The Stock

The US housing sector was surprisingly resilient to the pandemic-related business disruption and more recently the interest rate hikes. The high demand, despite economic uncertainties, resulted in a shortage of housing units. However, elevated mortgage rates and the Federal Reserve’s hawkish monetary policy stance are putting pressure on demand now. A survey conducted by the National Association of Home Builders/Wells Fargo revealed that homebuilder confidence dropped to a five-month low in September.

What to Look for

In the first two quarters of the year, KB Home’s earnings declined but came in above analysts’ forecast. The company likely maintained that trend in the most recent quarter. It is preparing to publish third-quarter earnings report on September 20, after the closing bell. On average, analysts are looking for earnings of $1.44 per share, which is sharply below the $2.86/share profit reported a year earlier. It is estimated that August-quarter revenues declined about 20% year-over-year to $1.48 billion.

“With our built-to-order model, we work from a large backlog and see value in the visibility and stability in deliveries that our backlog provides, particularly in times of challenging market conditions as we saw during the past year. With the improvement in our build times, which Rob will speak to in a moment, we expect to be able to convert our backlog to deliveries more quickly in the future than we’ve seen over the past two years,” said KB Home’s CEO Jeffrey Mezger in a recent statement.

Key Numbers

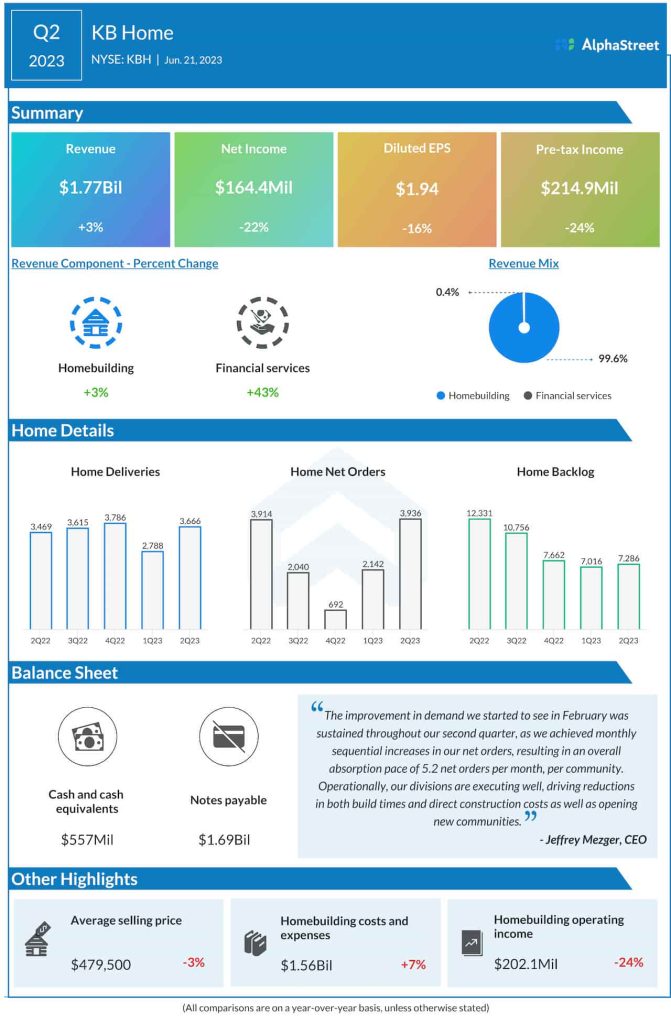

In the May quarter, revenues moved up 3% from last year to $1.77 billion, mainly reflecting higher sales at the core Homebuilding segment, and topped expectations. However, net income declined to $164.4 million or $1.94 per share in Q2 from $210.7 million or $2.32 per share in the prior-year period. The number of orders received and deliveries completed during the quarter was higher compared to last year.

The stock traded higher throughout Monday’s regular session, after experiencing weakness in the previous sessions. In the past 30 days, it traded around the $50 mark.