This acquisition has provided Disney with a rich trove of content and a massive advantage in the marketplace. Updates on Disney’s strategy and progress with regards to these assets is an area to keep an eye on. Another area of strength is ESPN+ with its rapidly expanding subscriber base and updates on this space are also key.

Disney has been making significant investments in its business units and these could lead to higher revenues in the Parks segment. Although the Studio segment is likely to benefit from the hit movie Captain Marvel, it might not match the performance of the Black Panther which released at the same time last year.

The higher investments are also likely to lead to higher costs that could in turn weigh on the bottom line results for the second quarter. Overall, Disney might not disappoint with its second quarter results.

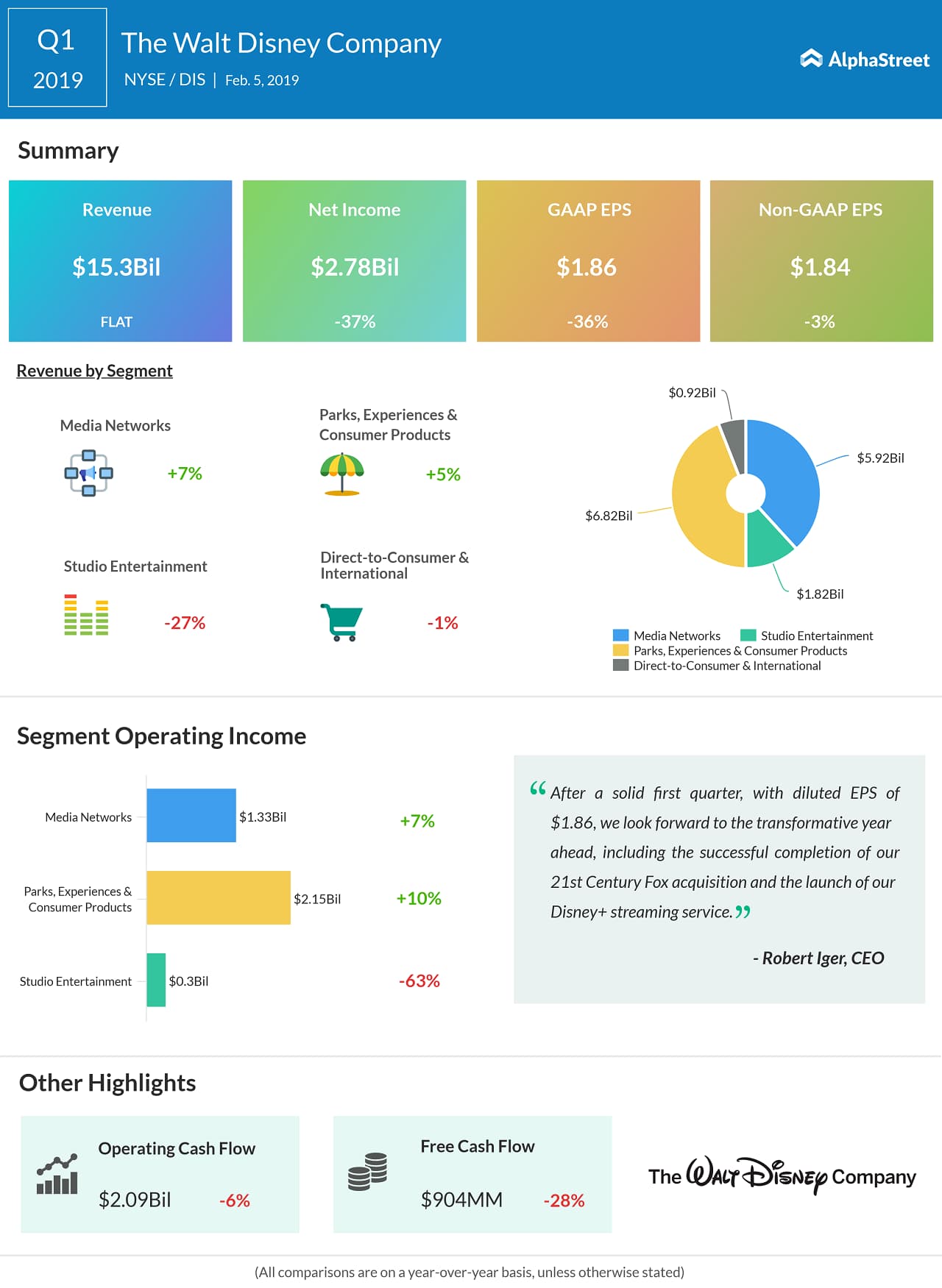

In the first quarter, Disney topped market estimates for revenue and earnings. Revenues of $15.3 billion were flat with the year-ago quarter while adjusted EPS declined 3% to $1.84.

Disney’s shares have gained 25% so far this year.