Q4 Estimates

The company’s fourth-quarter report is expected to come on Thursday, April 11, at 6:50 am ET. Analysts’ consensus earnings estimate is $0.47 per share, compared to $0.44 per share in the corresponding period of 2023. The forecast for Q4 revenue is $5.79 billion, which is slightly higher than the $5.72 billion revenue the company delivered a year earlier.

While the current macroeconomic scenario is much better than a year earlier, people remain cautious in their spending due to higher interest rates and inflation. Also, the prices of used cars have not come down from the highs seen a couple of years ago. Meanwhile, the management has laid down steps to tame the slowdown, including cost reduction and continued investment in omnichannel capabilities.

Digital Push

The company now operates an efficient e-commerce platform, despite the complications involved in selling cars online. Interestingly, CarMax’s store network has expanded constantly over the years, even during times of uncertainty, and the company continues to gain market share. So, there is ample reason to believe that the firm would navigate through the current headwinds, which look short-term, and return to the growth path in the near future.

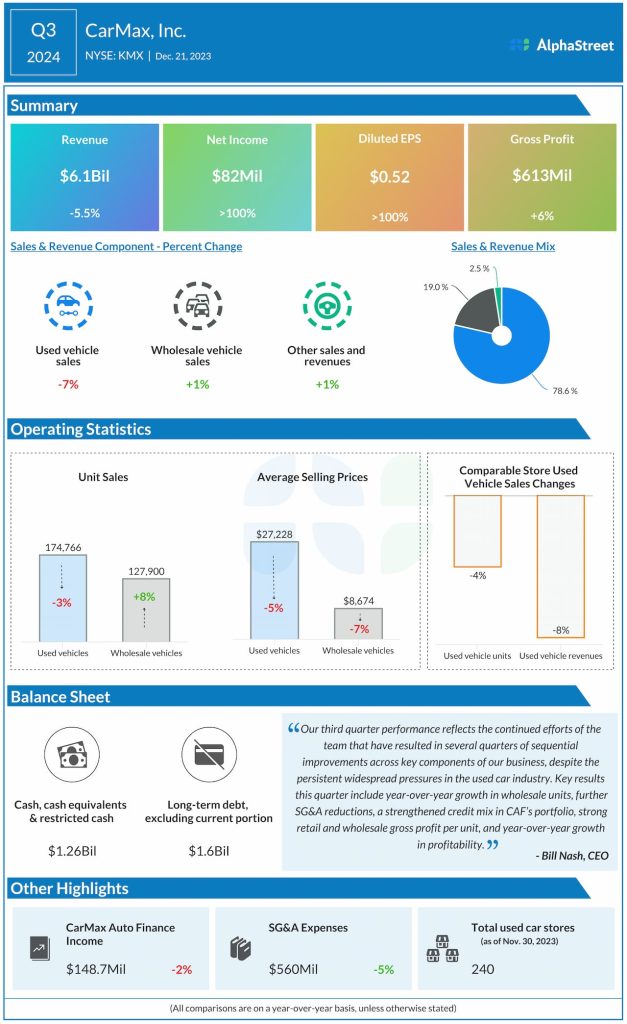

The company posted better-than-expected profit for the November quarter, marking an improvement from the preceding quarter when earnings missed. Meanwhile, the top-line came below estimates in the third quarter – revenues decreased 5.5% annually to $6.1 billion.

From CarMax’s Q3 2023 earnings call:

“We are well on track to outperform the target we set out at the beginning of the year of requiring low single-digit gross profit growth to lever SG&A for the full year, even when excluding the benefits from this year’s legal settlements. That being said, we remain disciplined with our spending and investment levels. Regarding capital structure, we resumed our share repurchase program in October, repurchasing approximately 649,000 shares for a total spend of $42 million in the quarter.”

Demand Slump

The weak revenue outcome in Q3 can be attributed to a 7% fall in used vehicle sales, which account for about 78% of the total. Net income more than doubled to $82 million or $0.52 per share, mainly reflecting higher wholesale gross profit/unit and continued reduction in SG&A expenses.

CarMax’s stock opened Monday’s session slightly above $80 and traded higher in the early hours. The average price for the past 52 weeks is $74.87.