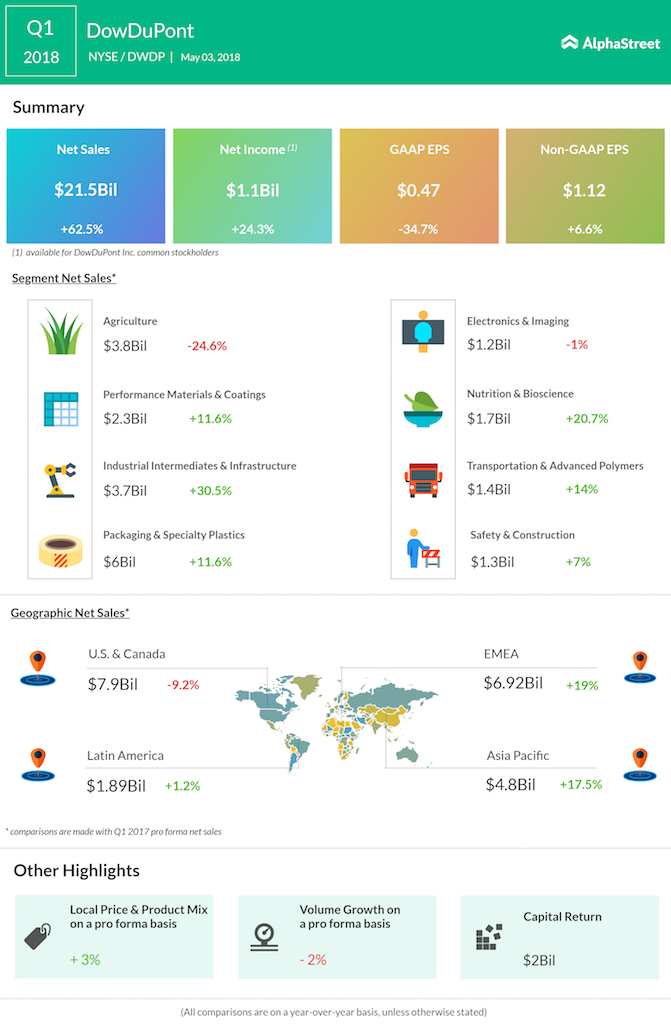

Sales benefited from growth in most operating segments and geographic regions. Gains in all segments and regions drove Materials Science and Specialty Products sales higher. This growth more than offset a 25% decrease in Agriculture sales due to weather-related delays to planting seasons in the Northern Hemisphere and Brazil. Net sales included a 4% benefit from currency, primarily from the Euro.

A weather-related shift in Agriculture hurt volume that declined 2% on a pro forma basis. Meanwhile, the local price rose 3% on a pro forma basis, led by increases in all regions and most operating segments.

The company achieved cost synergy savings of over $300 million in the first quarter, ahead of its run-rate plan and is now on pace to deliver a 75% run-rate against its $3.3 billion cost synergy commitment by the end of the third quarter of 2018.

DowDuPont continues to expect Materials Science to spin off by the end of the first quarter of 2019, with Agriculture and Specialty Products separating by June 1, 2019. Looking ahead into the second quarter of 2018, the company expects net sales to be up over 10% and operating EBITDA up more than 20% year-over-year.

The company continues to see their innovations and growth investments strength to drive above market growth into the second quarter. DowDuPont said leading indicators from manufacturing output to improving energy markets, to employment and consumer spending remain largely positive, reflecting higher economic activity.

Shares of DowDuPont ended Wednesday’s regular trading session up 0.68% at $63.49 on the NYSE. The stock had been trading between $61.27 and $77.08 for the past 52 weeks.