Snap Inc. (NYSE: SNAP) is scheduled to report second quarter 2019 earnings results on Tuesday, July 23, after regular hours. Analysts expect the company to report a loss of $0.10 per share on revenues of $359 million. In the trailing four quarters, Snap has consistently surpassed earnings estimates.

Snap has rallied this year with the stock soaring above 170%. There is optimism on Wall Street that the company will benefit from its revamped Android app as well as the launch of gaming and other new features on its platform. Analysts anticipate Snap will see a growth in both users and advertising revenues during the second quarter.

However, some analysts remain skeptical of Snap’s ability to

drive growth amid tough competition from rival Facebook (NYSE: FB) and its

divisions. Facebook’s Instagram unit enjoys tremendous popularity among younger

users and Snap will have to work harder to cross that.

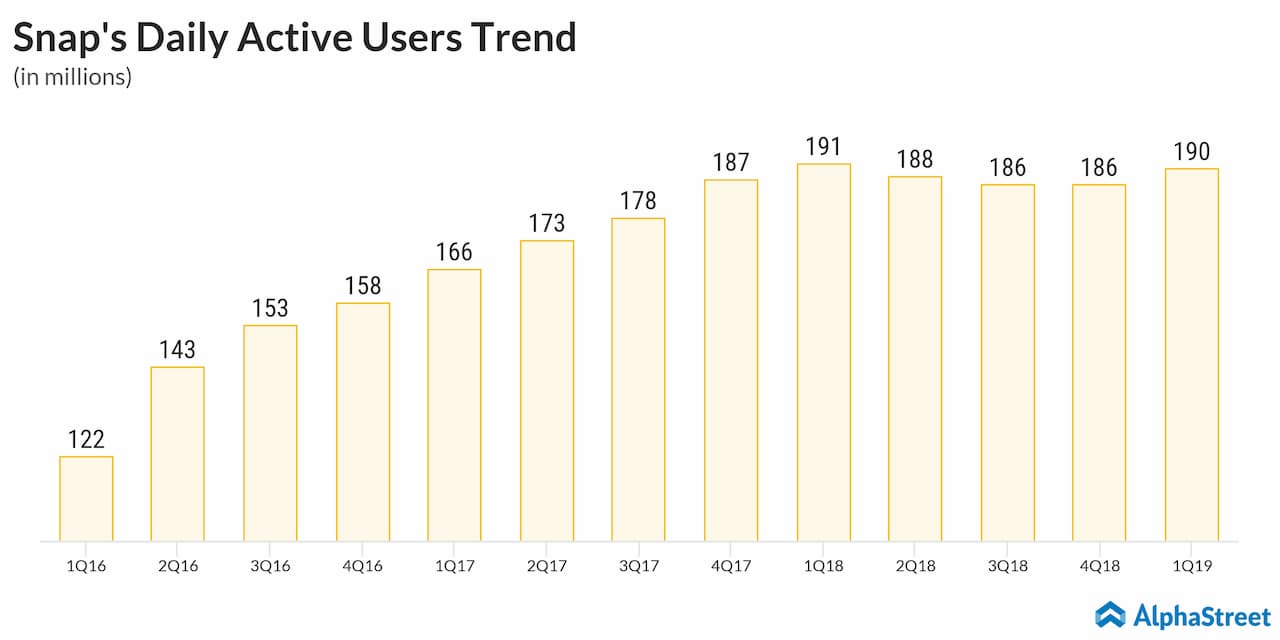

At the end of the first quarter, Snap’s social media app Snapchat

had 190 million daily active users, which was down from 191 million a year

earlier. The user base of Instagram

is more than double this number. Snap has been investing in various business growth

initiatives and the higher costs related to these are expected to put pressure

on margins in the quarter, which is another cause for concern.

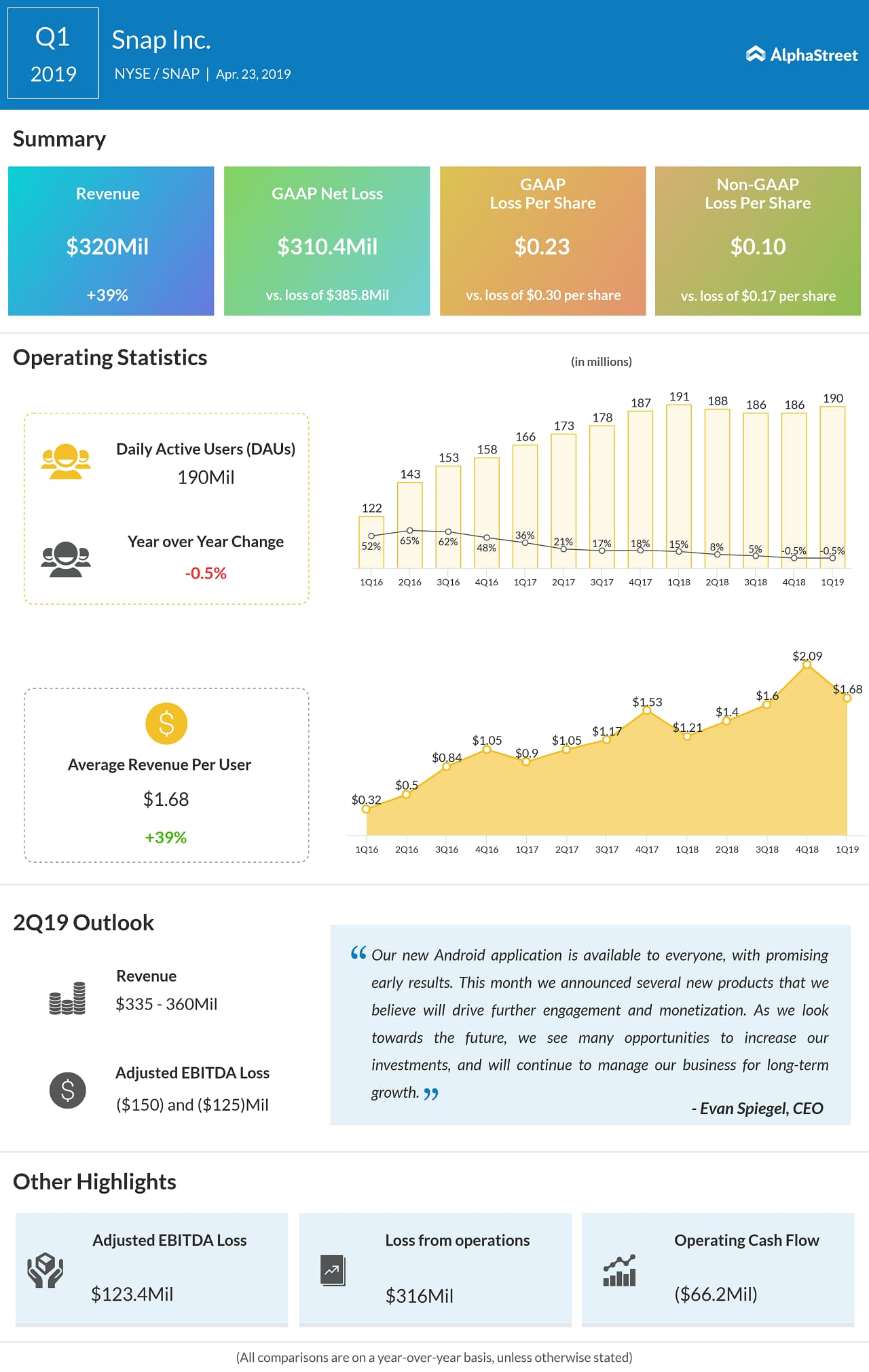

In the first quarter of 2019, Snap beat consensus estimates on both revenue and earnings. Revenues rose 39% to $320 million while net loss totaled $0.10 per share versus $0.17 last year. Daily Active Users saw a slight decline on a year-over-year basis but increased sequentially. Average revenue per user (ARPU) grew 39% to $1.68.

According to TipRanks, out of 24 analysts, seven have given Snap’s stock a Buy rating while 14 have given it a Hold rating. Three analysts have rated the stock as Sell. The one-year average price target is $13.65. Snap’s stock has gained 135% over the past six months and 23% over the past three months.