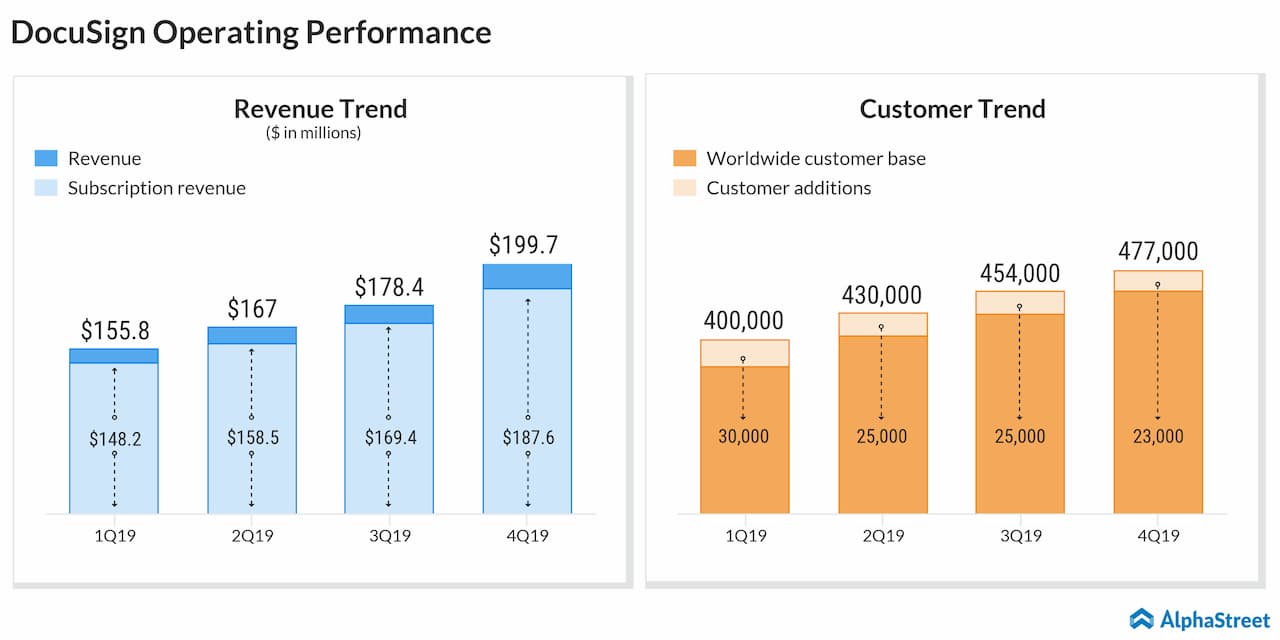

Over the past four quarters, the company has delivered consistent growth in customer additions and this is expected to continue in the first quarter. In the last-reported quarter, DocuSign said it added 23,000 customers, taking its global customer base to 477,000.

There has been a significant increase in market competition with the arrival of Adobe (NASDAQ: ADBE) and Dropbox (NASDAQ: DBX). However, DocuSign is yet to show a slowdown due to the entry of these new players.

According to Reports Monitor, the e-signature industry is set to grow at

a yearly pace of 31% over the coming six years, hence there is plenty of headspace

for growth.

DocuSign surprised Wall Street by reporting a profit in the fourth quarter of 2019, helped by a marked increase in revenues.

Revenues climbed

34% to $199.7 million in the fourth quarter, beating analysts’ estimate of

$193.68 million. The top line was lifted by a 37% growth in subscription

revenue.

The company

reported adjusted earnings of $0.06 per share during the quarter, even as the

market was expecting a breakeven.

DocuSign also raised its full-year outlook for total revenues to a range of $910-915 million, while billings are estimated to be $1.01-1.03 billion.

The stock, which started trading in April last year, has gained a modest

4.5% in the trailing 52 weeks, despite its relatively strong operational

performance. During the year-to-date period, meanwhile, the stock is up 37%.

Analysts are quite bullish on the stock, which as a 12-month average price target of $11.18. This represents an 18% upside from the last closing price.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.