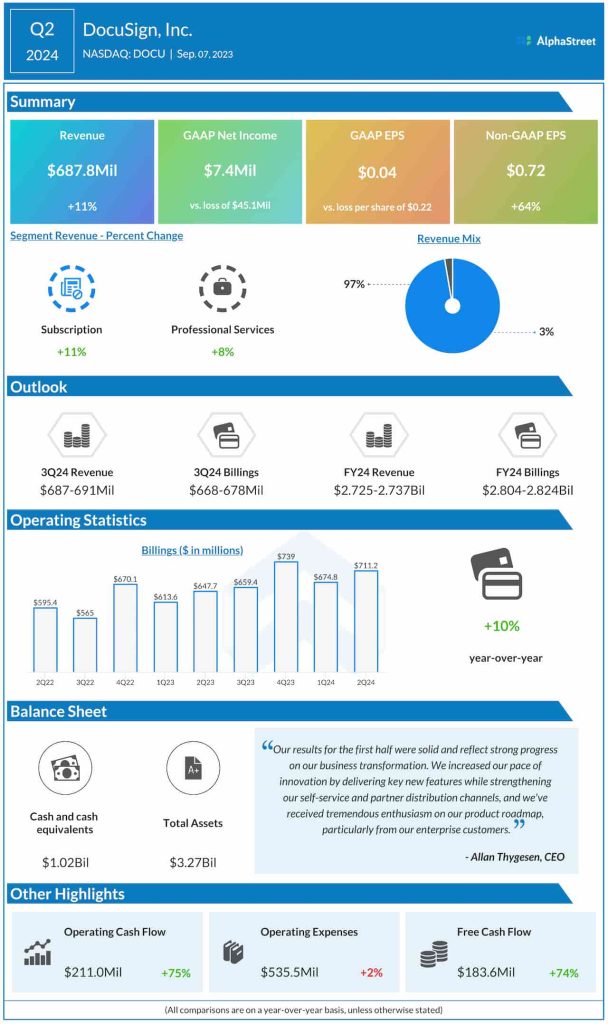

In the July quarter, net revenues increased 11% year-over-year to $687.7 million from $622.2 million in the same period of last year. Subscription revenue and professional service revenue increased by 11% and 8% respectively during the three-month period. As a result, adjusted earnings per share rose sharply to $0.72 from $0.44 last year. Second-quarter net profit, on an unadjusted basis, came in at $7.4 million or $0.04 per share, marking an improvement from the prior-year period when the company suffered a loss of $45.1 million or $0.22 per share. The results topped expectations, as they did in every quarter since early last year.

DocuSign’s CEO Allan Thygesen said: “In the short term, we’re looking to ship new features and functionality that differentiate DocuSign and streamline agreement workflows, bringing in new customers and continuing to deliver value to existing customers. To that end, we continue to expand our identity verification portfolio, announcing the global launch of Liveness Detection for ID Verification. Liveness Detection technology leverages AI-powered biometric checks to prevent identity spoofing, which results in more accurate verification without the signee being present.”

Guidance

Looking ahead, revenues are expected to be in the range of $687 million to $691 million in the third quarter when total billing is expected to come in between $668 million and $678 million. The guidance for full-year revenue has been raised to the range of $2.725 billion to $2.737 billion, and billings forecast to the $2.804-$2.824 billion range.

DocuSign’s stock traded down 2% on Friday afternoon and hovered near the $50 mark, despite the positive earnings report.