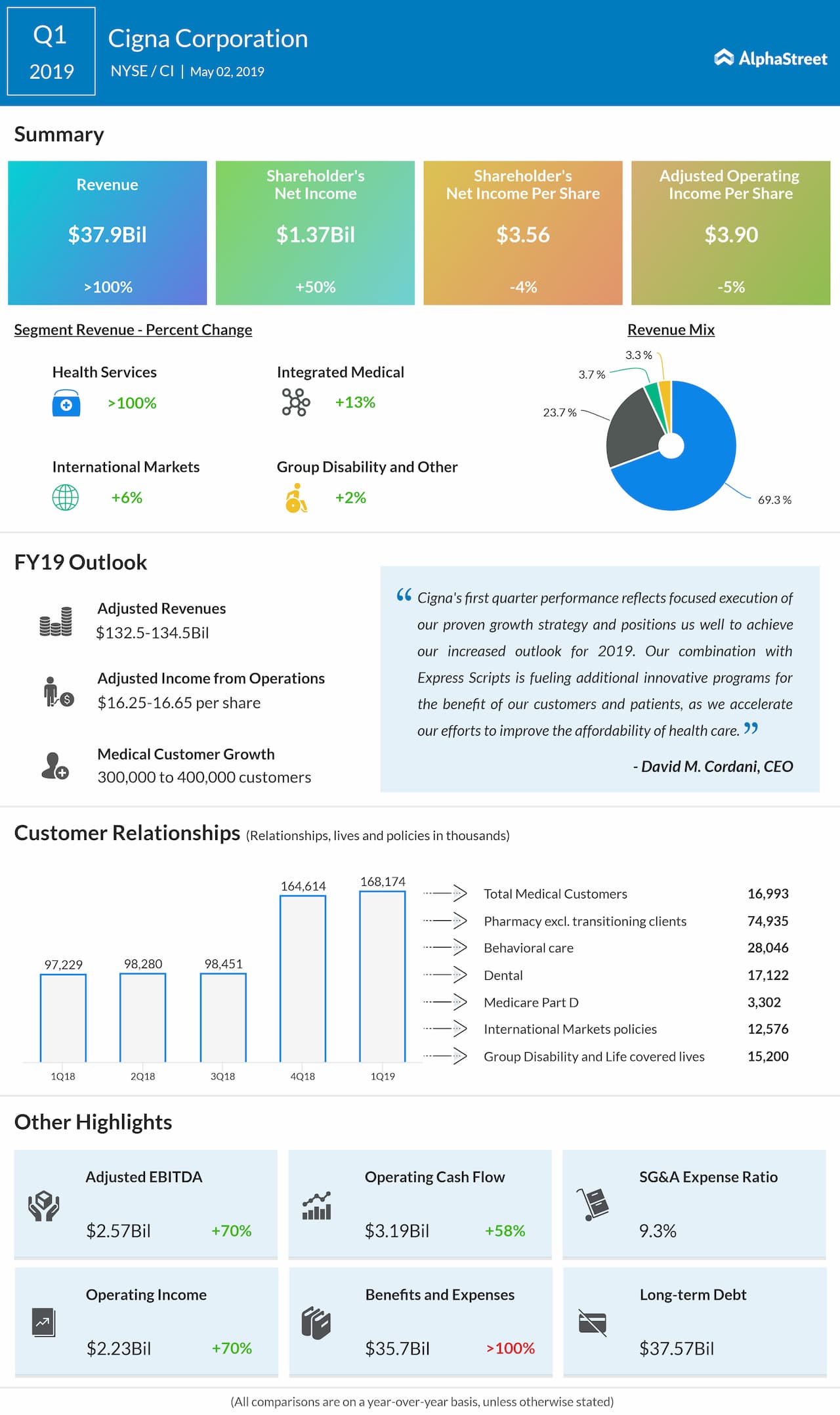

Continued strong business growth in Cigna’s Health Services and Integrated Medical segments drove total revenues higher by 232% to $37.9 billion. Adjusted revenue soared 193% to $33.43 billion and reflect strong contributions from each of Cigna’s ongoing businesses.

Health Services revenues soared to $26.95 billion from $1.07 billion a year ago, driven by organic growth in pharmacy customers since the start of the year, and strong adjusted pharmacy script volumes and performance in specialty pharmacy care. Revenue from Integrated Medical grew by 13% led by organic growth and strong margins in its Commercial and Government businesses.

Revenue from International Markets rose by 6% reflecting continued business growth, partially offset by some impact from unfavorable foreign currency movements. Revenue from Group Disability and Other Operations inched up 2% year-over-year.

The total medical customer base at first quarter was 17 million, an organic increase of 224,000 over last year driven by growth in the Select and Middle Market segments, partially offset by a decline in National Accounts.

Looking ahead into the full year 2019, the company now expects adjusted revenues in the range of $132.5 billion to $134.5 billion and adjusted income from operations in the range of $16.25 to $16.65 per share. The per share outlook excludes the impact of additional prior year reserve development of medical costs and potential effects of any future share repurchase. Global Medical customer growth is predicted to be 300,000 to 400,000 customers.

Shares of Cigna ended Wednesday’s regular session up 1.99% at $162 on the NYSE. The stock has fallen over 5% in the past year and over 16% in the past three months.