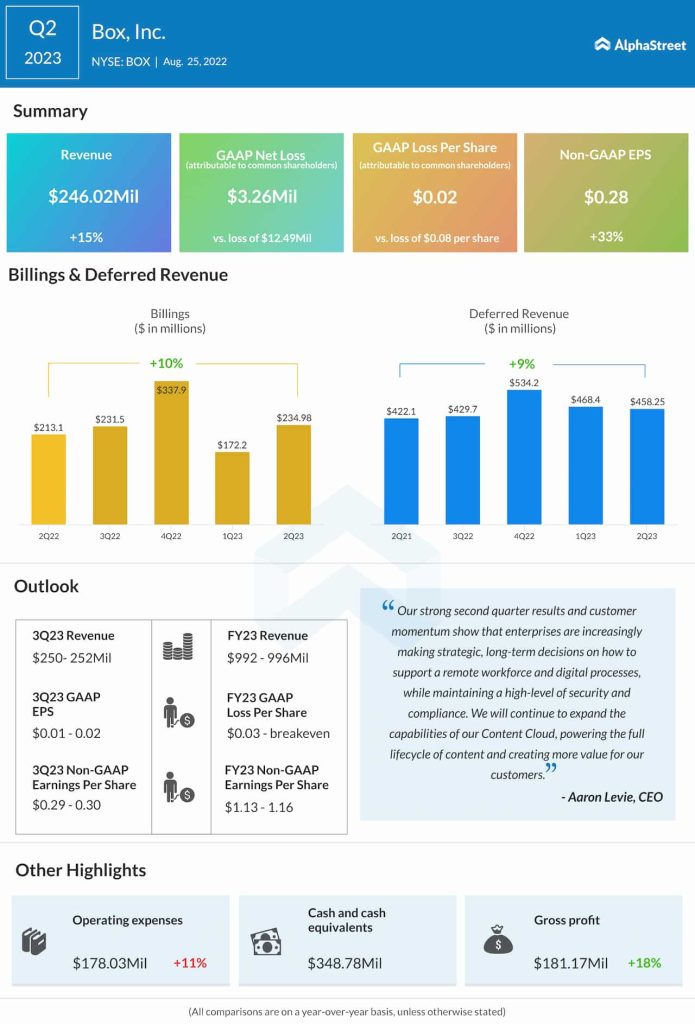

Second-quarter net income, on an adjusted basis, was $0.28 per share, compared to $0.21 per share in the same period of 2022. On a reported basis, it was a net loss of $3.26 million or $0.02 per share, compared to a loss of $12.49 million or $0.08 per share in the prior-year period.

At $246.02 million, revenues were up 15%, while billings increased 10% annually to $234.98 million. At the end of the quarter, the company had total deferred revenues of $458.25 million, up 9%.

Check this space to read management/analysts’ comments on Box’s Q2 2023 report

“As the value of our platform continues to resonate with customers and we continue to drive strong adoption of our multi-product offerings, we delivered a Net Retention Rate of 112%, up 600 basis points from the prior year. Our business momentum remains strong as we execute on our Content Cloud platform strategy to ensure that we will continue to drive further annual revenue acceleration and operating margin expansion in FY23,” said Box’s CFO Dylan Smith.