Categories AlphaGraphs, Earnings, Industrials

Earnings: Aerospace, IT help General Dynamics beat Q4 estimates

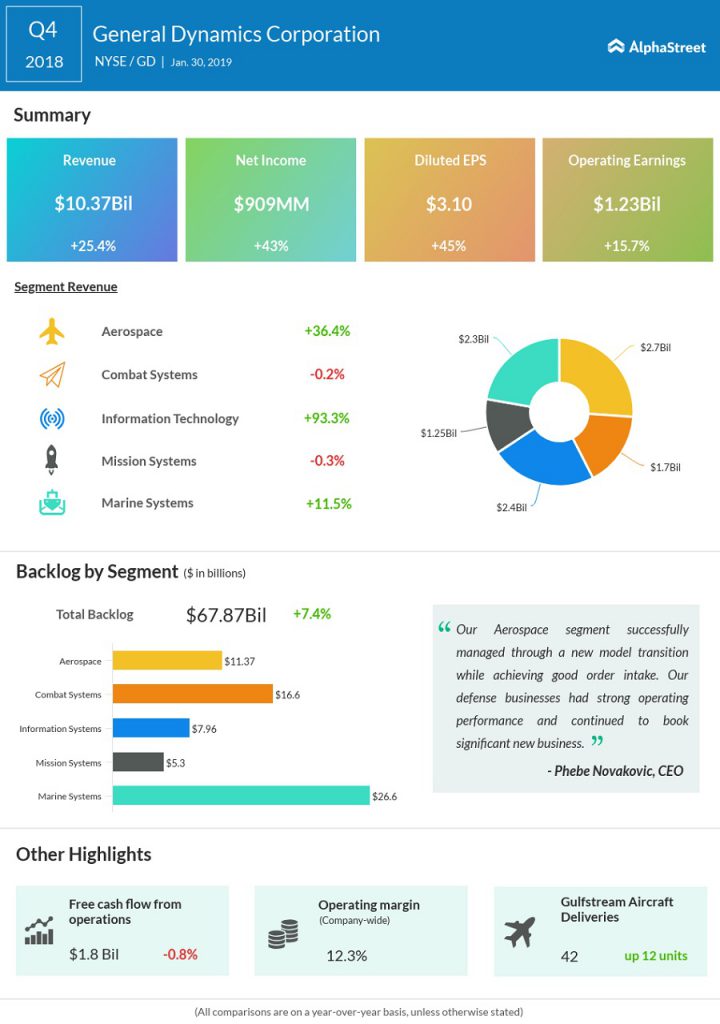

General Dynamics (GD) Wednesday reported 25% jump in fourth-quarter revenue to $10.4 billion, driven by the Aerospace and Information Technology segments. Earnings for the quarter rose to $3.07 per share from $2.10 per share a year ago.

The results came in above the estimates set by analysts, who had projected earnings of $2.98 per share on a top line of $10.29 billion.

GD shares closed its last trading session up 2.2% on Tuesday. The stock has declined 21% in the past 52 weeks.

Notably, the Information Technology segment almost doubled in revenue to $2.4 billion during the quarter, driven by the purchase of CSRA, which was integrated into the unit in April 2018. Since then, CSRA has won several high-value deals including government contracts. The Aerospace division, meanwhile, grew 36.4%.

CEO Phebe Novakovic said, “Our Aerospace segment successfully managed through a new model transition while achieving good order intake. Our defense businesses had strong operating performance and continued to book significant new business.”

The Falls Church, Virginia-based defense contractor said its total backlog at the end of 2018 was $67.9 billion, up 7.4%. The estimated potential contract value was estimated as $35.5 billion, up 43.2% from last year.

Competitor Lockheed Martin (LMT) on Tuesday reported quarterly earnings that fell short of estimates, following which, shares fell 2.4%. Northrop Grumman (NOC) is scheduled to report results on Thursday, January 31.

Browse through our earnings calendar and get all scheduled earnings announcements, analyst/investor conference, and much more!

Most Popular

Infographic: How Alaska Air Group (ALK) performed in Q1 2024

Alaska Air Group (NYSE: ALK) reported its first quarter 2024 earnings results today. Total operating revenue increased 2% year-over-year to $2.23 billion. Net loss amounted to $132 million, or $1.05 per

KMI Earnings: Kinder Morgan Q1 2024 adjusted profit increases; revenue drops

Kinder Morgan, Inc. (NYSE: KMI) reported higher adjusted earnings for the first quarter of 2024 despite a decrease in revenues. The energy infrastructure company also issued guidance for the full

What to expect when Altria (MO) reports first quarter 2024 earnings results

Shares of Altria Group, Inc. (NYSE: MO) stayed green on Wednesday. The stock has dropped 8% over the past one month. The tobacco giant is scheduled to report its first