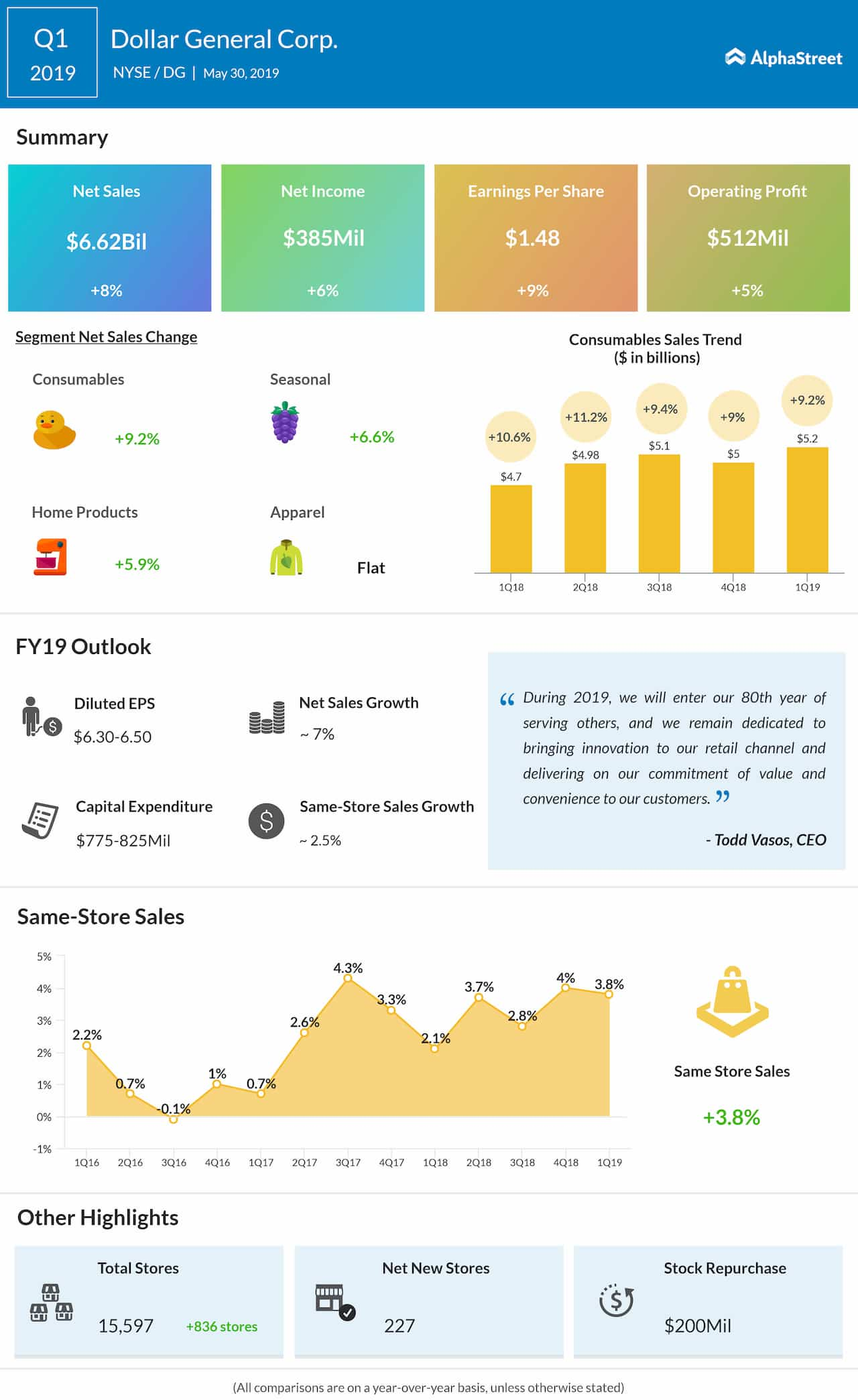

Discount store operator Dollar General Corporation (NYSE: DG) reported an 8% increase in first-quarter sales, supported by strong comparable store sales. Consequently, earnings rose sharply and exceeded estimates, driving the stock higher in premarket trading Thursday. The company also reaffirmed its full-year guidance.

Net profit was $385 million or $1.48 per share in the first quarter, compared to $365 million or $1.36 per share in the same period of last year.

Net sales moved up 8.3% to $6.63 billion, exceeding Wall Street’s forecast. The top-line benefitted from a 3.8% growth in comparable store sales, which was partially offset by the impact of store closures.

The top-line benefitted from higher comp sales, which was partially offset by the impact of store closures

“During 2019, we will enter our 80th year of serving others, and we remain dedicated to bringing innovation to our retail channel and delivering on our commitment of value and convenience to our customers. We are excited about our future and believe we are creating long-term value for our shareholders,” said CEO Todd Vasos.

During the quarter, Dollar General opened 240 new stores and remodels 330 stores, as part of its renewed real estate strategy. The board of directors declared a cash dividend of $0.32 per share for the second quarter, to be paid on July 23 to shareholders of record on July 9. Overall, $283 million was returned to shareholders in the form of share repurchases and dividends during the three-month period.

OUTLOOK

The management reaffirmed its full-year 2019 outlook for sales growth at 7% and continues to see a 2.5% increase in same-store sales. Full-year operating profit is estimated to increase between 4% and 6%. The forecast for earnings has been reiterated in the range of $6.30 per share to $6.50 per share.

The company confirmed its plan to repurchase shares worth approximately $1 billion during the year when capital expenditure is expected to come in the range of $775 million to $825 million.

PEER PERFORMANCE

Meanwhile, Dollar Tree’s (DLTR) shares slipped 4% after the discount store chain posted weaker than expected earnings of $1.14 per share for the first quarter. Revenues rose 5% to $5.81 billion and topped expectations. There was a 2.2% increase in same-store sales.

Shares of Dollar General gained 33% in the past twelve months and rose 10% since the beginning of 2019. The stock closed the last trading session lower but gained sharply following Thursday’s earnings report.