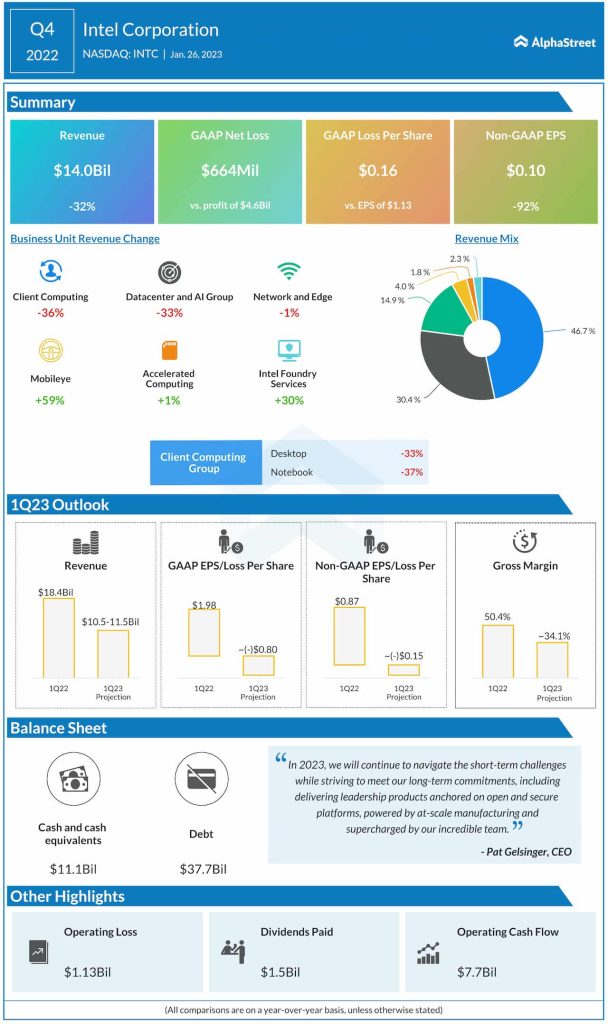

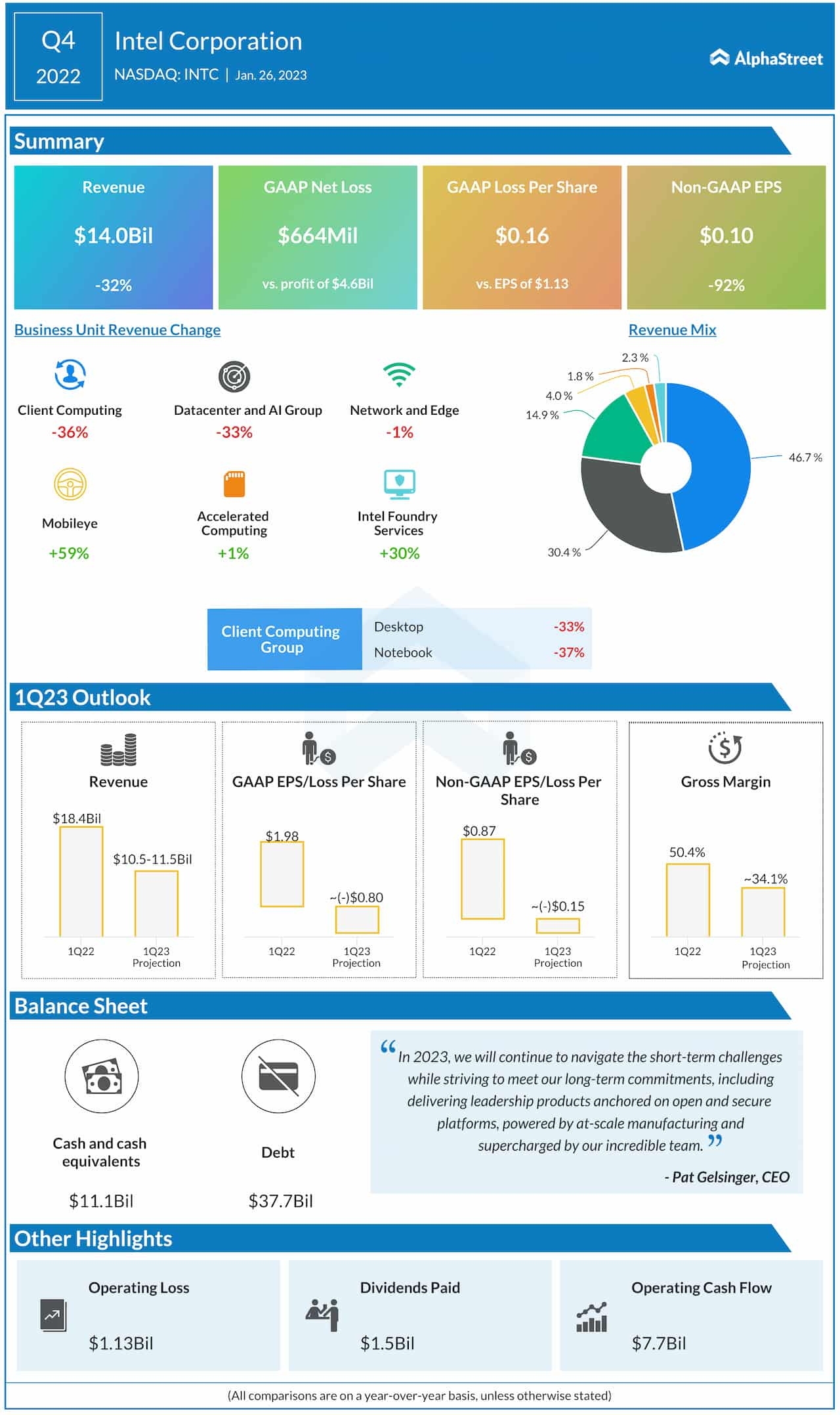

Fourth-quarter revenues decreased 32% annually to $14 billion. The top line was negatively impacted by continued slowdown in the core Client Computing segment.

Adjusted earnings declined to $0.10 per share in the latest quarter from $1.15 per share in the fourth quarter of 2021. On a reported basis, the company posted a net loss of $664 million or $0.16 per share, compared to a profit of $4.62 billion or $1.13 per share last year.

Check this space to read management/analysts’ comments on Intel’s Q4 2022 results

“In 2023, we will continue to navigate the short-term challenges while striving to meet our long-term commitments, including delivering leadership products anchored on open and secure platforms, powered by at-scale manufacturing and supercharged by our incredible team,” said Intel’s CEO Pat Gelsinger.