Traffic during the Thanksgiving weekend peaked, bucking fears of prolonged slowness in the airline sector. Delta Air Lines (DAL), meanwhile, said a record number of passengers – 2.3 million – used its services from November 21 to November 25.

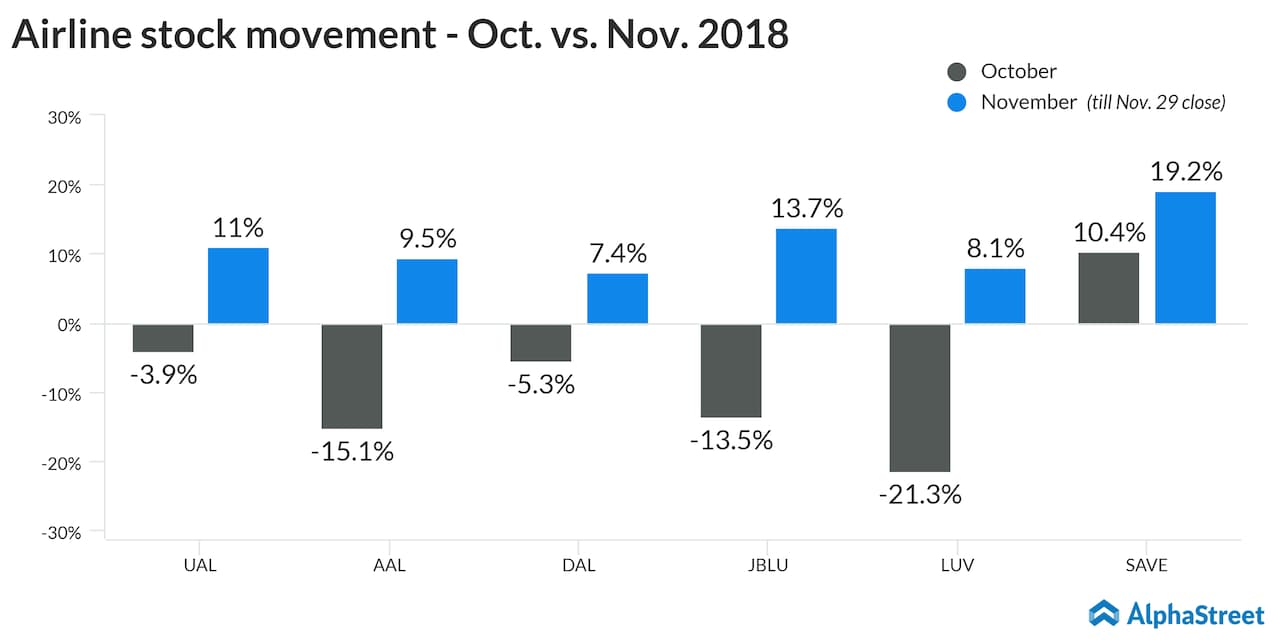

The bulls were quick to react. While most airline stocks ended October in red, all of them were back into a rally mode in all of November. In fact, Spirit Airlines (SAVE) stock jumped 15% earlier this week after the company raised its fourth-quarter TRASM growth outlook from 6% to 11%. The stock is up over 19% so far this year.

Separately, Alaska Air Group (AAL) raised its RASM guidance for the fourth quarter to 12.60 – 12.80 cents from the earlier projection of 12.40-12.60 cents.

American Airlines Group Q3 profit falls 49% but beats estimates

Adding to this optimism is the fact that the oil prices, which have haunted airline stocks throughout this year, are slowly receding over a weak demand outlook as well as fears of a supply glut.

All these factors coming together, combined with strong consumer confidence and low unemployment rates, promise a lucrative period ahead for airline companies. There is possibly no better time to board airline stocks.