The Prepared Foods business is a key growth driver for the

company and currently generates 30% of its profits. Tyson is seeing strong demand

for proteins alongside a growing preference for plant-based protein products.

To take advantage of this trend, the company has rolled out its own plant-based

and blended products along with its Raised and Rooted brand.

The alternative protein market is estimated to be a

multi-billion dollar category in the future and Tyson is looking to grow its

footprint in this space.

During the quarter, Tyson completed the acquisition of the

Thai and European operations of BRF S.A., which will help the company expand

its offerings in the traditional protein market. Around 98% of protein consumption

growth is estimated to happen outside the US over the next five years, and approx.

70% of this growth will be in Asia. The acquisitions of Keystone and the BRF

assets can be expected to benefit Tyson’s topline numbers in the quarter.

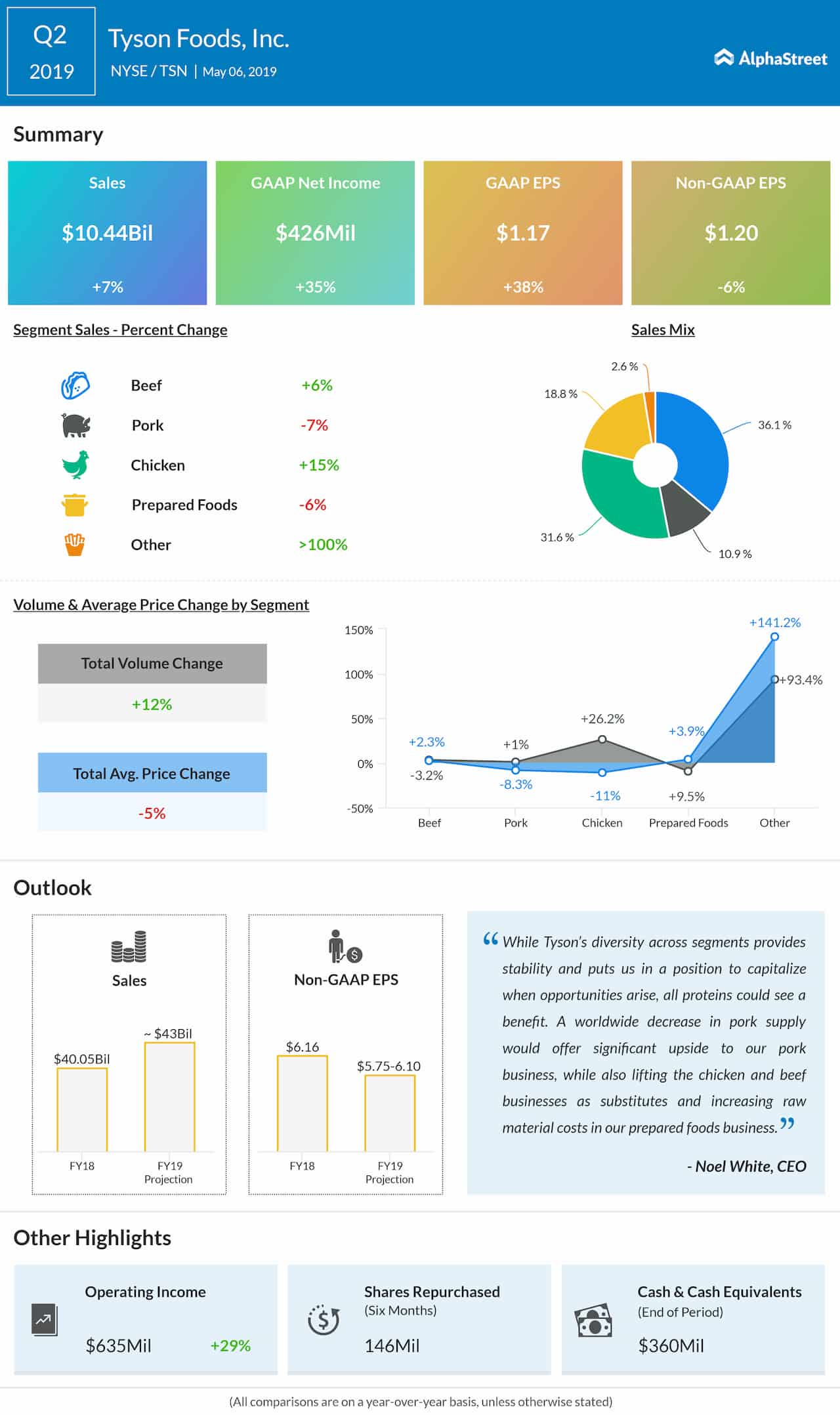

In the second quarter of 2019, Tyson beat market estimates for revenue and earnings. Sales grew 7% to $10.4 billion while adjusted EPS fell 6% to $1.20. For full-year 2019, the company has guided for adjusted EPS of $5.75-6.10.

Tyson’s shares have gained 55% year-to-date and 8% over the past three months. The majority of analysts have rated the stock Buy and the average 12-month price target is $87.