The company is expected to unveil its second-quarter results on Thursday, August 22, at 6:30 am ET. Market watchers forecast a sharp decline in June quarter earnings to $0.97 per share from $1.44 per share in the prior-year quarter. Meanwhile, Q2 revenue is expected to be $2.67 billion, broadly in line with the revenue the company generated in Q2 2023.

Turnaround

Under its recovery plan, the management is taking steps to reduce costs and strengthen the core fundamentals of the business. Those efforts should translate into stronger margins, which have lagged competitors for quite some time. Advance Auto Parts’ long-term prospects look encouraging because the ongoing sales slump is temporary. The demand for auto parts should pick up and stabilize in the future, thanks to aging vehicles and the thriving second-hand vehicle market.

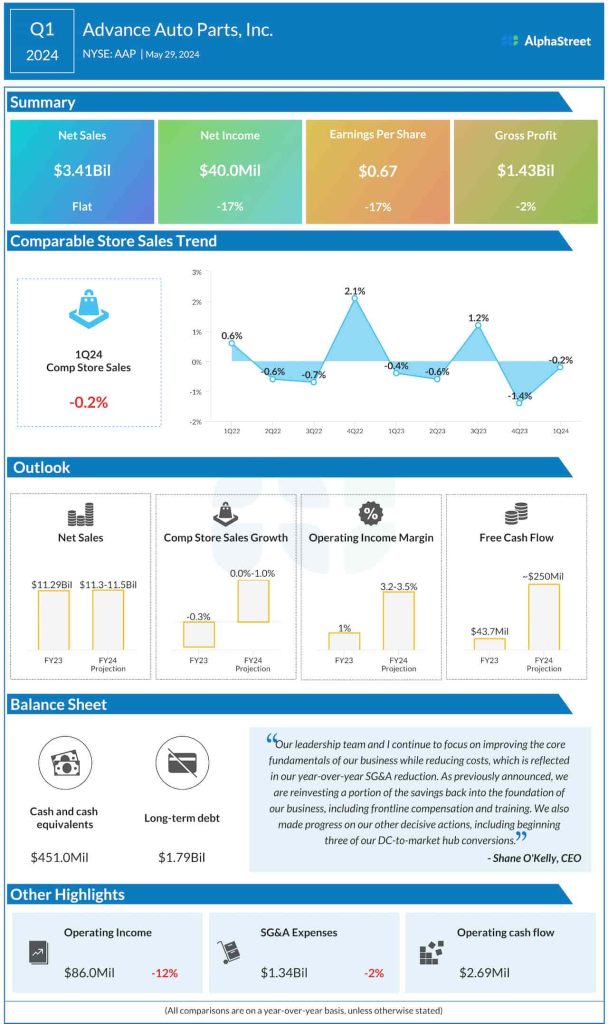

A few months ago, the company forecasted an improvement in overall performance for fiscal 2024, compared to last year. It looks to post a higher operating income margin and free cash flow in FY24. Full-year comparable store sales are expected to be flat to up 1%, while the top line is forecast to remain broadly unchanged.

Q1 Profit Falls

In the first three months of fiscal 2024, the company reported a 17% fall in net income to $40 million or $0.67 per share. Net sales remained broadly unchanged at $3.41 billion during the three months. Comparable store sales edged down 0.2% in Q1, which marked an improvement from the prior quarter when same-store sales dropped 1.4% year-over-year.

From Advance Auto Parts’ Q1 2024 earnings call:

“In terms of our turnaround, we continue to execute against our previously outlined decisive actions designed to simplify our business. Those decisive actions are — number one, continuing the sale process for Worldpac. Number two, reducing our costs to become more competitive while investing a portion of those savings back into the front line. Number three, making organizational changes to position us for success. Number four, improving the productivity of all assets. And number five, consolidating our supply chain.”

The company’s stock had a positive start to the week and maintained an uptrend since then. The shares opened at $60.50 on Thursday and traded up 3% in the latter half of the session.