Conagra has also been making several investments to drive

growth in its frozen and snacking business and this is expected to benefit the

quarterly numbers. However, the results are likely to be impacted by business

divestitures. The weakness in the Foodservice business is also likely to

continue.

Conagra and its peers like General Mills (NYSE: GIS) have

been struggling with higher input costs and this, along with negative currency

impacts, could hurt earnings in the to-be-reported quarter.

From the first quarter of fiscal 2020, Conagra will no longer report Pinnacle as a standalone reporting segment. The business components comprising the Pinnacle segment will be allocated to one of the four Legacy Conagra reporting segments.

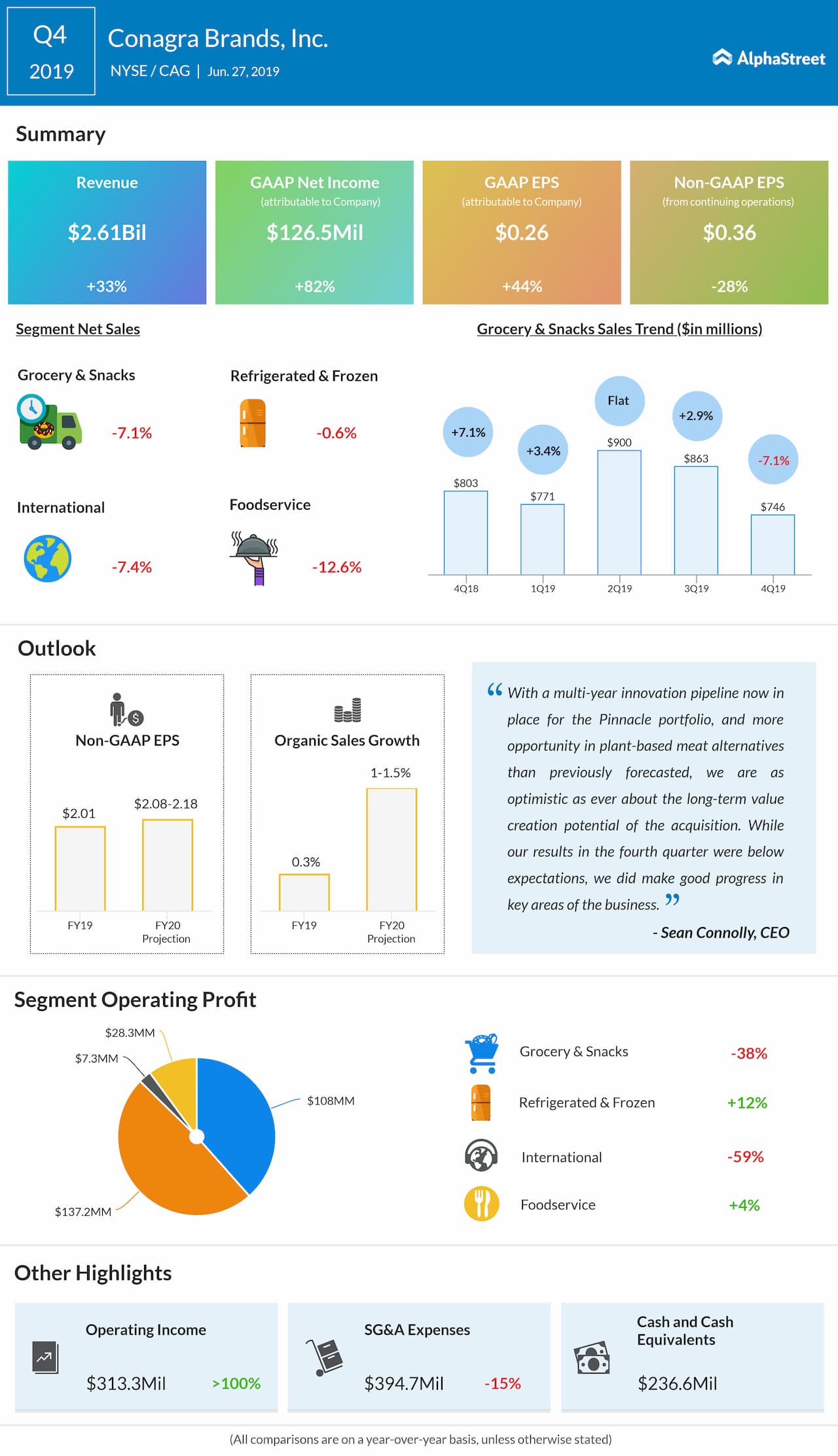

In the fourth quarter of 2019, Conagra missed earnings estimates. Adjusted EPS dropped 28% to $0.36. Revenue grew 33% to $2.61 billion.

For fiscal 2020,

the company expects net sales growth of 13.5% to 14%. Total company organic net

sales growth is now expected to be 1% to 1.5%. Adjusted earnings is expected to

range from $2.08 to $2.18 per share.

Conagra’s stock has gained 37% thus far this year. The majority of analysts have rated it as Buy and the average price target is $32.38.