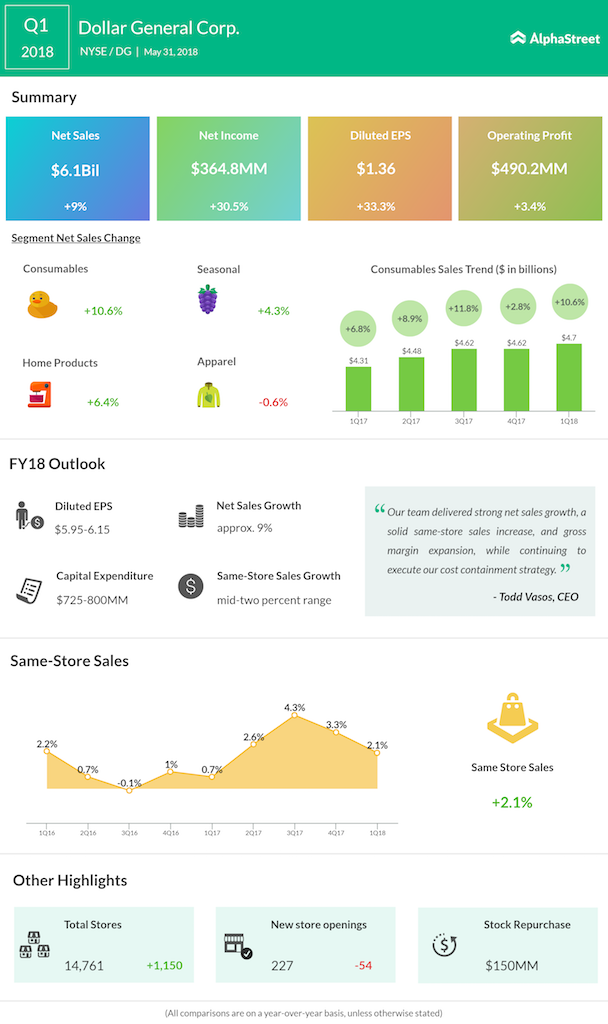

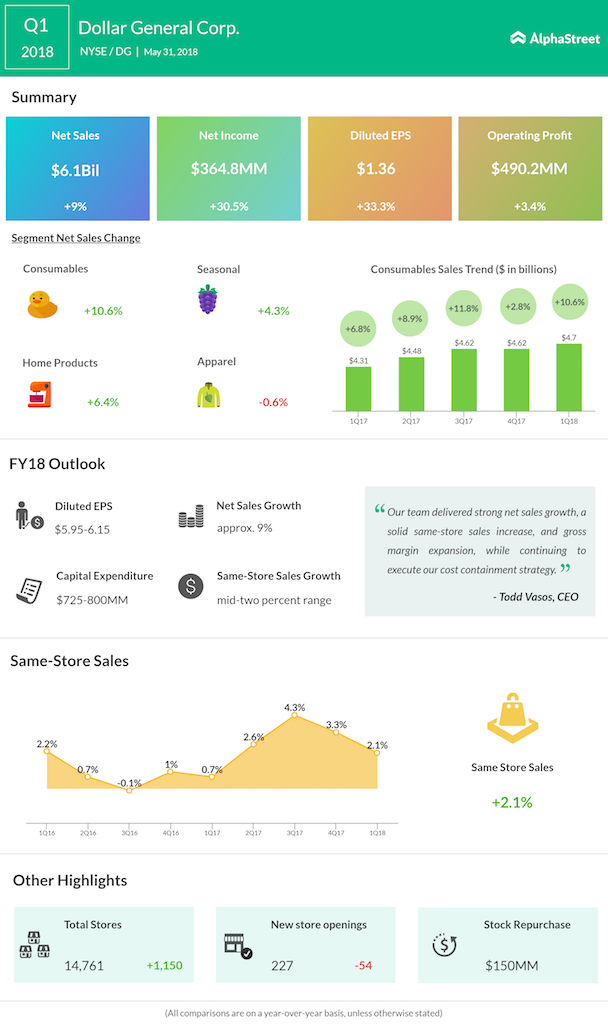

“We are pleased with the start of the second quarter, and based on our year-to-date performance and outlook for the remainder of 2018, we are reiterating our full-year guidance. We offer a unique value and convenience proposition that continues to resonate with customers, and we are excited about the initiatives we have in place,” said Todd Vasos, CEO.

The company declared a quarterly cash dividend of $0.29 per share on its common stock, payable on or before July 24, 2018, to shareholders of record on July 10, 2018.

Dollar General, which plans to open approx. 900 new stores this year, reiterated its guidance for this fiscal year. The company expects net sales to increase approx. 9%, with same-store sales growth estimated to be in the mid-two percent range. Diluted EPS is expected to be in the range of $5.95-$6.15.