During the quarter, Dollar Tree opened 127 stores, expanded or relocated 14 stores, and closed 18 stores. Additionally, 30 Family Dollar stores were re-bannered to Dollar Tree. Retail selling square footage at quarter-end was approximately 119.5 million square feet.

Dollar Tree now plans to renovate at least 1,000 Family Dollar stores in fiscal 2019 and open 350 new Dollar Tree and 200 new Family Dollar stores in fiscal 2019. About 200 Family Dollar stores are expected to be re-bannered as well in the period.

The trade war between the Trump administration and China did catch up to the retailer, as fresh taxes on imports worth $200 billion have resulted in price escalation affecting the arrival of low-priced consumer items. While usually tariffs were slapped on industrial goods imported from the Asian country, this new predicament has forced Dollar Tree and its peers to sell the products at old prices for losses or pull them from the shelves. However, the positive bottom line is a silver lining.

Other discount store operators like Dollar General (DG) are no different due to the new tariff regime. If the taxes are not rolled back, profitability will be under pressure in the long term, resulting in headcount reduction and store closures.

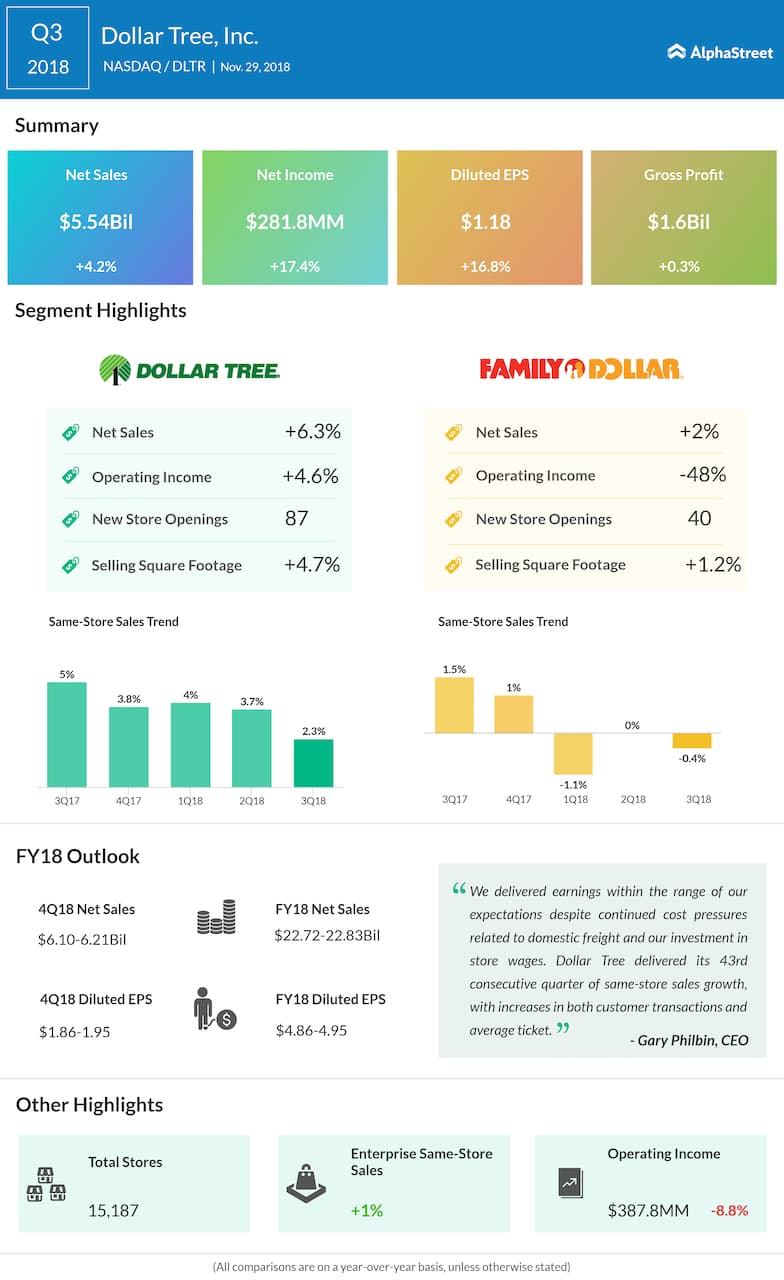

In this view, Dollar Tree has reduced its outlook. Consolidated net sales for fiscal 2018 are now expected to be lower at a $22.72-$22.83 billion range generating net income of $4.86-$4.95 per diluted share.

The company estimates consolidated net sales $6.10-$6.21 billion for the fourth quarter, due to a low single-digit rise in same-store sales for the combined enterprise. Earnings is expected to be $1.86-$1.95 per diluted share for the period.

However, the market has hopes for Dollar Tree.

Many big-time investors have recently increased their holdings in Dollar Tree. In the third quarter, Price Capital Management Inc. added $106,000 worth of shares, while SRS Capital Advisors ramped up its holdings by 250% with an additional 1,009 shares. Institutional investors now own 92.83% stock, indicating a possible long-term growth.