Estimates

Deere has regularly raised its dividend, currently offering a yield of 1.3%. The company’s stock made strong gains after it reported better-than-expected Q2 results in mid-May and climbed to an all-time high. Since then, DE has traded mostly sideways, maintaining a level well above its 52-week average of $454.45. The stock is up more than 20% over the past seven months.

Q2 Outcome

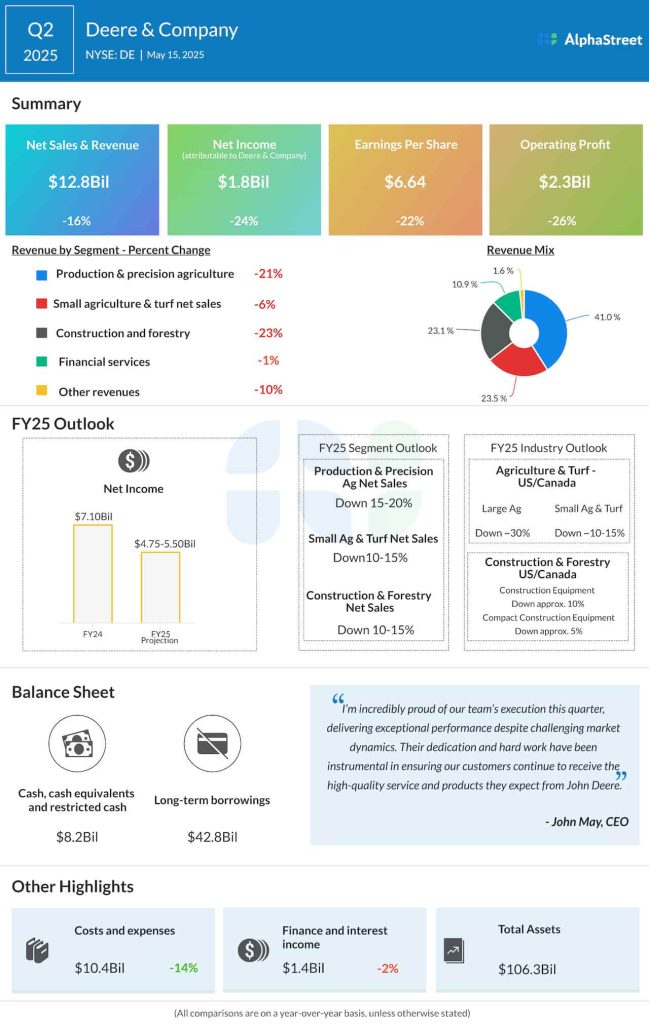

In the second quarter, Deere’s worldwide sales and revenues decreased 16% year-over-year to $12.8 billion, with sales declining across all operating segments. Q2 net income was $1.8 billion or $6.64 per share, compared to $2.37 billion or $8.53 per share in the year-ago quarter. For the whole of fiscal 2025, the management expects net income to be in the range of $4.75 billion to $5.50 billion, which is well below the profit generated in FY24.

“Smart Industrial’ unlocks value through the integration of cutting-edge technology with premium hard iron equipment. We will continue to robustly invest capital and R&D to bring these integrated solutions to market, enhancing our global competitiveness. I’m proud that this innovative work will build on our American roots, and we are prepared to invest $20 billion in the U.S. over the next decade as we spearhead new product development, cutting-edge technologies, and more advanced manufacturing,” Deere’s CEO John May said in the Q2 2025 earnings call.

On Friday, Deere & Company’s stock opened at $508.76 and traded mostly higher during the session. The shares have gained around 46% in the past twelve months.