It’s that time of the year when everyone packs up for their vacation. But before you board your flight, it might make sense checking into some of the airline stocks, which are all set for a good flight after a long period of staying grounded, thanks to fuel price inflation.

The holiday season is the airline industry’s best seasonal quarter when demand for air travel reaches its yearly peak. This year is no different and the initial signs are here already.

Traffic during the Thanksgiving weekend peaked, bucking fears of prolonged slowness in the airline sector. Delta Air Lines (DAL), meanwhile, said a record number of passengers – 2.3 million – used its services from November 21 to November 25.

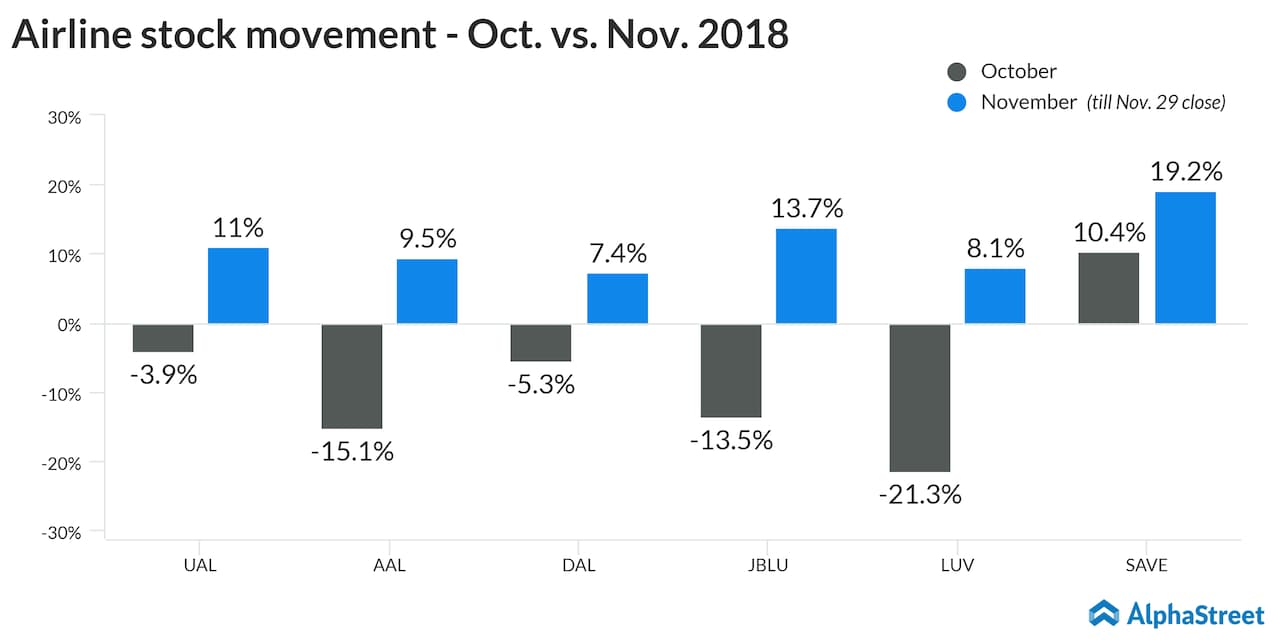

The bulls were quick to react. While most airline stocks ended October in red, all of them were back into a rally mode in all of November. In fact, Spirit Airlines (SAVE) stock jumped 15% earlier this week after the company raised its fourth-quarter TRASM growth outlook from 6% to 11%. The stock is up over 19% so far this year.

Separately, Alaska Air Group (AAL) raised its RASM guidance for the fourth quarter to 12.60 – 12.80 cents from the earlier projection of 12.40-12.60 cents.

American Airlines Group Q3 profit falls 49% but beats estimates

Adding to this optimism is the fact that the oil prices, which have haunted airline stocks throughout this year, are slowly receding over a weak demand outlook as well as fears of a supply glut.

All these factors coming together, combined with strong consumer confidence and low unemployment rates, promise a lucrative period ahead for airline companies. There is possibly no better time to board airline stocks.