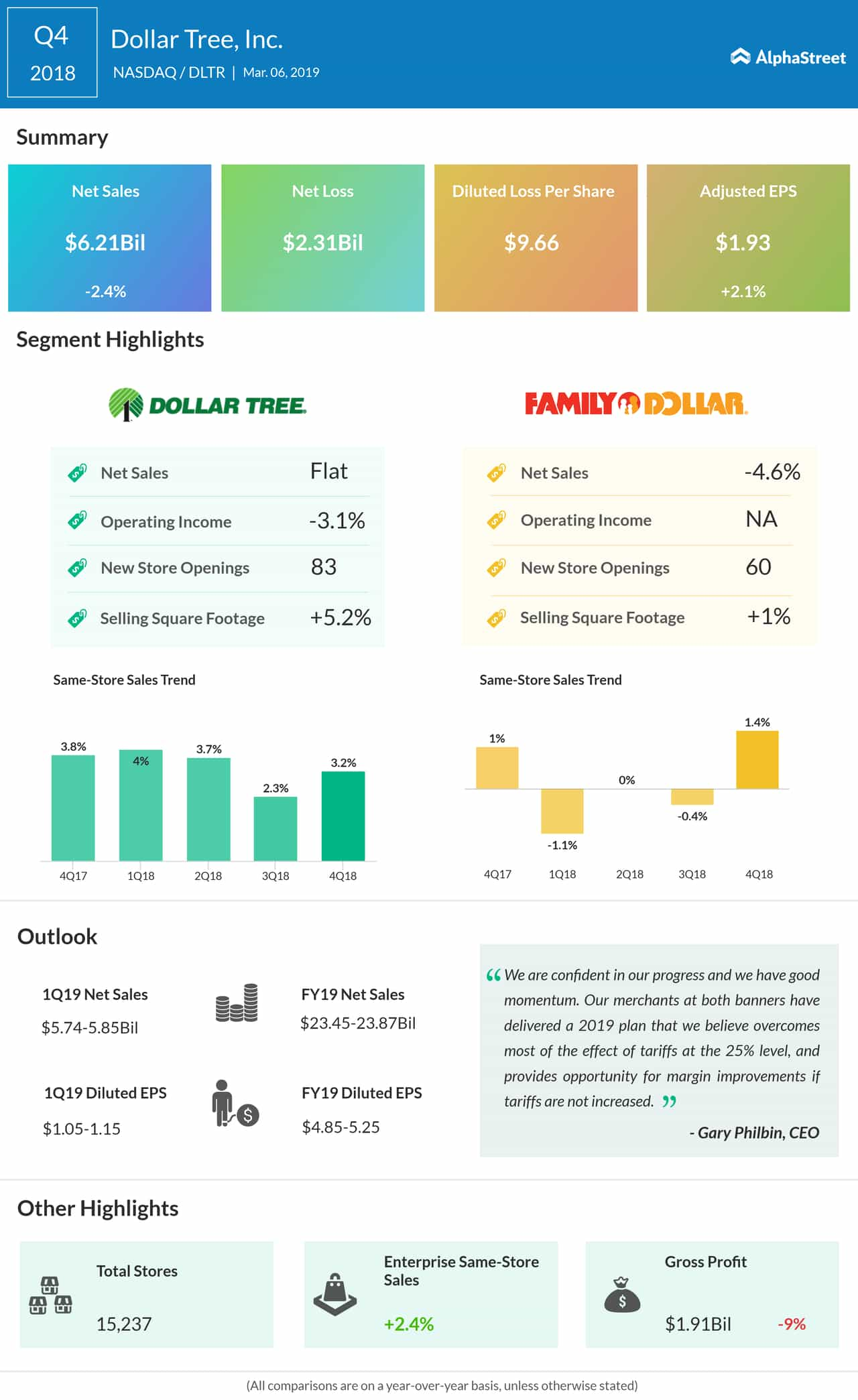

Total sales dropped 2.4% to $6.21 billion in the fourth quarter, when same-store sales at the Dollar Tree and Family Dollar segments moved up 3.2% and 1.4% respectively. Overall, enterprise same-store sales were up 2.4%. The top-line came in slightly above expectations.

Total sales dropped 2.4%, while same-store sales at both the Dollar Tree and Family Dollar segments moved up

Dollar Tree’s CEO Gary Philbin said, “Our results demonstrate the increasing strength of the Dollar Tree brand, and accelerated progress on the Family Dollar turnaround, as Family Dollar delivered its strongest quarterly same-store sales growth of the year.”

During the fourth quarter, the company opened 143 stores and expanded or relocated 14 others. Also, a total of 84 Family Dollar stores and 10 Dollar Tree stores were closed. As of February 2, 2019, Dollar Tree operated 15,237 stores in the US and Canada.

Also read: Walmart reports impressive Q4 earnings, eCommerce sales

Continuing its store optimization efforts, the company is planning to open 350 new Dollar Tree stores and 200 new Family Dollar stores in 2019, while closing the underperforming ones. The store reorganization is expected to result in the generation of $23.45-$23.87 billion in sales this year. Full-year earnings are forecast to be between $4.85 per share and $5.25 per share.

For the first quarter, the management expects sales in the range of $5.74 billion to $5.85 billion. Earnings are expected to be between $1.05 per share and $1.15 per share. According to the company, its ongoing growth initiatives will boost profitability in 2020, driving earnings per share up by 14- 18%.

Dollar Tree shares witnessed a great deal of volatility last year, before recovering towards the end of the year. The stock rose nearly 3% over the past twelve months and continued to gain in the early months of 2019.