After AMD’s high-value buyout of Xilinx and the Dunkin’-Inspire deal last week, the M&A scene slowed down, with business houses deferring major deals in the face of the virus-induced uncertainty. Meanwhile, Visa‘s planned acquisition of financial technology company Plaid hit a roadblock after the U.S government challenged the deal by filing a lawsuit.

Elsewhere, accommodation booking portal Airbnb moved closer to its long-pending stock market debut, with the management deciding to file for the $30-billion IPO next week.

It was a lean week for earnings, with only a few major companies reporting, including Alibaba Group, Electronic Arts, General Motors and PayPal. Some of the main events scheduled for next week are earnings reports from McDonald’s and Lyft — expected on Monday and Tuesday respectively. Others reporting their quarterly numbers include Tencent Music, on Tuesday, and Cisco and Walt Disney on Thursday.

Key Earnings to Watch

Monday: Plug Power, Workhorse, Beyond Meat, McDonald’s, Aurora, Canopy Growth, Tilray, Novavax, Zoominfo Technologies, and Air Canada

Tuesday: Advance Auto Parts, Eastman Kodak, Lyft, Tencent Music Entertainment, Embraer S.A., and 10x Genomics

Wednesday: HUYA, Super League Gaming, DouYou International, Air Products & Chemicals, and CGI Inc.

Thursday: Wix, Pinduoduo, Walt Disney, Cisco Systems, Applied Materials, and Dolby Laboratories,

Friday: DraftKings

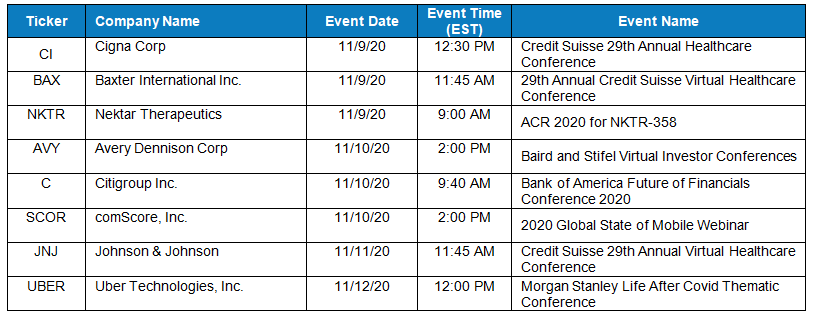

Key Corporate Conferences to Watch

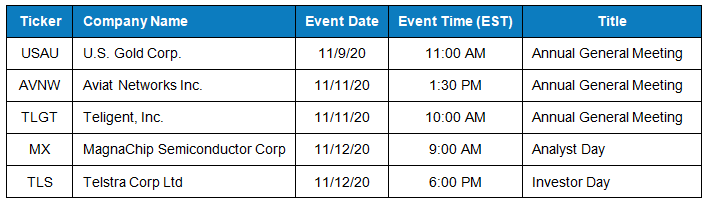

Key Investor Days/AGMs to Watch

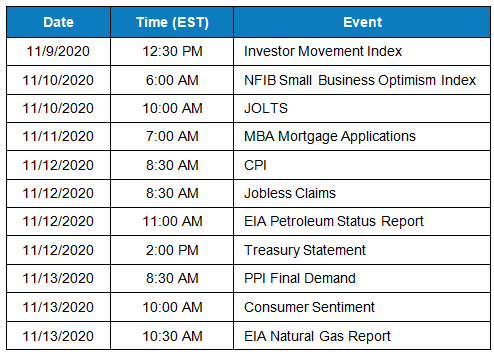

Key US Economic Events

Looking Back

The following are notable companies which have reported their earnings last week. In case if you have missed to catch up on their performance, click the respective links to skim through the transcripts to glean more insights.

PayPal (PYPL)

Qualcomm (QCOM)

Yelp (YELP)

Square (SQ)

Alibaba (BABA)

Dropbox (DBX)

TripAdvisor (TRIP)

Metlife (MET)

Marriott International (MAR)

If you want to listen to how management responds to analyst questions and the tone they use, you can head over to our YouTube channel to listen to conference calls on the go.