Shares of Take-Two Interactive Software, Inc. (NASDAQ: TTWO) stayed red on Monday. The stock has gained 35% year-to-date. The video game company is set to report its first quarter 2024 earnings results tomorrow after market close. Here’s a look at what to expect from the earnings report:

Revenue

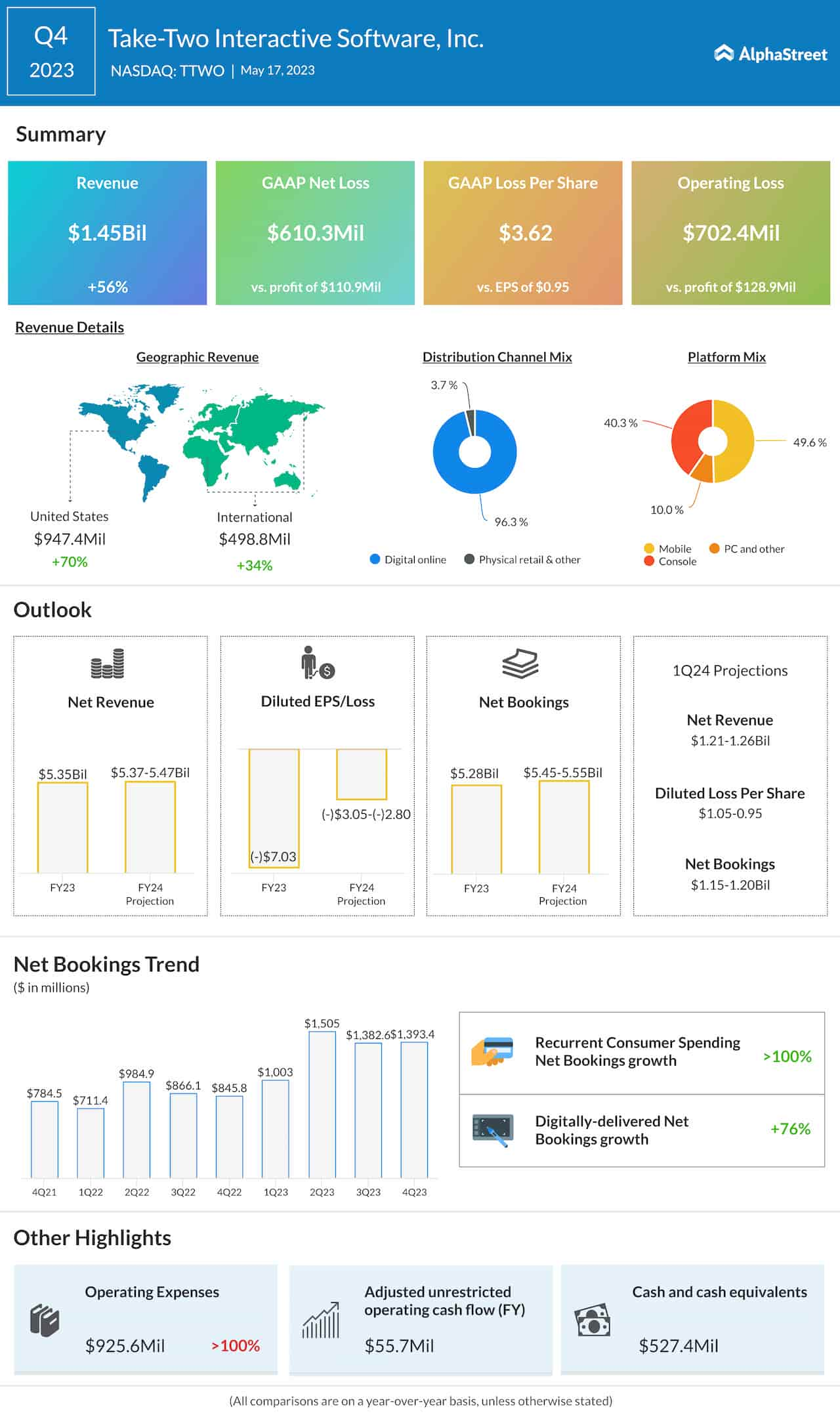

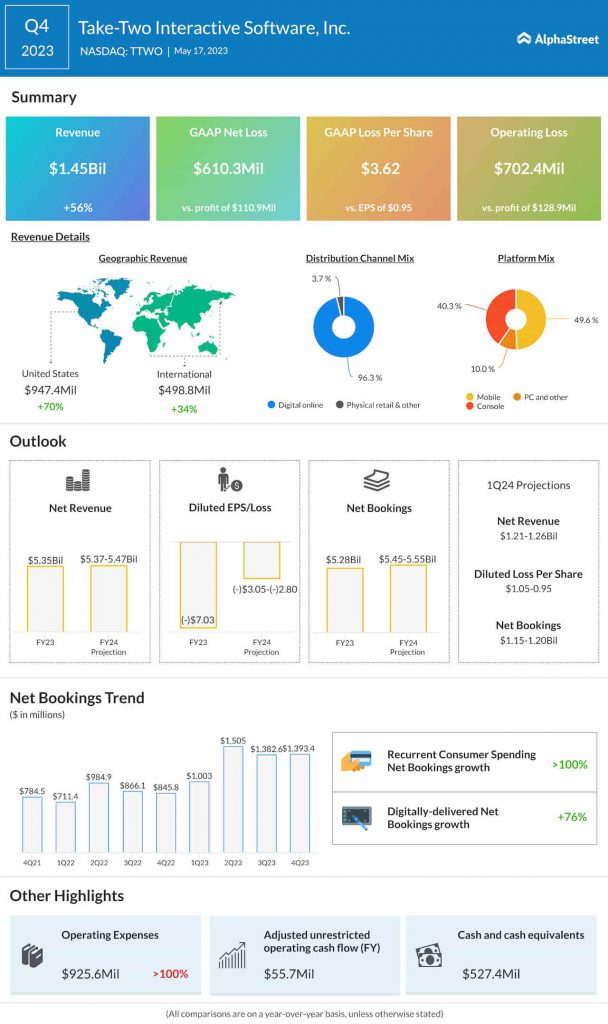

Take-Two has guided for revenues of $1.21-1.26 billion for the first quarter of 2024. Analysts are projecting revenues of $1.21 billion, which would reflect a 21% growth from the same period a year ago. In the fourth quarter of 2023, TTWO’s revenues increased 56% year-over-year to $1.45 billion.

Earnings

Take-Two has guided for a net loss of $161-178 million and a net loss per share of $0.95-1.05 for Q1 2024. Analysts are projecting EPS of $0.42. In Q4 2023, net loss was $610.3 million, or $3.62 per share.

Bookings

Take-Two expects net bookings for the first quarter to range between $1.15-1.2 billion. In Q4, net bookings grew 65% YoY to $1.39 billion.

Points to note

Against a challenging backdrop where customers continued to curb their spending on video games and related purchases, Take-Two’s popular franchises remained resilient. The biggest contributors to revenue in Q4 were NBA2K23 and NBA2K22, Grand Theft Auto Online and Grand Theft Auto V, Red Dead Redemption Online and Red Dead Redemption 2. This momentum is likely to have continued into the first quarter.

The acquisition of Zynga has proved to be beneficial to Take-Two with its hyper-casual mobile portfolio delivering strong gains. Titles like Empires & Puzzles, Toon Blast and Words With Friends contributed significantly to revenue growth and they are expected to contribute to net bookings through FY2024. These titles are likely to have benefited Q1 results.

Take-Two expects recurrent consumer spending in Q1 2024 to increase by 35%. It anticipates 79% of console game sales will be delivered digitally, which is up from 77% in the prior-year quarter.

Operating expenses for Q1 are expected to range between $827-837 million, which would represent an 18% increase over last year, reflecting a full quarter of Zynga, higher stock compensation, personnel and IT expenses.