PepsiCo continues to boost its strong product portfolio through

innovation and strategic partnerships. The company recently teamed up with

Lavazza to launch iced coffee in the UK. PepsiCo’s diversification efforts

through various acquisitions and partnerships are likely to pay off in driving

growth going forward.

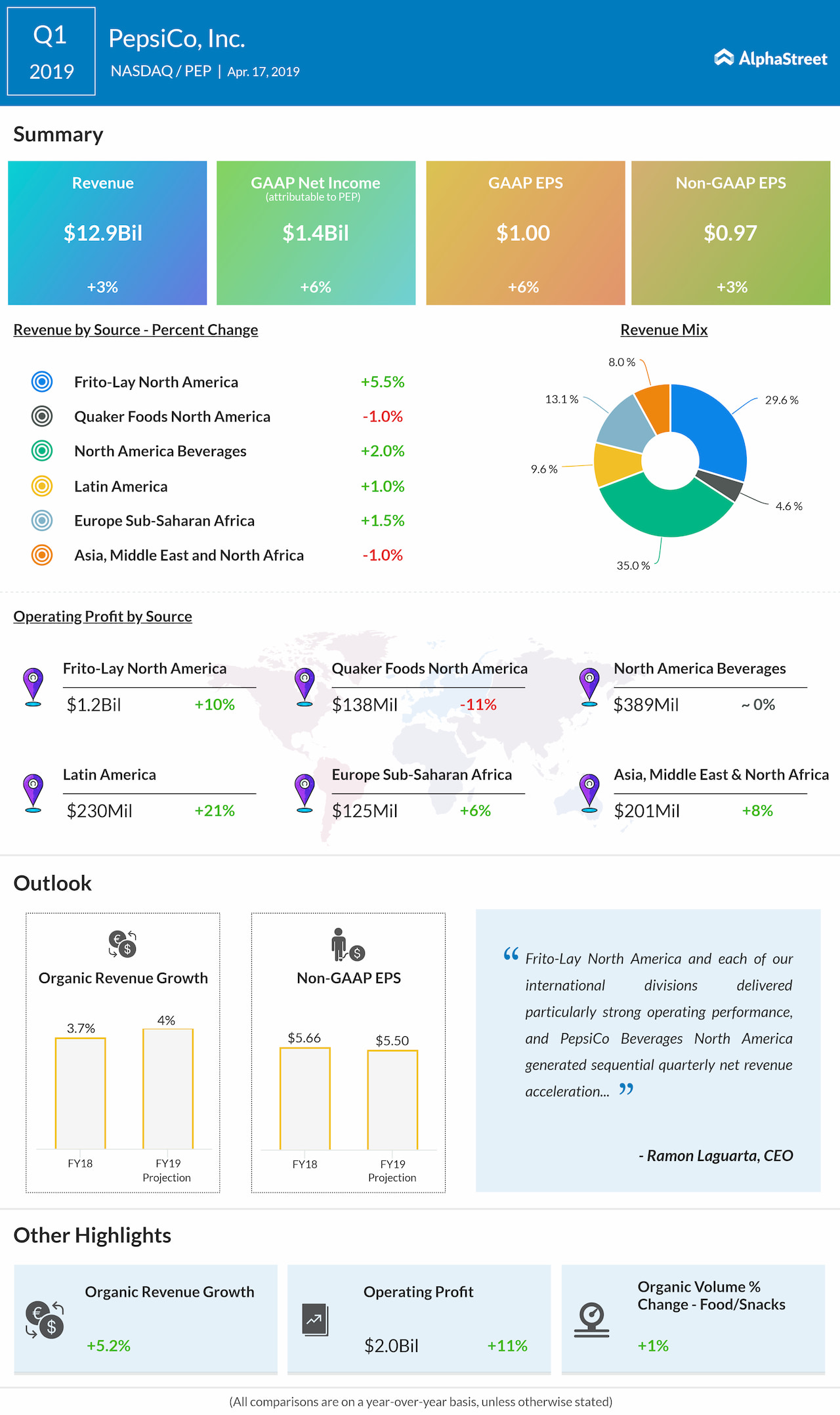

Although the company is dealing with changing customer preferences in the US, it is seeing growth outside the US, particularly in emerging markets. This growth is likely to prove beneficial to the results in the second quarter. PepsiCo has also been taking measures to reduce costs and this is likely to help profitability.

In the first quarter of 2019, PepsiCo beat revenue and earnings estimates. Both revenue and adjusted EPS grew 3% year-over-year. The company posted revenue growth across all its segments, barring Quaker Foods North America and AMENA.

For the full year of 2019, PepsiCo expects organic revenue to grow 4% and core constant currency EPS to decline 1%. PepsiCo’s shares have gained 19% thus far this year and 23% over the trailing 52 weeks.