Paychex Inc. (NASDAQ: PAYX) is scheduled to report first quarter 2020 earnings results on Wednesday, October 2, before the market opens. Analysts estimate the company will report earnings of $0.68 per share. This compares to EPS of $0.67 reported last year. Revenue is projected to grow around 15% year-over-year to $991.1 million.

Paychex’s growth is dependent on a strong employment rate and economic growth. Last quarter, the company benefited from growth in service revenue and interest on funds held for clients. This trend is expected to continue in the first quarter, driving the topline numbers.

Growth in the client base and in revenue per check are

expected to drive revenues in the Management Solutions segment. Results in the

PEO and Insurance Services division are expected to be driven by growth in

clients and client worksite employees as well as a higher number of health and

benefit clients.

The company is also expected to benefit from the Oasis acquisition in the first quarter. Paychex and Oasis together serve over 1.4 million work-site employees through its various HR outsourcing services. Paychex anticipates Oasis to contribute revenues of $355-375 million in 2020 and estimates it will be largely neutral to EPS.

Also read: Accenture Q4 2019 Earnings Report

ADVERTISEMENT

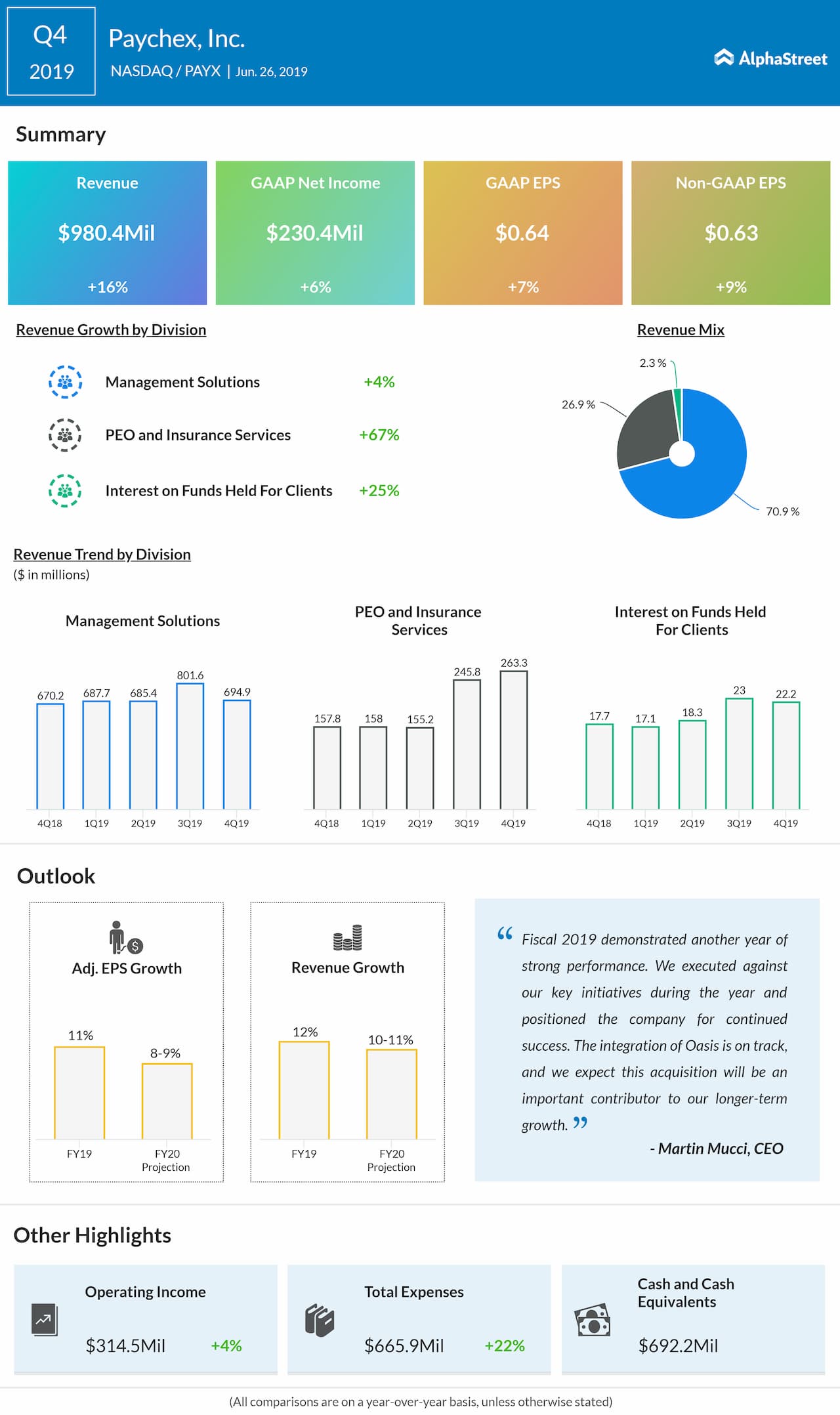

In the fourth quarter of 2019, Paychex beat revenue expectations while earnings missed estimates. Revenues grew 16% to $980 million while adjusted EPS rose 9% to $0.63. Revenues grew across all divisions during the fourth quarter.

For fiscal 2020, total revenue is expected to grow 10-11%. GAAP net income and EPS are expected to grow approx. 8% while adjusted net income and EPS are expected to increase 8-9%. Management Solutions revenue is estimated to grow approx. 4% while PEO and Insurance Services revenue is anticipated to grow 30-35%. Interest on funds held for clients is projected to grow 4-8%.

Shares of Paychex have gained 27% thus far this year and 12% in the trailing 52 weeks. The stock has an average price target of $83.53.