On the M&A front, tech firms Lumentum Holdings and Coherent, Inc. agreed for a merger last week. The $5.7-billion deal is expected to create one of the largest photonics and laser companies in the world. Elsewhere, Boston Scientific signed a pact to acquire privately-held mobile health solutions company Preventive Solutions. In another tech buyout, Cognizant agreed to acquire software company Magnetic Solutions to strengthen its digital engineering capabilities.

Some of the major Wall Street firms reported earnings this week, which was shortened by the holiday, with Bank of America, Goldman Sachs and Netflix reporting their results on Tuesday. UnitedHealth Group and Morgan Stanley were the important company’s that published earnings on Wednesday, while Intel and IBM reported on the next day.

Wall Street is headed into a busy earnings week, with the likes of Microsoft and Johnson & Johnson preparing for their quarterly announcements on January 26. Apple’s first-quarter report, a much-awaited event, is expected on January 27. On the same day, AT&T and Facebook will be unveiling their latest numbers. Airlines companies like JetBlue, Southwest and American will dominate the earnings scene on January 28.

Key earnings to watch

Monday: Kimberly-Clark, Heartland Financial, Bank of Hawaii, Cadence Bancorporation and Republic First Bancorp

Tuesday: Johnson & Johnson, Lockheed Martin, General Electric, Alaska Air, Starbucks, Raytheon Technologies, Microsoft, Rockwell Automation, 3M Company, UBS Group, Invesco, Advanced Micro Devices, Novartis AG, American Express, Verizon, and Xerox Corp.

Wednesday: Facebook, Boeing, Apple, AT&T, General Dynamics, Corning, Abbott Laboratories, Levi Strauss and Tesla

Thursday: Stanley Black & Decker, Southwest Airlines, Dow Chemical, Northrop Grumman, Murphy Oil, STMicroelectronics, McDonald’s, Comcast Corporation, Canon, Abiomed, American Airlines Group, JetBlue Airways, MasterCard, Visa, Dolby Laboratories, Teradyne, Mondelez International, and Juniper Networks

Friday: Caterpillar, Charter Communications, Chevron Corporation, Citigroup, Lyondellbasell Industries, Honeywell International, SAP, Colgate-Palmolive, United States Steel, and Eli Lilly

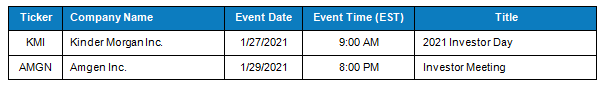

Key investor days to watch

Key US economic events

Looking back

The following are notable companies which have reported their earnings last week. In case if you have missed to catch up on their performance, click the respective links to skim through the transcripts to glean more insights.

Bank of America Q4 2020 Earnings Transcript

Goldman Sachs Q4 2020 Earnings Transcript

Netflix Q4 2020 Earnings Transcript

Morgan Stanley Q4 2020 Earnings Transcript

United Airlines Q4 2020 Earnings Transcript

Intel Corp. Q4 2020 Earnings Transcript

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.