Valuation

The stock is up 9% since early last year and looks all set to scale new highs this year and beyond. The brewer has regularly raised its dividend over the years and offers a decent yield. Experts, in general, are optimistic about the stock’s long-term growth prospects and recommend buying it. Constellation executives recently exuded optimism that the Wine and Spirits business would accelerate and meet the target set by them for the fiscal year.

Brand Power

The New York-based firm’s product portfolio is quite strong and includes popular brands like Corona, Modelo Especial, Negra Modelo, and American craft beer producer Funky Buddha. Interestingly, sales remained largely unaffected even after the company raised prices last year. Of late, Constellation Brands has been refocusing its portfolio on higher-end, higher-growth, and higher-margin brands and channels. In July, the company entered into a cooperation agreement with Elliott Investment Management to increase the size of its board to 13 directors from 11 and appoint new members.

“…the shift of the wine and spirits business toward driving growth and margin improvement through its pivot to the higher-end brands and broader channels and markets remains well on track. All-in, we are confident in our outlook for the wine and spirits business in fiscal ’24 as performance is expected to continue to accelerate throughout the course of the year, in line with seasonality and the business’ annual plan, particularly as the share of net sales from our Aspira fine wine and craft spirits portfolio increases over the coming quarter,” Constellation’s CEO Bill Newlands said in a recent statement.

Q2 Report Due

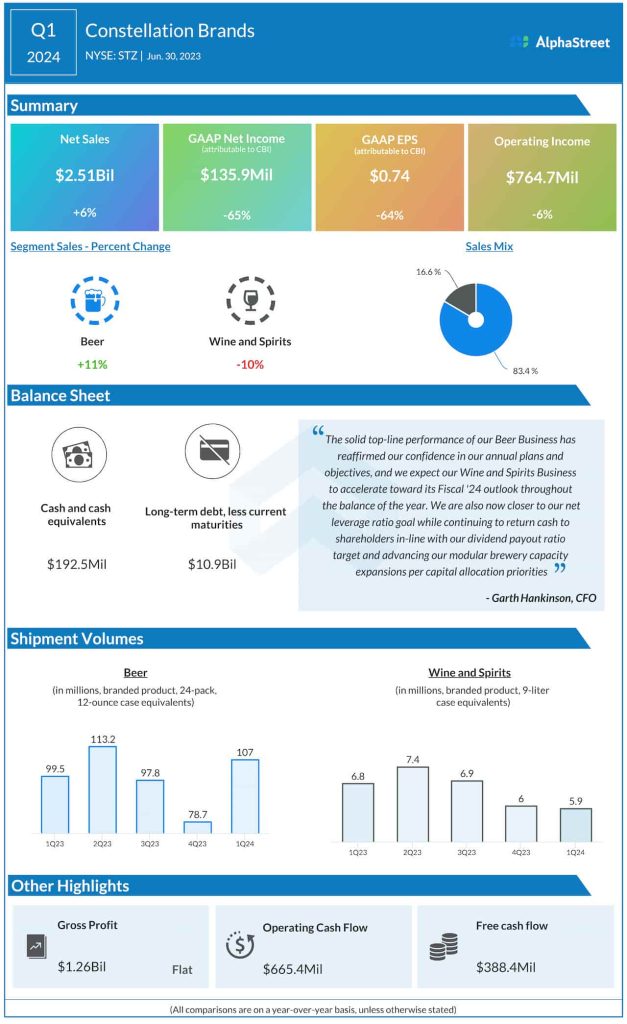

The company, which reported mixed results for the first three months of fiscal 2024, will be announcing second-quarter results on October 5 at 7:30 a.m. ET. The consensus estimates of market watchers point to a 6% increase in earnings per share to $3.35 in the August quarter. Revenues are expected to grow about 13% to $2.82 billion.

Over the years, Constellation Brands has impressed investors by delivering stronger-than-expected quarterly earnings consistently, though there are some exceptions. The trend continued in the first three months of FY24, but net income declined about 65% year-over-year to $135.9 million or $0.74 per share. There was a 6% increase in revenues to $2.51 billion, aided by double-digit growth in the core beer business. The top line also beat estimates, after missing by a cent in the prior quarter.

The stock ended the last session almost flat but declined in the after-hours. It traded slightly above $250 on Thursday morning.