Right now, the valuation looks favorable. The company regularly returns cash to shareholders through share buybacks and pays reasonably good dividends. Being a one-stop shop for all human resources and payroll-related solutions, the Paychex platform is widely used across industries. Paychex’s reports provide insights into labor market trends like wage growth and employment rate that help companies build effective HR strategies.

Estimates for Q1

On average, market watchers expect Paychex to report earnings of $1.12 per share when it reports results for the first quarter of 2024 — it is higher than what the company earned in the year-ago quarter. The announcement is expected on Wednesday, September 27, before markets open. Analysts are of the view that revenues increased about 8% year-over-year to $1.28 billion in the quarter ended August 2023. If the long-term trend is any indication, the results will likely beat the estimates – key quarterly numbers either beat or matched estimates in recent years.

Paychex’s CEO John Gibson said during an interaction with analysts after reporting fourth-quarter 2023 results, “As we move into fiscal year ’24, we will continue our focus on developing leading customer experiences that combine our technology, our advisory capabilities, and our partnerships to deliver superior value to our customers. Paychex is uniquely positioned to help small and midsized businesses navigate the challenges they face in a complex and ever-changing and evolving world. We remain committed to our purpose, and that is to help businesses succeed. And we’ll continually strive to have a positive impact on our clients, our employees our communities, and our shareholders.”

Good Start to FY24

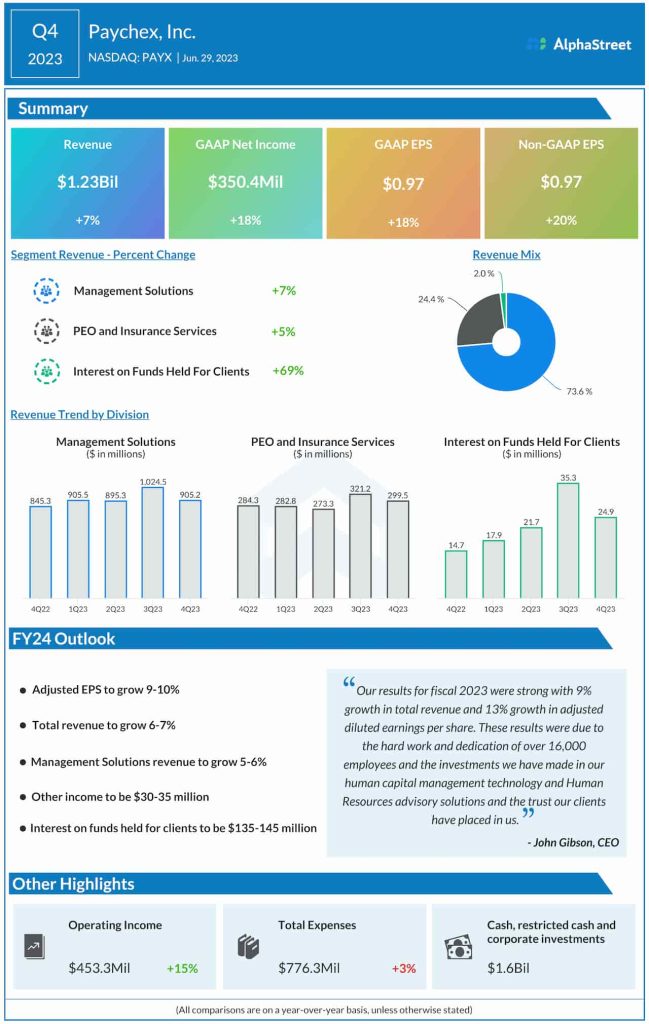

The company had an impressive start to the new fiscal year, after delivering strong revenue and earnings growth in the final three months of 2023. Revenues of the main Management Solutions and PEO & Insurance Services businesses increased in Q4, driving up total revenues to $1.23 billion. At $0.97 per share, adjusted profit was up 20% year-over-year. Meanwhile, Paychex executives are bullish on the company’s prospects this year and predict that adjusted earnings will grow between 9% and 10%. They are looking for a full-year revenue growth of 6-7%.

In the past 30 days, PAYX lost about 5% and the negative trend continued this week. On Thursday, the stock traded lower.