Bullish Outlook

Apple shares have maintained a steady uptrend since the last earnings report, with the rebound in iPhone sales and strong AI roadmap driving investor optimism. The stock has grown an impressive 32% since then, outperforming the broader market and reaching an all-time high this week. The company has moved closer to $4 trillion in valuation as it enters the final stretch of FY2025, with momentum across key segments.

Broad-based Growth

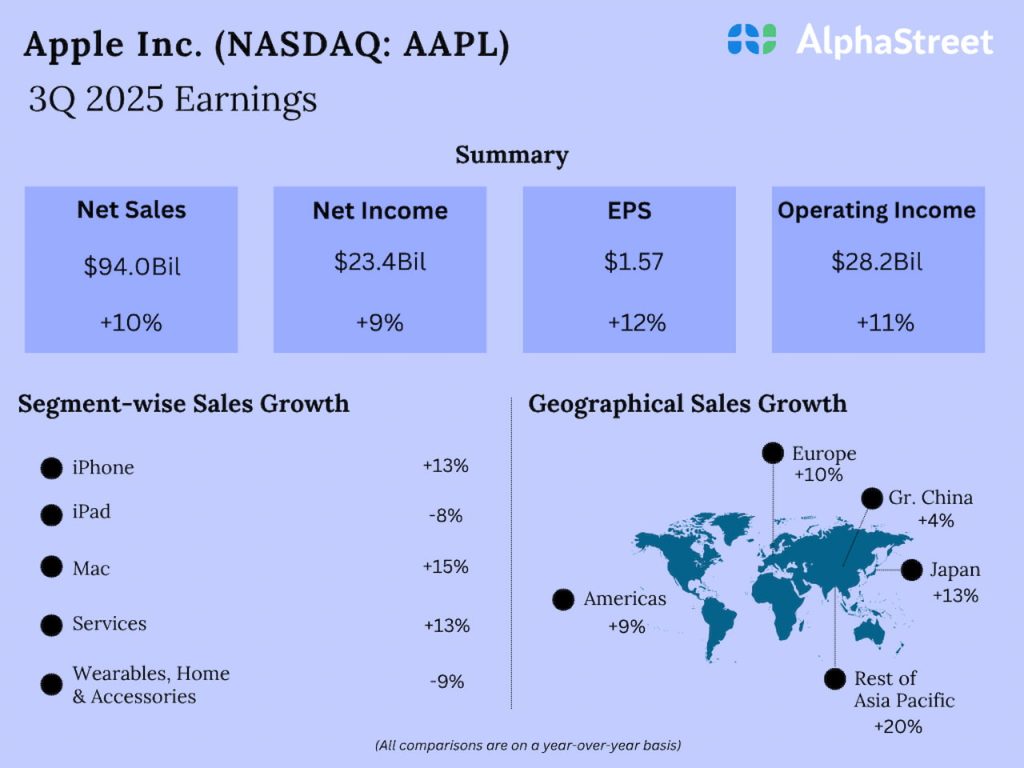

In the June quarter, revenues rose to $94.03 billion from $85.78 billion in the year-ago quarter, exceeding estimates. The growth was driven mainly by a record 13% increase in iPhone sales. Consequently, Q3 earnings advanced to $23.4 billion or $1.57 per share from $21.4 billion or $1.40 per share in the prior-year period. The bottom line also came in above Wall Street’s expectations.

“We’re making good progress on a more personalized Siri, and as we’ve said before, we expect to release these features next year. Apple silicon is at the heart of all of these experiences, enabling powerful Apple Intelligence features to run directly on devices. For more advanced tasks, our servers, also powered by Apple silicon, deliver even greater capabilities while preserving user privacy through our private cloud compute architecture. We believe our platforms offer the best way for users to experience the full potential of generative AI,” Apple CEO Tim Cook said during his post-earnings interaction with analysts.

Focus on AI

Apple has introduced several AI features in its gadgets, including visual intelligence, cleanup, and powerful writing tools. The latest iPhone model has been doing well since its September launch, underscoring the company’s resilience in the troubled market environment. Interestingly, demand picked up and remained strong in China, gaining further momentum after the iPhone 17 launch. However, higher costs related to new import tariffs could weigh on profitability going forward. After incurring around $800 million in tariff-related costs in the most recent quarter, Apple’s leadership expects $1.1 billion in additional tariffs for the current quarter.

The average price of Apple’s stock for the last 52 weeks is $225.61. On Monday, the shares opened at $264.88 and traded higher during the session. AAPL has gained about 27% in the past six months.