Perhaps Disney’s strongest area is its movie business, which has been immensely profitable last year, thanks to Thor: Ragnarok, Coco and Star Wars: The Last Jedi. The pipeline for this year is also pretty promising with Solo: A Star Wars Story, A Wrinkle in Time, Avengers: Infinity War, The Incredibles 2, and Ant-Man and the Wasp set for release.

Disney’s Buena Vista Pictures topped the domestic box office with 29.9% market share in 2017, followed by Sony/Columbia (16.2%), 20th Century Fox (14.1%), Comcast Universal (9.6%) and Time Warner’s Warner Bros (7.7%), according to Box Office Mojo.

With a strong movie business and growing hospitality business, it’s highly probable that the company may see a take-off this year.

Meanwhile, Disney’s line of parks and resorts continue to gain momentum driven by the rising demand for theme parks. Though Disney has been utilizing a major chunk of its capital expenditures on resorts and parks, it balances off with the pretty high returns. Resorts & Parks, combined with stable cruise and movie businesses pushed the company’s first-quarter results above the expected levels.

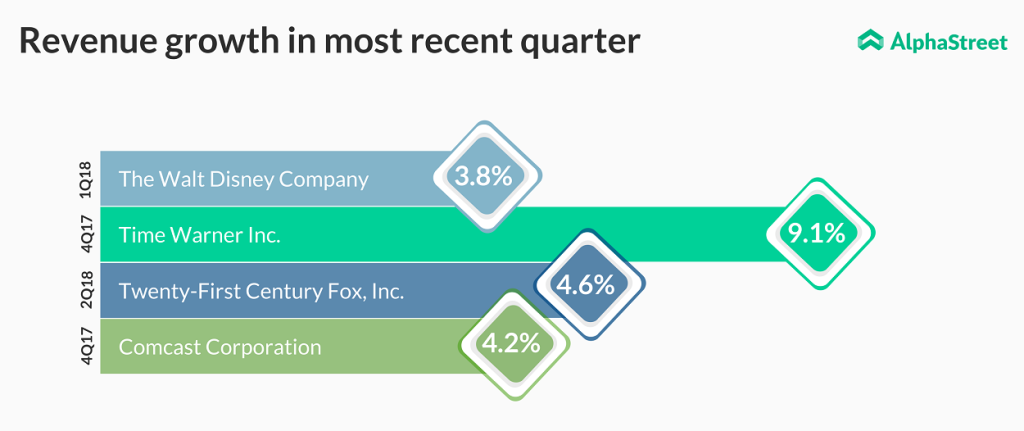

However, rivals Comcast and Time Warner stole Disney’s thunder by posting upbeat earnings from their sides as well. Revenue-wise, Comcast saw a 4.2% growth, while CBS jumped 11%. Time Warner, meanwhile, posted 9% increase in revenue.

All is well except Disney’s Broadcasting segment, where the situation has been woeful due to a drop in ESPN viewership, lower program sales and softness in political advertising. Also, the fall of ESPN has been pretty concerning for Disney, fell misjudged the audience trend of moving towards video streaming industry. This combined with an unconventional timing of College Football Playoff games, also hurt the viewership. Disney is currently hoping to make a rebound with the introduction of the first direct-to-consumer streaming service, ESPN Plus, which comes at a price of $4.99 per month.

Disney is now hoping to get ahead of its competitors with the acquisition of Fox, ie unless Comcast plays spoilsport by winning the bid. Anyways, Disney is trying to correct its past mistakes to make a comeback into the mainstream. With a strong movie business and growing hospitality business, it’s highly probable that the company may see a take-off this year.