Family Dollar sale

Q4 results

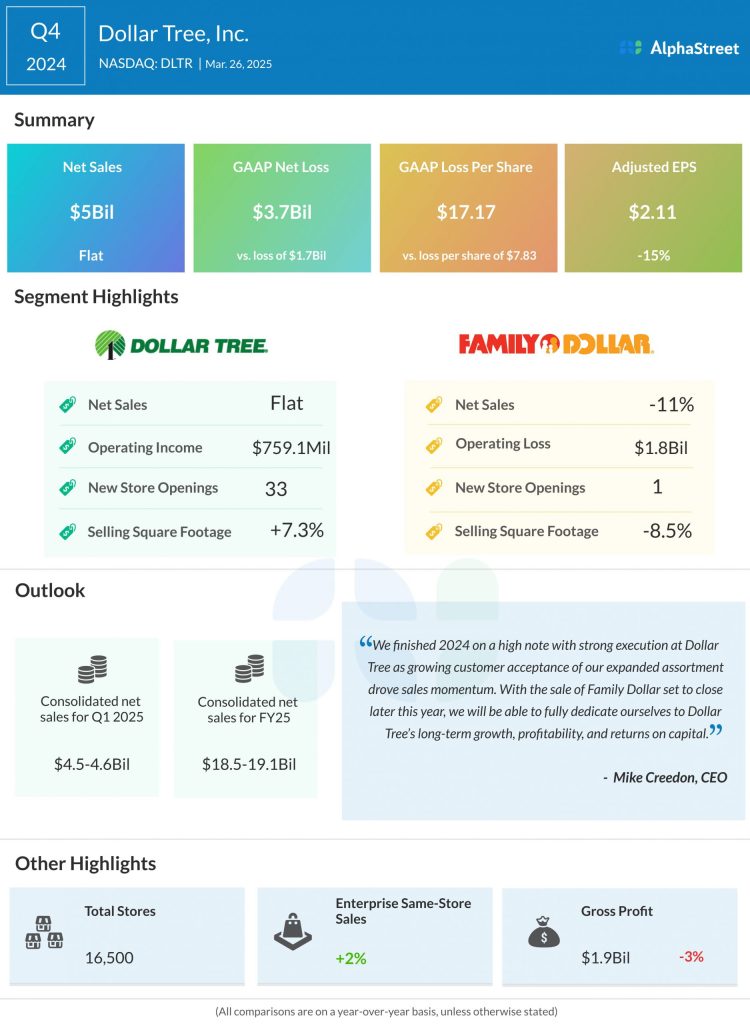

In the fourth quarter of 2024, Dollar Tree posted net sales of $5 billion, which saw little change from the prior-year period. Adjusted earnings per share decreased 15% year-over-year to $2.11. The top and bottom line numbers came below analysts’ projections.

Same-store sales grew 2%, helped by a 0.7% rise in traffic and a 1.3% increase in average ticket. Consumables comps rose 4.2% while discretionary comps were up 0.4%. Gross margin fell 130 basis points to 37.6%, mainly due to the loss of leverage from an extra week of sales in 2023, lower initial mark-on, and higher shrink, distribution, and markdown cost.

The discount retailer opened 33 new Dollar Tree stores during the quarter, bringing the total openings for the year to 525. It ended fiscal year 2024 with approx. 2,900 Dollar Tree 3.0 multi-price format stores, including 2,600 conversions and 300 new stores.

Outlook

For the first quarter of 2025, Dollar Tree expects net sales from continuing operations to range between $4.5-4.6 billion, with comparable sales growth of 3-5%. Adjusted EPS is estimated to be $1.10-1.25.

For fiscal year 2025, net sales from continuing operations are expected to be $18.5-19.1 billion, with comparable sales growth of 3-5%. Adjusted EPS from continuing operations is expected to be $5.00-5.50.