Q3 Report Due

When the company publishes third-quarter results on November 12, at 6:00 am ET, Wall Street will be looking for a net income of $3.63, on a per share basis. That compares to $3.81 per share the company earned in the third quarter of 2023. On average, analysts forecast revenues of $39.12 billion for the October quarter, which represents a 4% year-over-year increase.

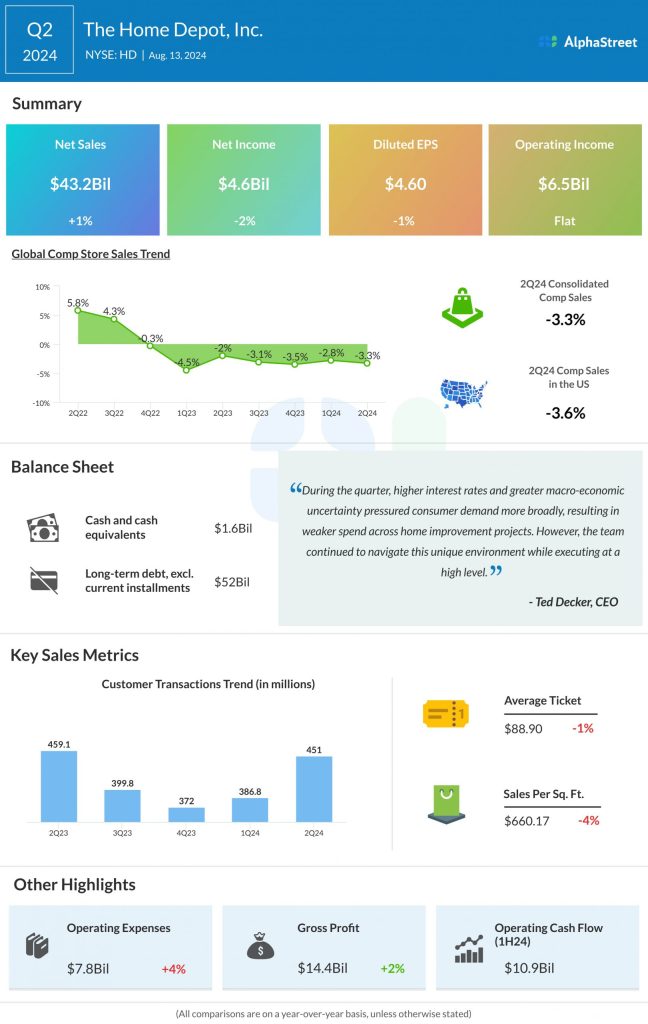

In the second quarter, Home Depot’s sales edged up 1% annually to $43.2 billion and beat Street View. Comparable sales fell 3.3%, marking the seventh drop in a row. Hurt by the weak top-line performance, the July-quarter profit decreased to $4.6 billion or $4.60 per share. The bottom line beat estimates, as it did in each of the trailing four quarters. Average customer ticket, a measure of the average value of individual customer transactions, declined 1% year-over-year in Q2, while total customer transactions dropped modestly to $451 million.

Road Ahead

With its extensive store footprint and customer-focused business model, Home Depot looks well-positioned to tackle the present challenges. While the recent sales slowdown is expected to continue through the remainder of the year, a turnaround cannot be far away, aided by improving economic conditions and declining interest rates.

From Home Depot’s Q2 2024 earnings conference call:

“Regardless of the current pressure in the environment, our team remains focused on serving our customers and ensuring we have the right products at the right values, and we remain focused on long-term share growth in the highly fragmented approximately $1 trillion home improvement market. Remember, we operate in one of the largest asset classes, which is estimated at approximately $45 trillion, representing the installed base of homes in the United States. Today, we have roughly 17% market share, with tremendous growth potential.”

Outlook

The Home Depot leadership has downwardly revised its full-year guidance — expects sales and comparable sales to decline 3-4% and earnings per share to drop 9-11% year-over-year. Including SRS Distribution, which was acquired earlier this year as part of the company’s efforts to revive the slowing Pro business, FY24 revenue is expected to grow between 2.5% and 3.5%. Capital expenditure is expected to be approximately 2% of sales on an annual basis as the company maintains its strategy of continued investment in the business.

The stock opened higher on Monday and was trading close to the $400 mark by midday. The long-term average price of HD, for 12 months, is $356.70.