Walmart’s second-quarter report is slated for release on Thursday, August 15, at 7:00 am ET. Experts predict an increase in July-quarter sales and adjusted profit from the year-ago period – revenue is estimated to have increased by 4% year-over-year to $168.53 billion, and earnings by 14% to $0.64 per share. The retailer has a history of beating analysts’ consensus earnings/revenue estimates regularly.

Positive Outlook

Walmart’s effective inventory management and favorable business mix have helped it beat the inflation-related pressure on consumer spending. Aggressive technology adoption enables it to continue leveraging the massive opportunities in digital advertising and third-party sales. Taking innovation to the next level, the company is replacing physical price tags with electronic shelf labels for convenience and to enhance customer experience.

Doug McMillon, CEO of Walmart, said in a recent interaction with analysts, “We’re bringing new experiences to life like generative AI-driven product search that helps our customers shop more intuitively. The team continues to build and improve the platforms for the marketplace and data that we’re using across countries, and they’re building and improving the operating system that enables us to create a more intelligent, flexible, and automated supply chain. The implementation of our automated storage and retrieval systems in our DCs and FCs is on track, and we’re as enthusiastic about the impact of that work as we’ve ever been.”

Strong Sales

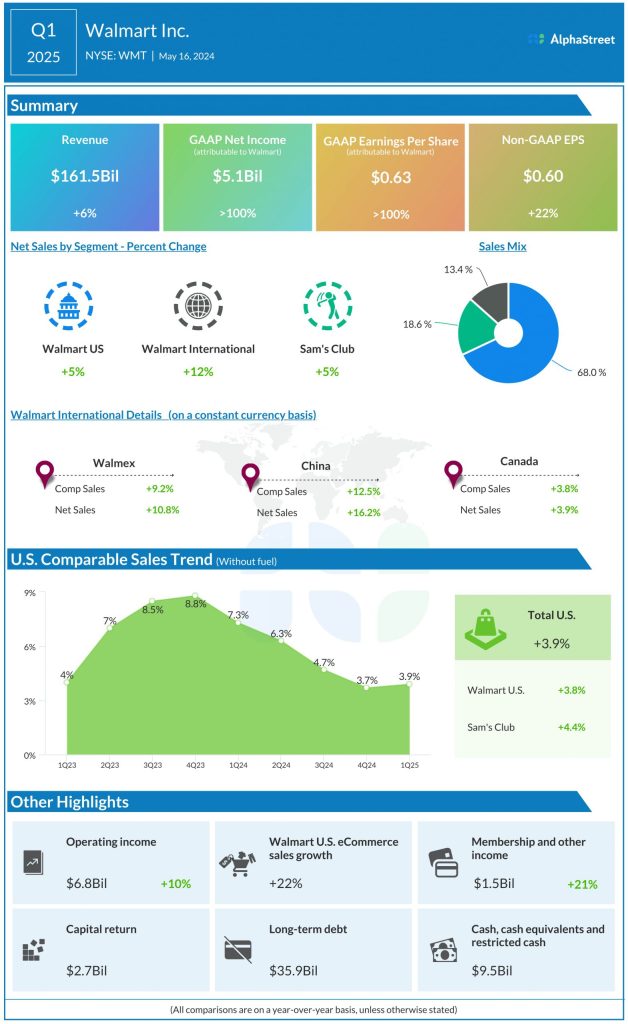

In the first quarter, US comparable store sales grew at an accelerated rate of 3.9%, after slowing down in the trailing four quarters. Total revenues increased 6% year-over-year to $161.5 billion in Q1 and rose 5.8% on a constant currency basis. International sales grew in double-digits, while both domestic and Sam’s Club sales rose by 5%. Sales increased in Canada and China, where the company has a significant presence. At $0.60 per share, adjusted profit was up an impressive 22% year-over-year in the April quarter. Reported net income more than doubled year-over-year to $5.1 billion or $0.63 per share.

Walmart’s stock opened at $67.66 on Friday, after trading sideways during the week. It made modest gains in the early hours of the session.